The value of Ethereum (ETH) has proven some important change up to now day rising by 1.86%. Nonetheless, in response to trading data from CoinMarketCap, the favored altcoin has recorded unfavourable progress since December 2024 regardless of some important features up to now month. Apparently, underlying market exercise factors to a possible worth breakout.

Ethereum Sees Sturdy Accumulation Exercise Amid Worth Dip

Ever since touching the $4,000 price mark, Ethereum has slipped right into a downtrend falling as little as $3,000. Amidst notable gains by Bitcoin in January, Ethereum continues to battle hitting constant decrease lows throughout this era.

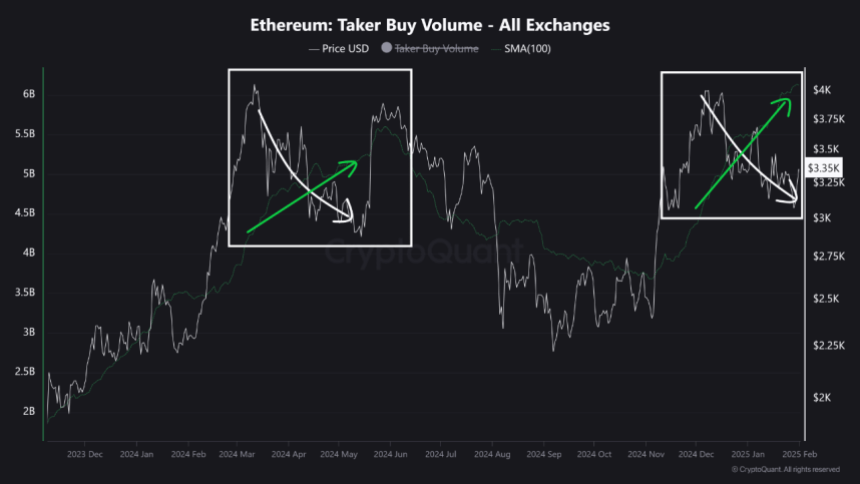

Nonetheless, a CryptoQuant market professional with the username Crypto Sunmoon has noted a rise in market shopping for quantity amidst the present worth dip indicating a bullish divergence within the ETH market. For context, a bullish divergence happens when an asset’s worth is making decrease lows whereas a momentum indicator is making increased lows, thereby hinting at a possible reversal or upward motion.

As for Ethereum, the rise in shopping for quantity amid falling costs signifies a powerful demand from patrons particularly on the present worth ranges. This growth additional suggests a powerful confidence within the asset’s profitability as traders anticipate shopping for stress to surpass promoting exercise within the coming days.

Based mostly on historic knowledge, Crypto Sunmoon predicts Ethereum might expertise a worth surge such because the one in Might 2024 when the same bullish divergence final occurred. Throughout that month, ETH rose by over 21% suggesting the altcoin will seemingly return to $4,000 if the projected worth breakout happens, in response to present market costs.

ETH Lengthy-Time period Holders Sign Sturdy Market Confidence

In different information, IntoTheBlock reports that long-term holders of Ethereum at present boast a median holding time of two.4 years displaying large confidence in Ethereum’s future worth potential.

Nonetheless, Ethereum faces different points together with an absence of short-term contributors which prevents ETH from experiencing important ranges of speculative buying and selling that may drive up worth appreciation. Moreover, the speedy progress of layer 2 options similar to Optimism, and layer 1 blockchains similar to Solana are additionally tampering with the potential market demand and a focus for Ethereum.

At press time, ETH trades at $3,306 after a achieve of 1.86% over the previous day as earlier said. In the meantime, the asset’s every day buying and selling quantity has elevated by 55.69% leading to a price of $30.3 billion. On bigger time frames, Ethereum can be up by 0.22% on its weekly chart however down by 2.27% on its month-to-month chart leaving a lot to want for a lot of short-term traders.