The worldwide crypto market tumbled once more within the final 24 hours whereas buyers didn’t even recuperate from DeepSeek AI and Financial institution of Japan’s price hike-led market crash final Monday. Bitcoin and Ethereum costs are actually down 6% and eight% in per week, respectively.

The macro components wreaked havoc on the shares and crypto markets once more as Donald Trump determined to right away signal the order to impose tariffs on Canada, Mexico, and China. Consequently, the worldwide crypto market cap tumbled greater than 3% from $3.49 trillion to $3.35 trillion. It means greater than $140 billion erased from the crypto market in just below 24 hours.

Furthermore, the Crypto Concern & Greed Index has dropped from Greed to Impartial at 47 as we speak, indicating detrimental sentiment continues to construct amongst buyers.

Bitcoin Worth and Crypto Market Downfall As a consequence of Trump Tariffs

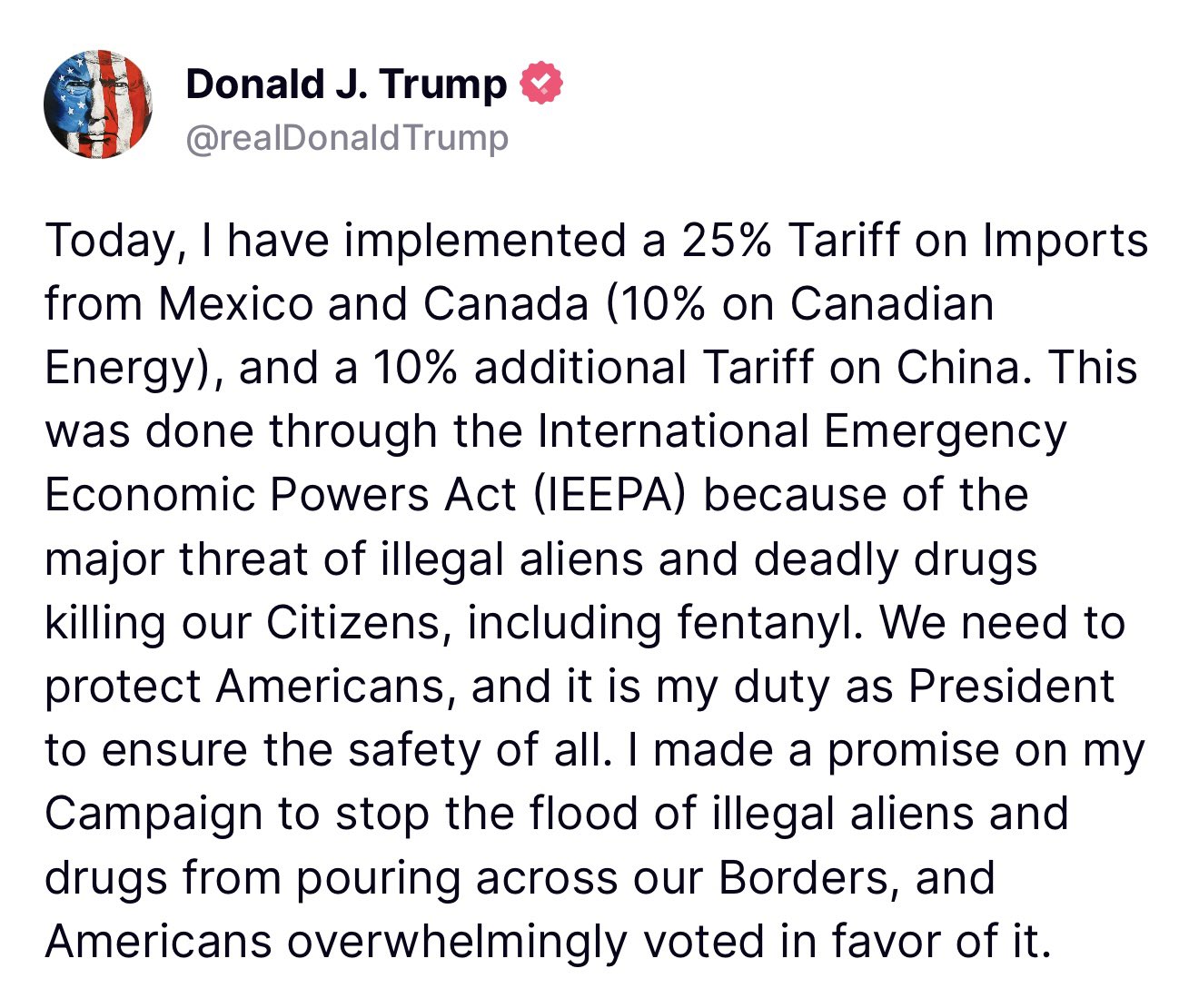

US President Donald Trump declared a nationwide emergency citing fentanyl and immigrants below the 1977 Worldwide Emergency Financial Powers Act (IEEPA). This gave President Trump energy to signal an govt order imposing 25% tariffs on Mexico and Canada, in addition to 10% tariffs on imports from China.

Consequently, Bitcoin and altcoins fell on considerations of a commerce struggle risking greater costs for U.S. customers. US PCE inflation data on Friday indicated that inflation has elevated for 3 consecutive months. Notably, US inventory indexes ended the week decrease.

Moreover, economists say blanket tariffs with a number of prime buying and selling companions are dangerous for the US, inflation, and result in greater costs and layoffs. The choice has triggered a commerce struggle as Canada, Mexico, and China retaliate.

Prime Minister Justin Trudeau stated Saturday that Canada will impose 25% tariffs in opposition to C$155 billion of US items.

This comes after the US introduced it should put 25% tariffs on Canada and Mexico, in addition to a ten% tariff on China https://t.co/DW7GA4W8Ka pic.twitter.com/RwIPrJdCl7

— Bloomberg (@enterprise) February 2, 2025

Crypto Market Sees $700 Million in Liquidations

Coinglass data signifies over $700 million in crypto liquidations, with over 250K merchants liquidated within the final 24 hours. The biggest single liquidation order of ETHUSDT valued at $11.84 million occurred on Binance.

It is very important observe that the most important liquidation occurred through the crypto market crash last Monday. An investor liquidated BTCUSDT valued at $98.46 million on crypto change HTX.

Almost $520 million lengthy and $80 million quick positions had been liquidated, with BTC, ETH, SOL, DOGE, XRP, TRUMP and RUNE main the liquidations. Within the final 12 hours, $350 million in longs had been liquidated inflicting the crypto market to bleed.

Specialists Predict Crypto Market Correction

Crypto dealer Skew predicts “short-term mayhem” within the crypto market as uncertainty round how far tariff bluffing will go. He used the time period “bluffing” as a result of these tariffs are unlikely to be the ultimate standing % on account of retaliatory tariffs by Canada and different nations.

In response to The Telegraph, hedge funds are betting massive that the inventory market to endure a devastating crash on account of tariffs by US President Donald Trump. Furthermore, information from Goldman Sachs is sending shockwaves by way of monetary circles, revealing a dramatic surge in ‘quick’ positions in opposition to US shares.

With the crypto market within the crosshairs on account of Bitcoin ETFs and institutional curiosity, Bitcon price fell to a 24-hour low of $99,022. Whereas, ETH value tumbled greater than 5% to a low of $3,069. Additionally, prime altcoins XRP, SOL, DOGE, ADA, LINK and others have plunged greater than 5% within the final 24 hours.

60% of American plebes don’t have $1k of emergency funds. The Fed is “apprehensive” about inflation. So Trump decides to hike power costs by way of tariffs? He ain’t a idiot, perhaps he’s attempting to set off a mini monetary disaster? It’s def within the perhaps column. pic.twitter.com/VEiI9qZZqC

— Arthur Hayes (@CryptoHayes) February 2, 2025

In the meantime, the US greenback index (DXY) has jumped to 108.50 indicating a strengthening greenback. Additionally, the 10-year Treasury yield is spiking above 4.54%. Notably, BTC value normally strikes in reverse to DXY and US Treasury yields.

A serious selloff could occur provided that Bitcoin value tanks under the $95K degree. Merchants are even staying away on account of double-top sample formation within the day by day timeframe.

Disclaimer: The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: