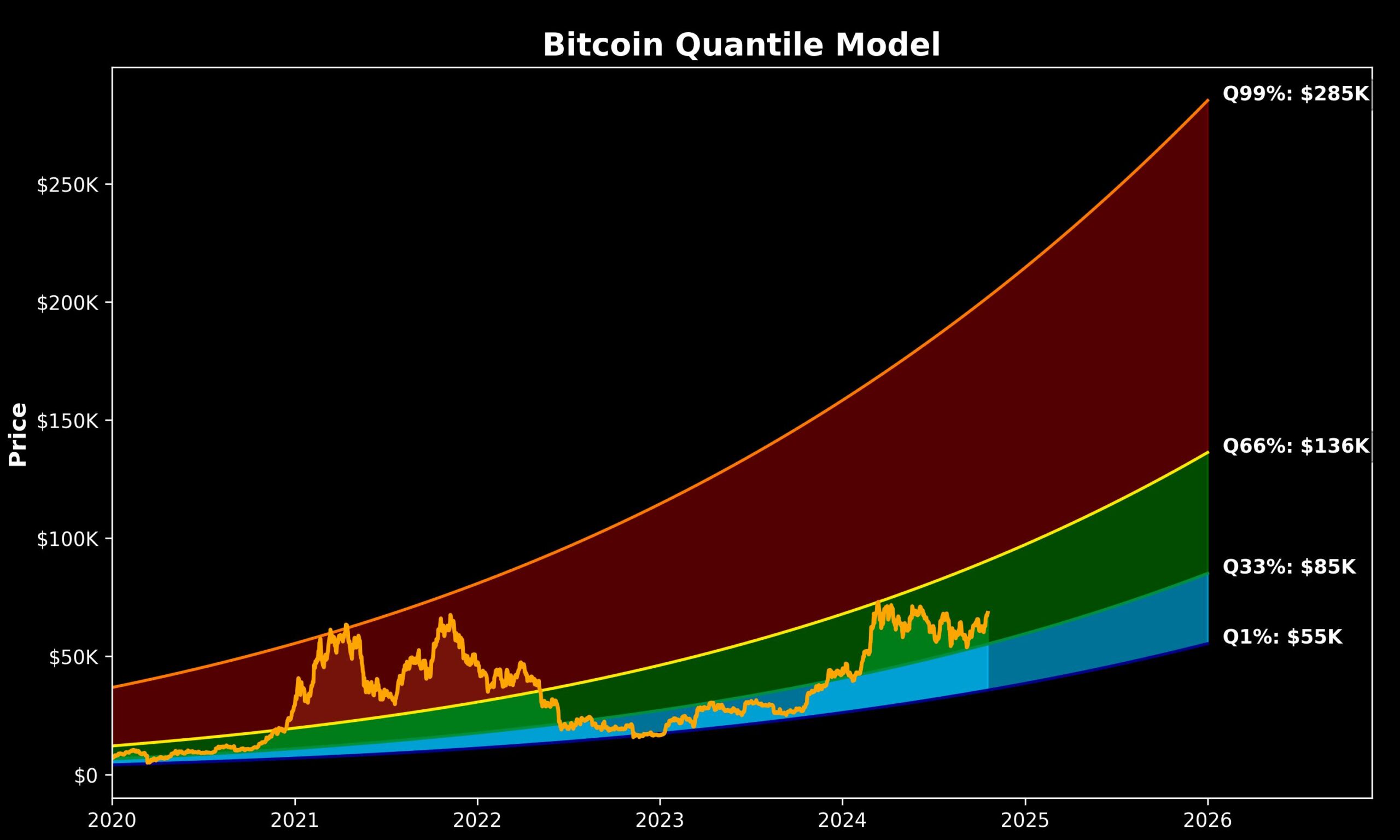

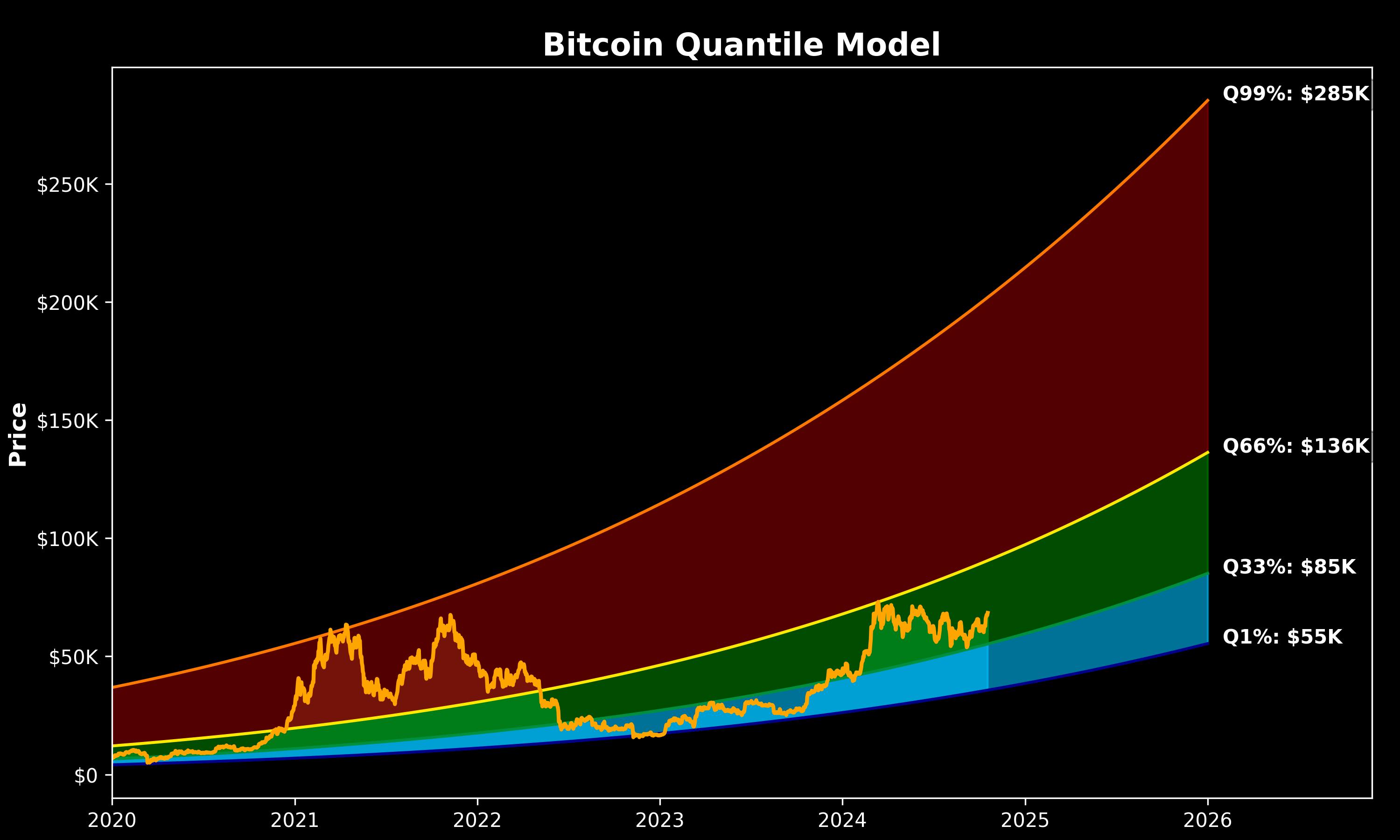

Sina—a professor, guide, and co-founder & COO of 21stCapital.com—is projecting that the Bitcoin value might rise as excessive as $285,000 by the top of 2025 in a brand new evaluation shared on X. Using a quantile regression mannequin, Sina identifies distinct phases in Bitcoin’s market cycle.

Can Bitcoin Value Skyrocket Above $200,000?

The model identifies the Chilly Zone (<33%) as the value vary between $55,000 and $85,000. This zone represents the bottom doable vary by the top of 2025 and suggests a interval superb to “aggressively accumulate.”

The Heat Zone (33-66%), spanning from $85,000 to $136,000, marks a interval the place the market beneficial properties momentum, and mainstream attention intensifies. Throughout this part, speedy value progress is anticipated because the “practice leaves the station.” Sina recommends a normal accumulation technique right here, equivalent to dollar-cost averaging (DCA), to steadily improve holdings.

Associated Studying

Probably the most important part, the Scorching Zone (>66%), ranges from $136,000 to $285,000. This zone is characterised by heightened volatility and important value swings as mass adoption peaks and leveraged positions change into prevalent.

Whereas there’s substantial room for upside, the danger of reversals escalates quickly. Sina advises buyers to both maintain and revel in potential beneficial properties or contemplate progressively exiting positions based mostly on danger assessments, significantly since historical tops happen within the ninetieth to 99th quantile vary. Notably, the ninetieth quantile begins at $211,000.

What astonishes Sina is how these 33% quantile ranges align seamlessly with Bitcoin’s historic part transitions. He notes that Bitcoin tends to spend precisely one-third of its time in every zone earlier than transitioning to the following, nearly like clockwork. This sample implies that a lot of the bear market happens beneath the 33% quantile, whereas bull market euphoria begins above the 66% quantile.

Famend crypto analyst PlanC (@TheRealPlanC) acknowledged Sina’s mannequin, commenting that it’s a “good rationalization—tremendous clear.” Sina, in flip, credited PlanC for the foundational work that influenced his personal mannequin.

Associated Studying

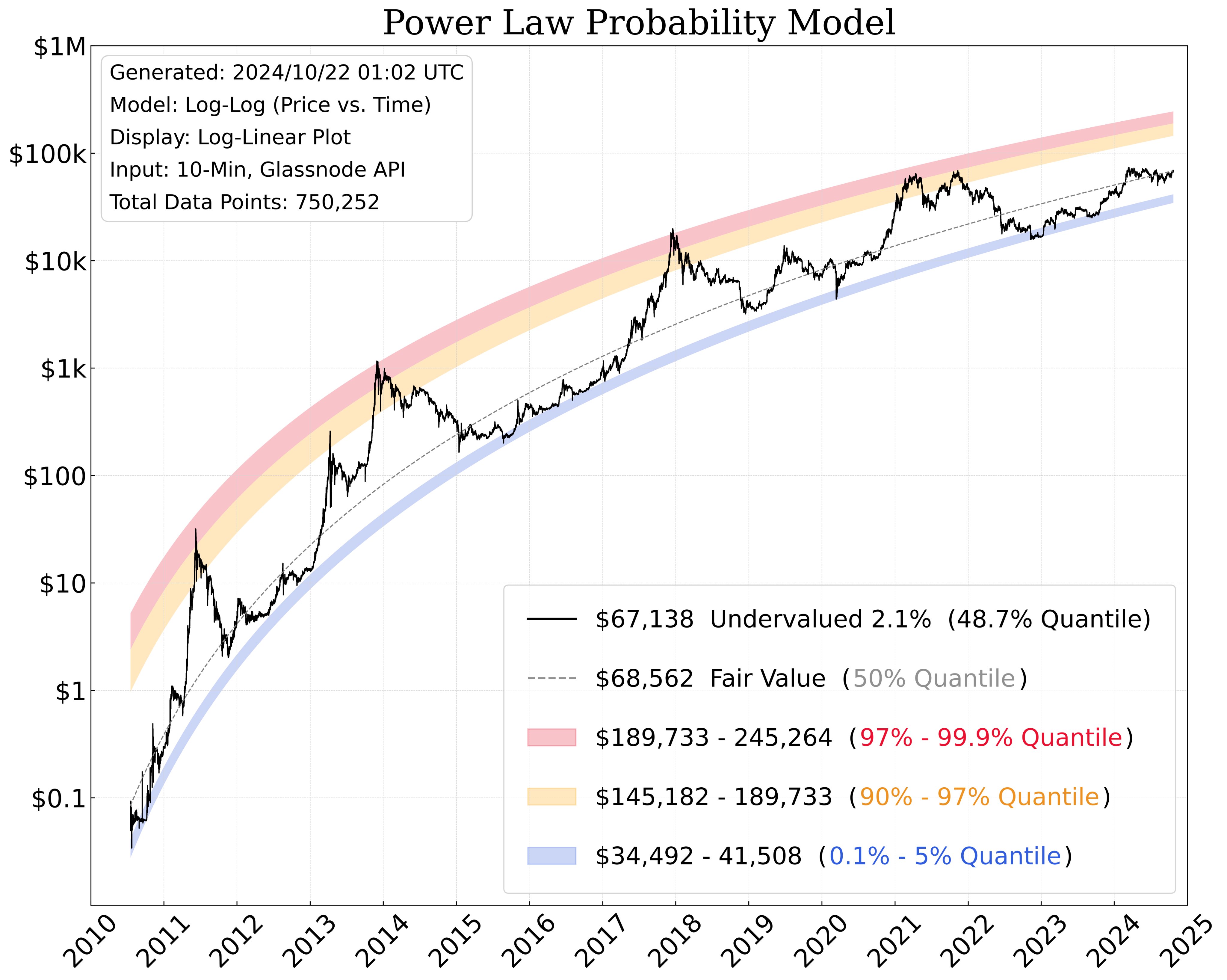

PlanC has additionally just lately updated his “Energy Legislation Chance Mannequin,” which forecasts Bitcoin costs starting from $189,733 to $245,264 for the 97% to 99.9% quantile and $145,182 to $189,733 for the 90% to 97% quantile. He emphasizes that regardless of appearances, the underlying knowledge follows a power-law relationship, impartial of the way it’s plotted—be it linear, log-linear, or log-log scales.

“The information follows a log-log relationship with quantile regressions, whereas the rainbow chart makes use of logarithmic regression with a log-linear relationship. […] I’m not ‘drawing’ these traces. These are quantile regressions of the log of value vs. time, based mostly on all the information we have now up to now,” he explains.

To contextualize the mannequin’s predictive capabilities, PlanC elaborates on the importance of varied quantiles. The 99.9% quantile means the value has been above this line solely 0.1% of the time, equating to only sooner or later out of each 1,000 days—a really uncommon occasion. The 99% quantile signifies the value has exceeded this line 1% of the time, or sooner or later out of each 100 days, additionally thought-about uncommon. Conversely, the 0.1% quantile displays that the value has fallen beneath this line solely 0.1% of the time.

At press time, BTC traded at $67,121.

Featured picture created with DALL.E, chart from TradingView.com