Coinspeaker

Truflation Unveils Hedge Index to Protect Investments against Inflation with Real-World Asset Tracking

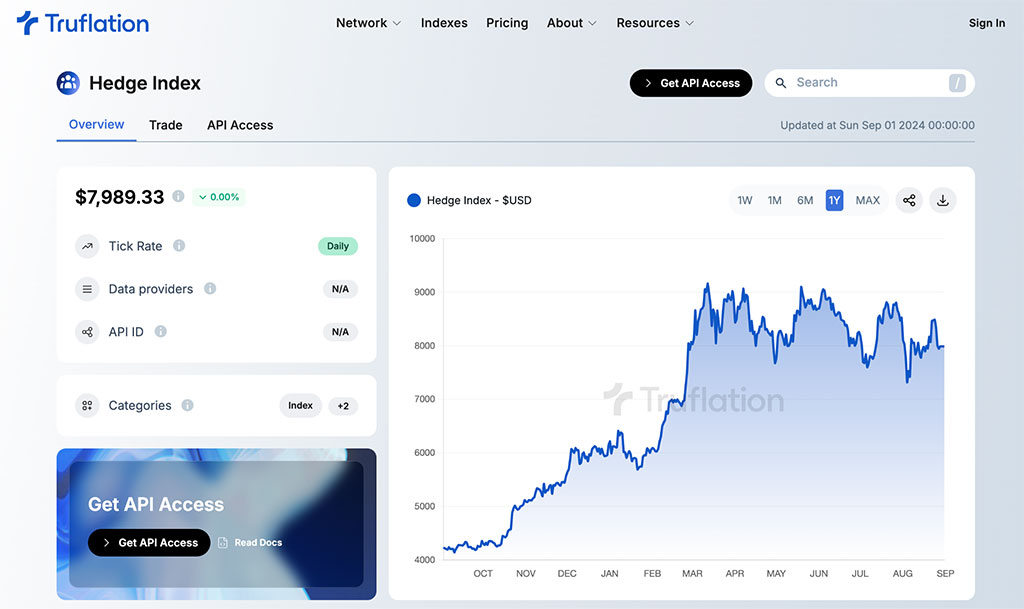

Truflation, a number one real-time monetary information supplier, has launched a Hedge Index aimed toward serving to buyers shield their portfolios towards inflation. This cutting-edge index displays Actual World Belongings (RWAs) and serves as a efficiency benchmark, providing a diversified technique to cut back the results of inflation on investments.

The Truflation Hedge Index contains 5 key asset courses: Gold (25%), Silver (20%), WTI Crude Oil (20%), the S&P 500 (25%), and Bitcoin (10%). These belongings are fastidiously weighted to create a balanced hedge towards inflation. The index’s worth is constantly up to date all through the day, reflecting the worth actions of those elements, which helps buyers handle the dangers related to inflation.

A Device for Conventional and Decentralized Finance

The Hedge Index is crafted to serve each conventional finance (TradFi) and decentralized finance (DeFi) sectors. For conventional buyers, it gives a reliable technique to hedge towards inflation by spreading investments throughout varied asset courses. This diversification helps mitigate potential losses from different investments throughout instances of inflation.

Within the decentralized finance sector, the index is especially helpful for protocols that concentrate on the tokenization of RWAs. Initiatives like Nuon Finance, Frax Finance, and Overlay Protocol can use this index to gauge the effectiveness of RWAs as a hedge towards inflation. By monitoring the worth of those belongings, the Truflation Hedge Index gives correct, real-time information that’s essential for making knowledgeable choices in an ever-changing financial panorama.

Stefan Rust, CEO of Truflation, acknowledged:

“The Truflation Hedge Index is a game-changer for buyers looking for to guard their portfolios towards inflation. By leveraging real-time information and diversifying throughout core asset courses, we offer a robust device that mitigates the affect of inflation on investments.”

Truflation’s decentralized information feeds, indexes, and oracles are important instruments for DeFi purposes. With information sourced from over 65 companions and monitoring greater than 18 million objects, these instruments present a reliable basis for each conventional and decentralized finance.

Picture: Truflation

Past Inflation Monitoring

Truflation’s choices lengthen past the Hedge Index. The corporate additionally gives devoted dashboards for monitoring inflation in varied nations, together with the US, UK, and Argentina. These dashboards are a part of Truflation’s mission to carry correct financial information on-chain, providing different metrics that deal with the restrictions of conventional indices just like the Shopper Value Index (CPI).

These improvements purpose to enhance decision-making for people, companies, and policymakers, contributing to a extra knowledgeable and resilient financial system.

About Truflation

Established in 2021, Truflation advantages from the backing of main companions like Coinbase and Chainlink. The corporate runs the Truflation Stream Community (TSN), a decentralized real-time information oracle that displays greater than 18 million objects. This community, which is immune to censorship, is significant for decentralized purposes (dApps) and helps varied monetary devices, together with commodity value forecasts and BTC-denominated markets.

Truflation’s options mark a big leap ahead within the Web3 sector, enhancing each innovation and transparency in monetary markets.