Professional-XRP lawyer Invoice Morgan reacts to mounting issues over the U.S. Securities and Alternate Fee (SEC) or Chairman Gary Gensler spoiling the RLUSD stablecoin launch occasion. Notably, the US SEC lately labeled the stablecoin as an unregistered crypto asset within the Ripple lawsuit.

XRP Lawyer Addresses US SEC’s ‘Unregistered’ Declare on RLUSD

Professional-XRP lawyer Invoice Morgan commented on an X submit relating to RLUSD issuance as soon as labeled as an ‘unregistered‘ crypto asset by the US SEC in its remedies-related reply temporary. Whereas the Ripple USD stablecoin received greenlight from the New York Division of Monetary Providers (NYDFS), some crypto buyers are skeptical.

The submit raised questions on whether or not the SEC or outgoing Chair Gary Gensler may cause issues for Ripple on RLUSD stablecoin. Apparently, the SEC has remained silent on the approval from the NFDFS. Within the Ripple vs SEC lawsuit, the company talked about RLUSD to assert that Ripple offered crypto belongings with out correct registration. This doesn’t imply instant actions however regulatory readability is essential for broader adoption.

Morgan commented — “That’s right.” Nonetheless, he added that the SEC made many incorrect statements about crypto and the regulator was fallacious right here too. Notably, this additionally contains the time period ‘crypto asset securities’ for which the SEC expressed regrets to the courtroom.

“Ripple doesn’t care in regards to the assertion. If it was meant to be a warning or a risk it has been disregarded or labored round and fairly frankly neither the market nor anyone else cares as a result of RLUSD is now regulated,” he added.

Will the Stablecoin Profit the XRP Worth Rally?

Ripple President Monica Long earlier addressed concerns about RLUSD stablecoin impacting XRP. He clarified that the Ripple USD and XRP will serve totally different functions throughout the ecosystem. XRP is used as a bridge asset for cross-border transactions.

In the meantime, the RLUSD stablecoin is extra about impression resembling rising liquidity, boosting utility, and increasing enterprise. Its use circumstances embody cross-border funds, decentralized finance, actual world asset (RWA) tokenization, and crypto on-off ramps because it launches on XRP Ledger and Ethereum. It is going to be initially accessible within the Americas, Asia-Pacific, UK and Center East areas by way of its distribution and trade companions.

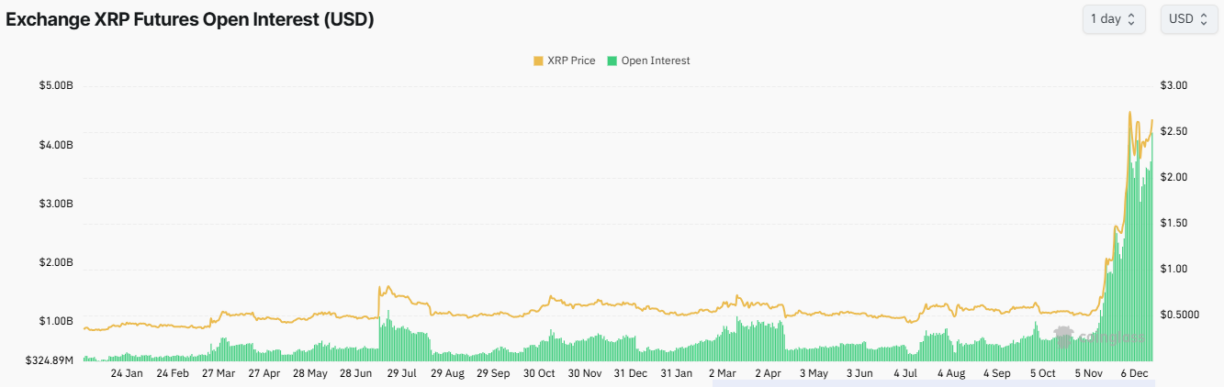

Furthermore, the stablecoin launch fueled XRP price to surge 12% at the moment and 22% in every week. The value at the moment trades at $2.62, with an intraday excessive of $2.72. It noticed buying and selling volumes of just about $19 billion, which is up 172% during the last 24 hours.

Within the derivatives market, the entire XRP futures open curiosity shoots to $4.50 billion. It skyrockets 19% within the final 24 hours, with Bybit and Binance main the trades, as per Coinglass data.

Disclaimer: The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: