The Bitcoin worth can hit a brand new all-time excessive (ATH) this Uptober, contemplating that this month is traditionally one among its finest months. This historic development signifies that the flagship crypto might rise to as excessive as $80,000 because it surges previous its present ATH of $73,000. Nevertheless, the trail to a brand new ATH won’t be as simple as anticipated.

Bitcoin Worth To Rally To New ATH This Month

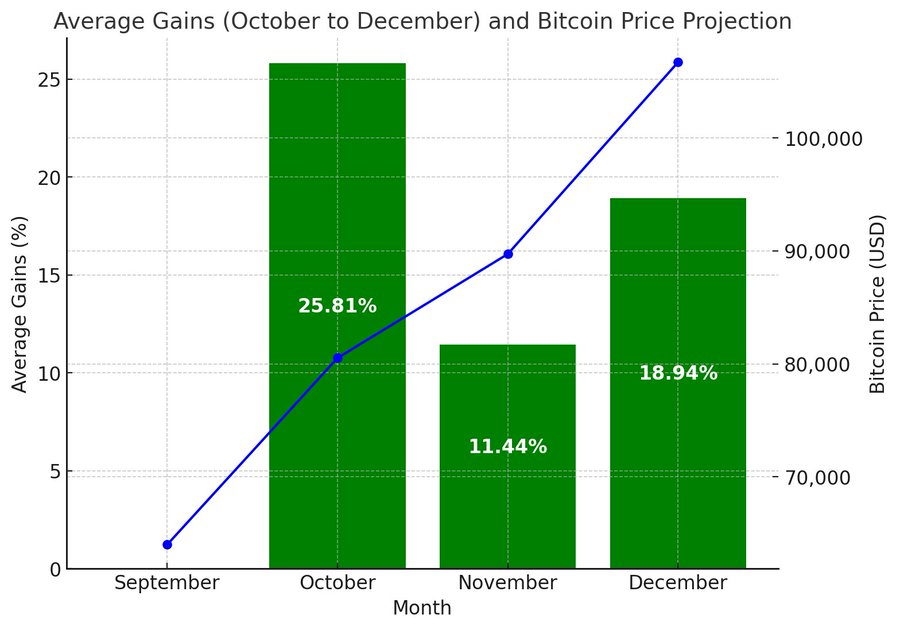

The BTC worth is ready to rally to a brand new ATH this month, with historic traits pointing to this occurring. The flagship crypto closed in September with a worth achieve of seven%. That is notable as a result of Coinglass data shows that Bitcoin has recorded constructive month-to-month returns within the final three months of the yr, the thrice this has occurred.

Moreover, the outstanding Bitcoin X platform BTC Archive shared information that confirmed that the flagship crypto might rise to as excessive as $80,000 following its inexperienced September. The crypto has loved a mean achieve of 25.81% in October after a inexperienced September candle. Primarily based on this, BTC might attain $80,500 if it replicates this common achieve.

In the meantime, buying and selling agency QCP Capital famous that the Bitcoin worth has loved a mean achieve of twenty-two.9% in 8 out of the final 9 October. An analogous worth achieve would ship BTC above $78,000, properly above its present ATH of $73,000. The buying and selling agency additionally cited different components that help the crypto reaching a brand new ATH.

QCP Capital talked about that the Spot Bitcoin ETFs inflows stay constantly constructive whereas perp funding is approaching ranges that have been recorded in the course of the bull run within the first quarter of this yr. The numerous inflows these Bitcoin ETFs recorded in Q1 contributed to the BTC worth reaching its present ATH of $73,000 in March.

10x Analysis founder Markus Thielen also predicted that BTC will quickly reclaim $70,000 and attain a brand new ATH by late October. The analyst cited the rising stablecoin liquidity and China’s financial easing insurance policies as components that would spark this worth rally above $73,000.

The Highway To A New ATH Gained’t Be Easy

Though the Bitcoin worth will probably attain a brand new ATH this month, the rally above $73,000 gained’t be simple. In keeping with a CoinGape evaluation, BTC will likely correct following the drop beneath the essential help stage of $65,000. The evaluation additional predicted that the flagship crypto might revisit $61,000 as a result of this worth correction.

This has already occurred partly because of the escalating battle between Israel and Iran. The Bitcoin worth is quick approaching the psychological worth stage of $60,000. Nevertheless, crypto analyst Ali Martinez acknowledged this was only a “little shake out earlier than the breakout.” The analyst had beforehand outlined a situation whereby the flagship crypto drops to as little as $57,000 earlier than it breaks out in direction of $78,000.

The on-chain analytics platform Santiment had additionally prompt that any worth retrace can be bullish for the Bitcoin worth and the broader crypto market. The platform acknowledged that the group’s present bullish sentiment towards BTC indicated a excessive high chance for the market. This bullish sentiment might change because the Isreal Iran battle is already sparking a wave of sell-offs. Santiment predicts that the bull market will start shortly as soon as FOMO turns to FUD.

The Israel Iran stress is presently affecting the crypto market rally and placing downward stress on costs. Nevertheless, the market might simply reverse as soon as tensions within the Center East cooled off. It’s price mentioning that September started on an analogous notice because the Bitcoin worth suffered a ten% crash within the first week earlier than kickstarting its 26% rally to $65,000.

Disclaimer: The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: