CryptoQuant CEO Ki Younger Ju has revealed that there’s just one approach that MicroStrategy’s ‘Bitcoin Technique’ might result in chapter for the software program firm. The corporate’s BTC technique has led to huge success regardless of criticisms about the way it accumulates extra Bitcoin.

How MicroStrategy’s Bitcoin Technique May Lead To Chapter

In an X put up, Ki Younger Ju indicated that MicroStrategy’s Bitcoin Technique might solely result in chapter if the Bitcoin price drops to $16,500. He defined that MSTR has $7 billion in debt and $46 billion in BTC holdings.

Due to this fact, primarily based on Bitcoin alone, the corporate’s liquidation worth is $16,500. The CryptoQuant CEO additionally defined why it’s virtually unattainable for the corporate to go bankrupt, stating that this is able to solely occur “if an asteroid hits Earth.”

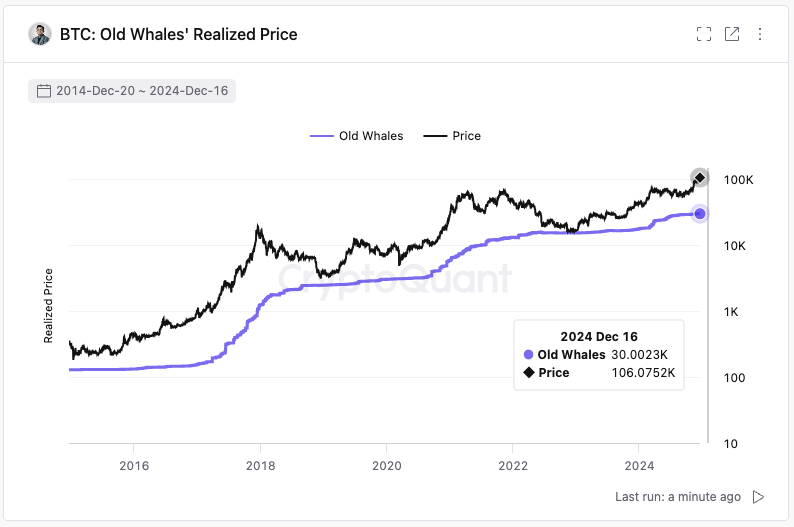

Ki Younger Ju talked about that since its inception, Bitcoin has by no means dropped beneath the associated fee foundation of long-term whales, which presently stands at $30,000. In one other X post, the crypto CEO famous that $16,000 was the final cycle’s backside.

On this regard, Ki Younger Ju believes that speaking about this worth goal is like alluding to the $3,000 worth stage when the Bitcoin worth hit $60,000. Mainly, the crypto CEO is assured that the flagship crypto won’t ever contact the $16,000 worth stage once more. As such, he remarked that BTC dropped to $16,000 once more after all of the institutional adoption, ETFs, and MSTR shopping for, it’s as dangerous as an asteroid hitting Earth.

MicroStrategy additionally appears to be assured that the Bitcoin worth would by no means drop to such a stage because it has continued to build up extra BTC regardless of criticisms. The software program firm not too long ago acquired 15,350 BTC for $1.5 billion, bringing its whole Bitcoin holdings to 439,000 BTC.

Saylor Highlights Firm’s Success

In an X put up, MicroStrategy’s co-founder additionally highlighted his firm’s success because of its Bitcoin Technique. Saylor talked about that MSTR treasury operations have delivered a BTC yield of 72.4% year-to-date (YTD).

Moreover, this has led to a web advantage of 136,965 BTC to the corporate’s shareholders. At $107,000 per BTC, these Bitcoin income equate to round $14.66 billion for the yr. These shareholders have additionally witnessed a major improve within the worth of their MSTR shareholdings as MicroStaretgy’s inventory is up over 540% YTD.

Saylor continues to advocate for different firms and even governments to undertake Bitcoin. Lately, he laid a framework for the US to pay off its $36 trillion debt with Bitcoin.

Disclaimer: The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: