BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in influx on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after traders turned cautious with sturdy US JOLTS job openings and ISM Providers PMI information.

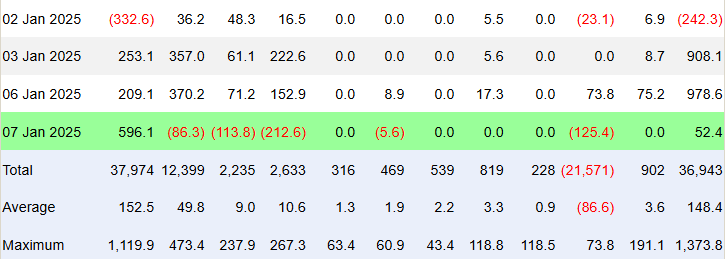

The spot Bitcoin ETF in the USA noticed a internet influx of $53.46. Bitcoin ETFs by Constancy, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Noticed Influx Regardless of Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) bought 6,078 BTC value $208.7 on January 7, whereas miners solely mined 450 new BTCs. IBIT recorded an influx of $597.18 million, as per Dealer T information.

This makes the third consecutive influx into IBIT regardless of a serious selloff in the crypto market. Notably, US Bitcoin ETF noticed an influx of $978.6 million on Monday, sparking optimism because the flagship crypto soared previous the $102K mark.

In the meantime, Constancy’s FBTC, Bitwise’s BITB, and Ark Make investments’s ARKB noticed outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Additionally, Franklin EZBC noticed a $5.58 million in outflow.

Grayscale’s GBTC additionally witnessed an outflow of $125.45 million. Flows have been zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

In line with Farside Investors, the full internet influx for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Belief by BlackRock noticed a internet influx of $596.1 million. Whereas, different ETFs skilled various levels of outflow.

Bitcoin and Crypto Market Crash On Macro Issues

In line with the U.S. Bureau of Labor Statistics, the JOLTS jobs openings elevated by 259,000 to eight,098 million in November 2024, Additionally, ISM Providers PMI got here in increased than anticipated, which reveals the resilience of the U.S. financial system at the moment. This triggered Bitcoin price to crash by greater than 5%.

In truth, the US greenback index (DXY) holds its advance above 108.50 at this time, after a two-day low transfer that triggered a restoration in Bitcoin value. Additionally, the 10-year US Treasury yield elevated to a 35-week excessive of 4.68%. The sturdy US financial information lowered expectations for additional price cuts by the Federal Reserve.

Whereas, BTC price continues to fall regardless of higher efficiency by BlackRock Bitcoin ETF. The worth at the moment trades at $96,259. The 24-hour high and low are $96,132 and $102,022, respectively. Moreover, the buying and selling quantity has decreased by 23% within the final 24 hours.

Disclaimer: The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: