The Bitcoin ETFs have undoubtedly loved huge success since they launched at first of the yr. To crown an incredible first yr, these funds achieved a big milestone as they surpassed Satoshi Nakamoto’s BTC holdings.

Bitcoin ETFs Surpass Satoshi Nakamoto

In an X publish, Bloomberg analyst Eric Balchunas revealed that the Bitcoin ETFs have simply surpassed Satoshi Nakamoto in whole held. These ETFs maintain a cumulative whole of over 1.1 million BTC, whereas the Bitcoin creator holds 1.1 million.

He highlighted how exceptional this feat is contemplating that these funds aren’t even a yr outdated but, exhibiting how a lot demand they’ve loved since they launched on January 10. The Bitcoin ETFs achieved this feat on the again of the $770 million inflows they recorded yesterday.

SoSoValue data exhibits that BlackRock’s Bitcoin ETF has loved essentially the most success amongst these funds. IBIT at present holds $51.46 billion in belongings below administration, virtually half of the $109.15 billion in whole web belongings these funds maintain.

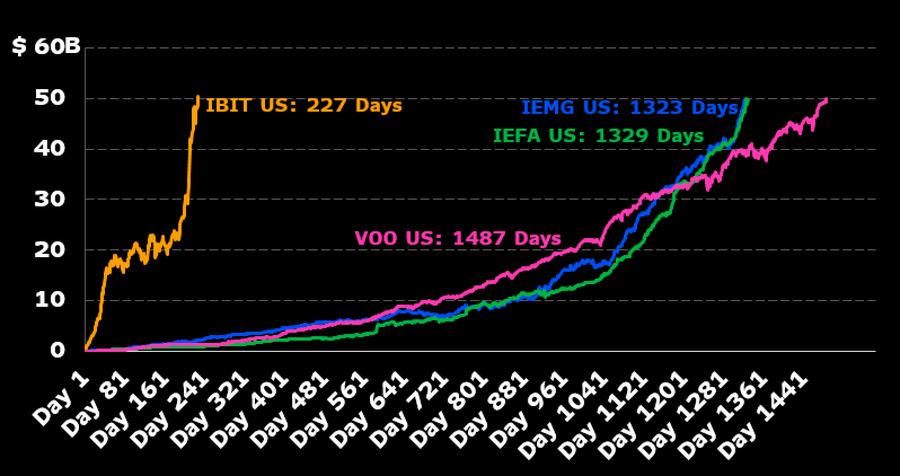

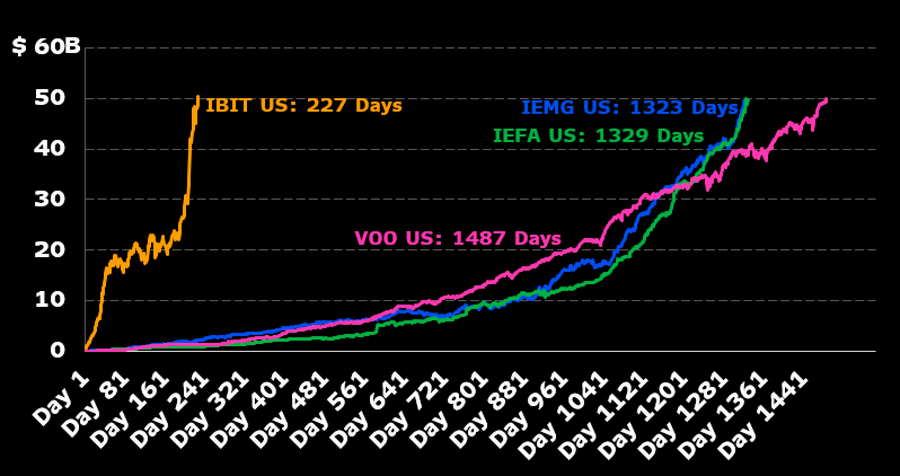

BlackRock’s IBIT simply crossed the $50 billion mark, which is a document in itself. Balchunas famous that it took the world’s largest asset supervisor 227 days to realize this feat, 5 instances sooner than the earlier document holder, who did it in 1,323 days.

BlackRock’s Ethereum ETF can be having fun with its personal success, because it lately hit a brand new milestone. The iShares Ether ETF (ETHA) inflows crossed $1 billion for the primary time because it launched on July 23.

The Others That Make Up The Prime 5 Checklist

Balchunas additionally revealed the opposite entities that make up the highest 5 listing of the biggest BTC holdings alongside the Bitcoin ETFs and Satoshi Nakamoto. Third on the listing is Binance, with 633,103 BTC. MicroStrategy and the US authorities are fourth and fifth on the listing, with 402,100 and 198,109 BTC, respectively.

MicroStrategy has been actively accumulating extra BTC and will transfer up the listing in some unspecified time in the future. The software program firm lately bought 15,400 BTC, bringing its whole holdings to this quantity.

In the meantime, the Chinese language authorities, Bitfinex, Kraken, Block One, and Robinhood make up the highest ten listing. It’s value mentioning that each governments on this listing acquired their BTC via seizures fairly than actively shopping for the flagship crypto. For the US, that might change quickly sufficient as Donald Trump has promised to create a Strategic Bitcoin Reserve, which may result in them shopping for extra BTC.

Disclaimer: The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: