In a dramatic flip of occasions, the Bitcoin value has breached the $64,000 threshold once more after a 7.7% improve from a low of $59,400 in 4 days. This sudden price jump has despatched shockwaves by means of the crypto market, with information from Coinglass revealing a major wave of liquidations following the surprising rally. Quick sellers, who had been anticipating a decline, discovered themselves in a troublesome spot as Bitcoin defied their expectations.

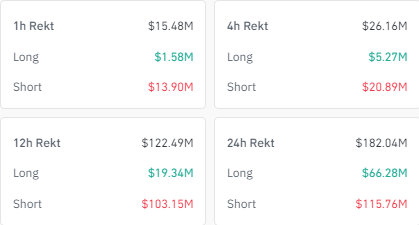

Notably, liquidation data from Coinglass exhibits that over $182 million price of positions have been liquidated throughout numerous exchanges previously 24 hours, with a majority being brief positions.

Bitcoin Value Breaks Above $64,000 Once more

Bitcoin rose above $64,000 within the early hours of Monday, October 14, after breaking above a decent vary over the weekend and gaining 2.53% previously 24 hours. Bitcoin reached as excessive as $64,500 previously few hours, which is its highest level up to now in October. As such, the Bitcoin value has now crossed above its open for the month, with the October month-to-month return lastly turning inexperienced for the primary time.

Associated Studying

The value motion, nonetheless, wasn’t as optimistic for everybody. In keeping with the information proven within the image beneath, the sudden rise has been pricey for a lot of merchants holding brief positions. Bears who wager on a continued decline had been hit exhausting as Bitcoin’s continued rally triggered a wave of liquidations.

Of the $182 million price of liquidations recorded throughout numerous exchanges, a staggering $115.76 million got here from brief positions, whereas $66.28 million had been from lengthy positions.

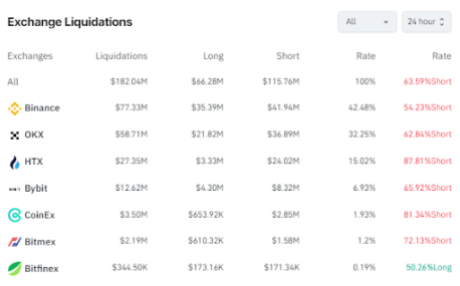

Binance has led the crypto trade market in liquidations over the previous 24 hours, accounting for 42.48% of the overall liquidations. On Binance alone, roughly $77.33 million price of positions had been worn out, with 54.23% being brief positions. OKX follows intently, with $58.71 million in liquidations, the place a fair bigger proportion of 62.84% had been brief positions.

HTX, Bybit, and CoinEx additionally noticed important liquidations, although on a smaller scale. HTX recorded $27.35 million in liquidations, a staggering 87.81% of which had been brief positions. Bybit got here subsequent with $12.62 million in liquidations and a brief charge of 65.92%, whereas CoinEx rounded out the listing with $3.50 million liquidated, 81.34% of which was from shorts.

Associated Studying

Extra Liquidations Forward?

Bitcoin’s current uptick brings back the possibility of a declining Uptober sentiment. This fascinating rally might set the stage for a surge within the second half of October, just like what was witnessed in September.

If this rally were to continue for the remainder of the month, we might see extra brief positions liquidated within the subsequent few hours. Bears, who’ve been betting in opposition to Bitcoin’s rise, could rush to shut their positions to attenuate losses. The lower in promoting strain from brief sellers exiting the market could further fuel Bitcoin’s ascent.

Featured picture created with Dall.E, chart from Tradingview.com