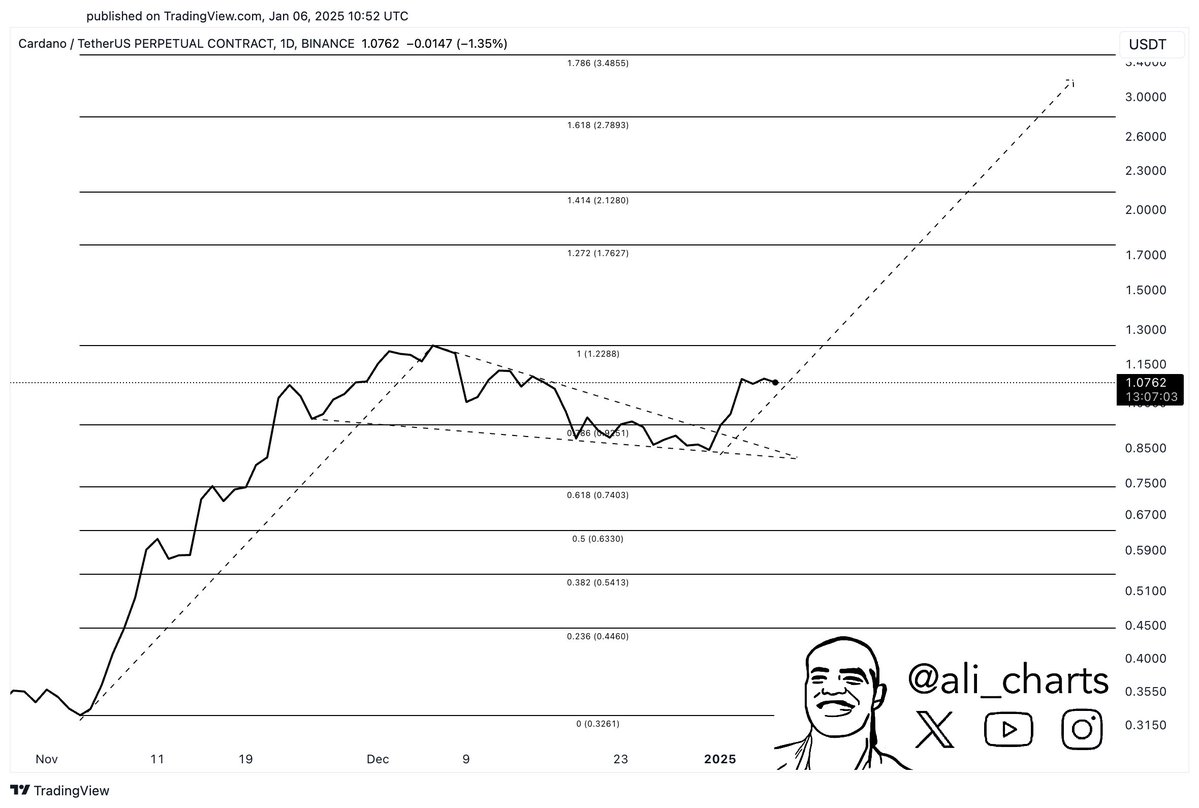

Cardano (ADA) value is exhibiting sturdy indicators of a possible breakout because it consolidates close to $1.10, sparking optimism amongst merchants. Ali Charts, a cryptocurrency analyst, has highlighted a bullish pennant formation on ADA’s value chart, suggesting an upward transfer could possibly be on the horizon.

If this sample performs out, Cardano value might goal larger ranges, with the potential for reaching $1.40 within the brief time period and breaching the earlier all time excessive of $3.10. The cryptocurrency has gained 28% for the reason that begin of 2025, supported by rising community exercise and elevated investor curiosity.

Cardano Worth Prediction Factors To New ATH

Cardano’s value is at the moment forming a bullish pennant, a technical sample that always predicts a continuation of an uptrend. This sample is characterised by a pointy value enhance, adopted by consolidation in a triangular form.

The resistance degree of the pennant is round $1.11, whereas the assist lies close to $1.10. If ADA breaks above the higher trendline, merchants might count on the value to surge, with a goal close to $1.40. Ali Charts emphasised that the “Cardano breakout to $3 could possibly be quick and easy” if bullish momentum strengthens. This ADA price prediction aligns with an ealier evaluation by Coingape pointing to the same value breakout after the formation of an Elliott Wave.

Technical indicators additionally assist this outlook. The Relative Energy Index (RSI) is at 67, reflecting sturdy shopping for exercise, although it’s approaching overbought ranges. In the meantime, the MACD (Shifting Common Convergence Divergence) stays in bullish territory, suggesting continued upward stress.

Rising Community Exercise Boosts Investor Confidence

Along with technical indicators, Cardano’s community exercise has been gaining momentum, which might additional assist its value motion. Based on knowledge from DeFiLlama, the Whole Worth Locked (TVL) on the Cardano blockchain has surged to $595 million, marking a 33% enhance for the reason that begin of the 12 months.

The rise in TVL signifies rising curiosity in Cardano’s decentralized finance (DeFi) ecosystem, which is attracting each retail and institutional buyers. Transaction volumes have additionally elevated, with the metric reaching $10.64 million, signaling larger on-chain exercise.

Furthermore, the variety of funded wallets on the Cardano community has grown considerably. Since December 19, over 10,000 new wallets have been added, bringing the whole to 4.38 million. This inflow of recent buyers is commonly seen as a constructive indicator of market sentiment.

ADA Worth Resistance Ranges and Potential Targets

Whereas Cardano value prediction is exhibiting bullish momentum, it faces key resistance ranges that should be breached to maintain its uptrend. The fast resistance is at $1.20, as recognized by Donchian Channels.

Breaking above this degree might pave the best way for a transfer towards $1.34, which corresponds to the 1.618 Fibonacci extension.

If ADA continues to draw shopping for stress and breaks out of its present consolidation, it might finally goal larger value ranges at the same time as excessive as $7. Nevertheless, failure to surpass $1.20 might result in a pullback, with $1.00 serving as a vital assist degree. A breach beneath this assist might expose Cardano to additional declines, probably testing $0.92.

Disclaimer: The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: