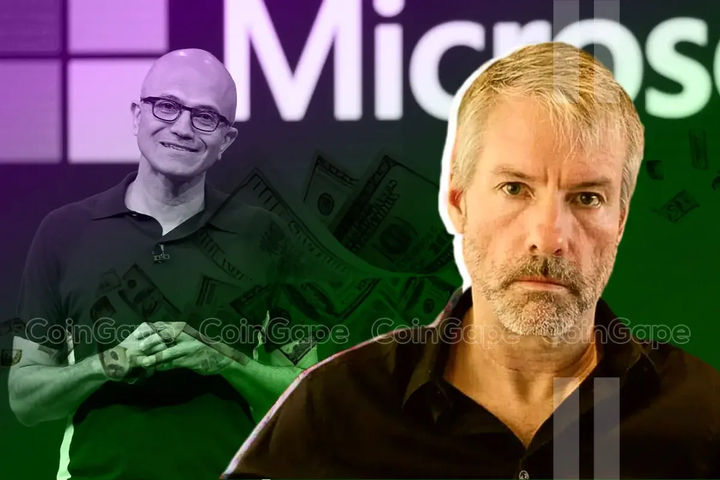

Bitcoin Maxi Michael Saylor has known as on Microsoft CEO Satya Nadella to contemplate adopting Bitcoin as one of many firm’s investments. This push comes concurrently a shareholder proposal has been submitted with the U.S. Securities and Alternate Fee (SEC) for Microsoft to contemplate Bitcoin as a treasury asset.

Saylor, an advocate for Bitcoin, acknowledged that if Microsoft have been to undertake Bitcoin, it may generate important returns attributable to inflation that impacts different belongings.

Bitcoin Maxi Michael Saylor Factors to MicroStrategy’s BTC Success

Michael Saylor, CEO of MicroStrategy, not too long ago took to X (previously Twitter) to suggest a “subsequent trillion-dollar” alternative for Microsoft. He inspired Microsoft CEO Satya Nadella to include Bitcoin into the corporate’s stability sheet. MicroStrategy, in contrast to most main tech corporations, holds a major quantity of Bitcoin. As of now, the corporate holds 252,220 BTC, at present valued at over $17 billion, with a complete acquisition value of round $9.9 billion.

This technique has reaped advantages as MicroStrategy’s inventory soared to $235.89, a 25-year excessive this week, and closed with greater than 10% beneficial properties. MicroStrategy’s market capitalization, as well as, is at present $43.6 billion, which is slightly excessive compared to the corporate’s internet asset worth of its BTC holdings.

This sample is just like Grayscale Bitcoin Belief earlier than its conversion to the spot Bitcoin ETF not too long ago. Bitcoin Maxi Saylor has steered that attributable to Microsoft’s measurement and clout, integrating with Bitcoin could possibly be very worthwhile for the corporate. Within the final three years, the value of Bitcoin has rose by over 971% which is a lot better than company bond and quick time period treasury payments.

Nonetheless, regardless of his requires Microsoft to contemplate BTC, Saylor has faced some backlash for suggesting that massive banks providing Bitcoin custody is likely to be useful.

Potential of Bitcoin for Microsoft’s Treasury

A shareholder proposal, submitted by the Nationwide Heart for Public Coverage Analysis, calls on Microsoft’s board to assess Bitcoin as a possible asset for its treasury administration. The proposal underscores that Microsoft’s present investments, primarily in U.S. authorities securities and company bonds, is probably not adequate to guard in opposition to inflation.

It suggests {that a} small allocation to Bitcoin, even as little as 1% of Microsoft’s complete belongings, may act as a hedge in opposition to foreign money devaluation. Furthermore, Microsoft’s second-largest shareholder, BlackRock, has been a major participant in Bitcoin’s institutional adoption. Its Bitcoin ETF, often known as IBIT, has been driving substantial inflows within the U.S. Bitcoin ETF market.

This week, IBIT recorded another $300 million in inflows, bringing complete inflows since inception to greater than $23.5 billion. This exhibits rising demand amongst institutional traders for Bitcoin publicity, which may help Bitcoin Maxi Michael Saylor’s argument for Microsoft to discover related alternatives.

The vote on this proposal is scheduled for December 10 at Microsoft’s annual shareholder assembly. Nonetheless, Microsoft’s board has beneficial a vote in opposition to it, citing Bitcoin’s excessive volatility as a key danger issue.

Disclaimer: The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: