Bitcoin specialists are buzzing as President-elect Donald Trump lashed out towards present Federal Reserve coverage, calling rates of interest “far too excessive” regardless of persistent inflationary pressures. “We’re inheriting a tough scenario from the outgoing administration,” Trump stated at his Mar-a-Lago membership, including that officers appear to be “attempting every thing they will to make it tougher” for his incoming group.

The blunt remarks, coming fewer than two weeks earlier than Trump’s inauguration, have stoked anticipation of a potential shift in US financial coverage—and raised hypothesis a few enhance for Bitcoin and different danger property within the new yr.

The 2017 Trump Playbook: Greenback “Too Sturdy”, Bitcoin Up?

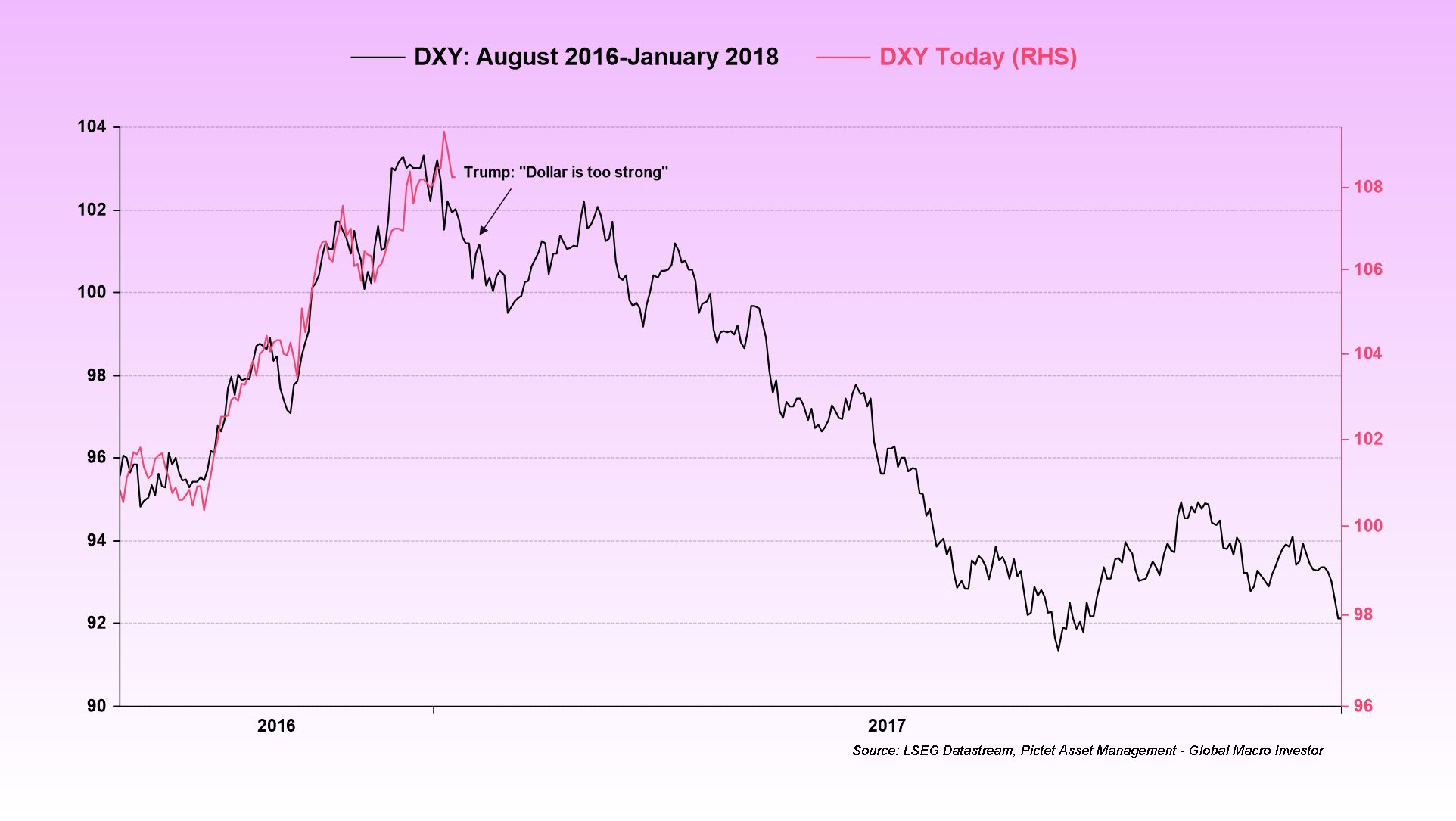

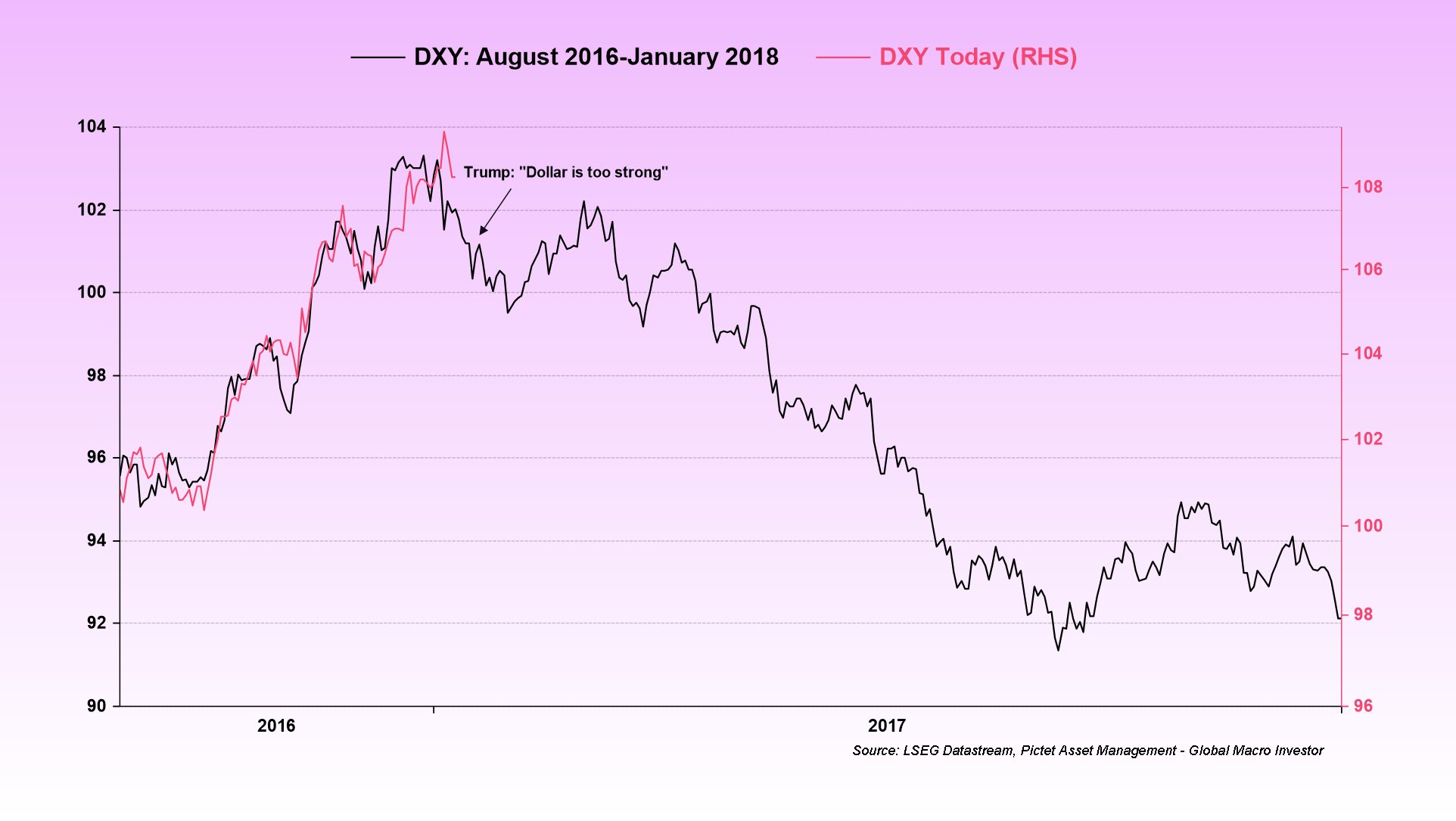

Though the financial and geopolitical panorama has modified since Trump’s first time period, some market watchers see parallels to his 2017 rhetoric. Again then, he lambasted a US greenback that he deemed “too sturdy,” a stance that preceded a notable decline within the forex. The US Greenback Index (DXY) peaked close to 104 in early January 2017 however started a downward pattern that prolonged into early 2018, bottoming out round 98.

Associated Studying

This sharp transfer within the greenback coincided with a broader risk-on environment, fueling rallies in equities in addition to the Bitcoin and crypto markets. Julien Bittel, Head of Macro Analysis at World Macro Investor (GMI), drew a direct comparison on X.

“The final time Trump stated one thing was ‘too excessive,’ it was the greenback – again in January 2017, simply days earlier than his inauguration,” Bittel acknowledged and recounted: “Right here’s what he stated: ‘Our firms can’t compete with them now as a result of our forex is simply too sturdy. And it’s killing us.”

Notably, final yr, Trump additionally referred to as latest energy a “super burden on US companies.” Bittel additional argued: “Trump understands the influence of a powerful greenback – and the identical logic applies to excessive rates of interest. They suppress exports, damage company earnings, and gradual financial development.”

Associated Studying

Talking on the influence on Bitcoin and the broader crypto market, Bittel concluded: “What occurred subsequent? Nicely, the greenback started a big decline, setting the stage for one of the crucial pivotal macro strikes we’ve seen in years – triggering a melt-up in danger property. Déjà vu? I feel so. Let’s see the way it performs out.”

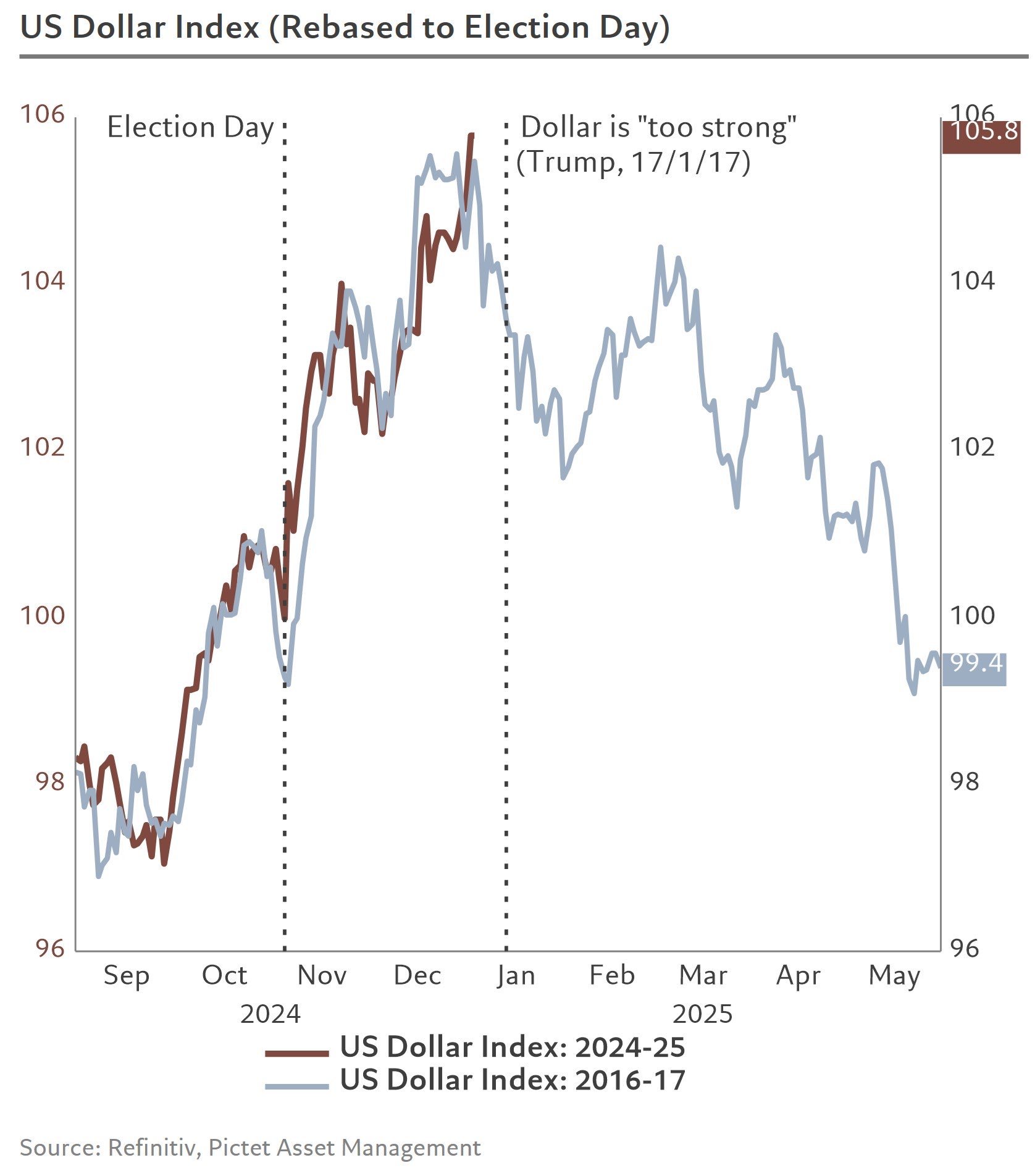

Bittel isn’t the one professional speculating that the DXY might have already got peaked, mirroring its 2017 topping sample. Steve Donzé, Deputy CIO for Multi Asset at Pictet Asset Administration Japan, shared a extensively discussed chart on X, remarking “On time. Prepared for pushback,” whereas overlaying latest DXY movements with the forex’s trajectory in early 2017. The chart suggests the same sample that would foreshadow renewed greenback weak spot within the coming weeks.

In a separate submit, monetary analyst Silver Surfer (@SilverSurfer_23) pointed to an uncanny timing overlap: “DXY topped on January third, 2017—18 days earlier than Trump’s Inauguration. DXY appears to have topped on January 2nd, 2025—19 days earlier than Trump’s Inauguration.” He characterised the parallel as “loopy historical past repeating,” explaining that he sees a correlation between the trail of the DXY earlier than each inaugurations.

Such analogies are fueling hypothesis {that a} repeat greenback stoop may usher in an surroundings favoring danger property. Ought to the greenback certainly enter a brand new downtrend—very like in 2017–2018—Bitcoin may experience a wave of renewed liquidity and speculative urge for food.

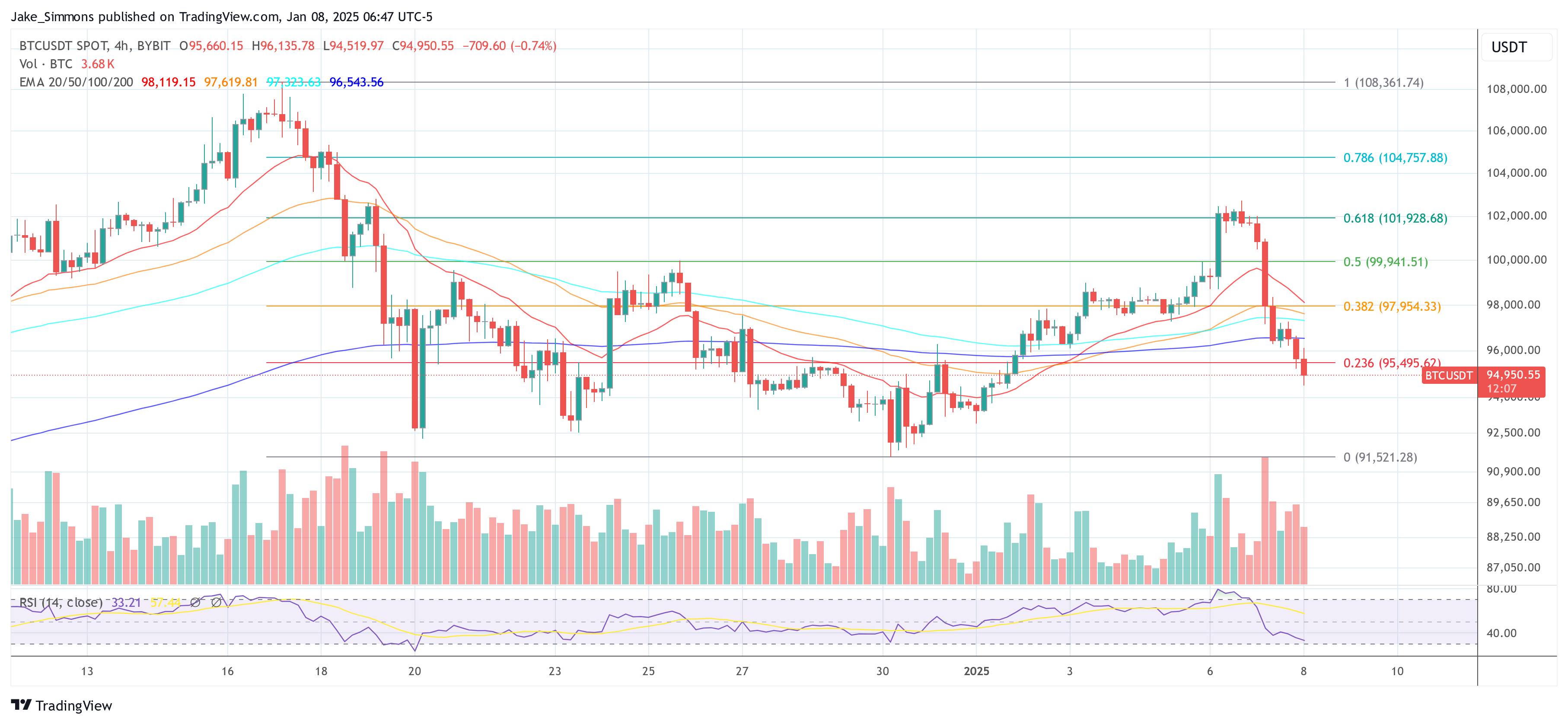

At press time, BTC traded at $94,950.

Featured picture created with DALL.E, chart from TradingView.com