Bitcoin (BTC) has recorded huge volatility over the past a number of weeks, rising previous the $100,000 milestone solely to retrace to the $90,000 vary. This has sparked debate over whether or not the crypto market has topped, drawing opinions from varied analysts and merchants.

Regardless of market fluctuations, many stay optimistic concerning the future trajectory of Bitcoin and altcoins, whereas others warning towards unchecked bullish sentiment.

Optimism for Q1 and Bitcoin’s Bullish Pattern

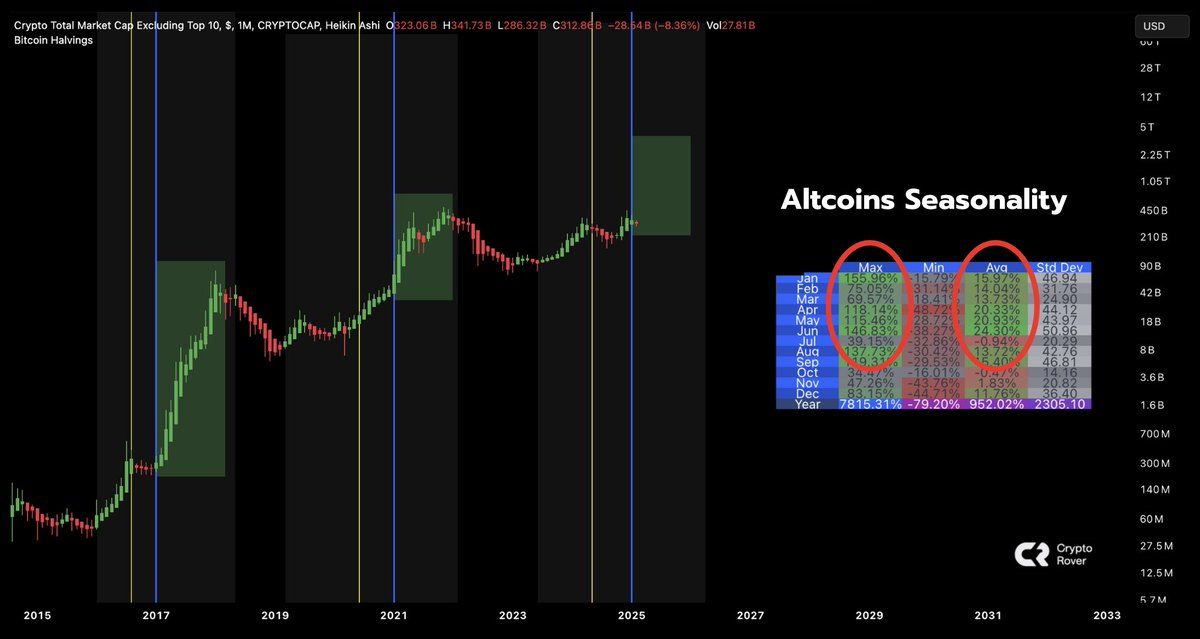

Crypto Rover stays assured that historical past will repeat itself, sustaining that Bitcoin’s value goal stays steadfast at $175,000. In line with the famend analyst, a bullish breakout is imminent.

“Q1 is at all times bullish for altcoins. This time won’t be any totally different. I belief historical past,” Rover remarked.

In the meantime, some analysts urge traders to shift their focus away from short-term market tops. As an alternative, they need to focus on figuring out robust communities with longevity, citing a “struggle of attrition” within the crypto area.

HODL Protocol reinforces that momentum ought to information decision-making reasonably than an obsession with whether or not the market has peaked. Their advice is to remain adaptable and give attention to long-term features.

In the identical tone, Crypto Nova, a seasoned investor, cautions towards trying to time market tops. As an alternative, she recommends taking income progressively, no matter whether or not the market continues to rise. This technique, she argues, will finally outperform most merchants.

“Hear it from somebody that has been right here for fairly some time: Don’t ever attempt to time to the highest on something. Not on Bitcoin, not in your favourite alts, not on something. Ultimately, the objective is to take income earlier than the highest of the market occurs. Regardless if it retains working or not. Do this and also you’ll outperform virtually anybody on this complete area,” the analyst quipped.

Trump’s Affect on Bitcoin and the Crypto Market

Elsewhere, analyst Crypthoem presents an intriguing concept relating to the Trump household’s affect on the crypto market. He suggests that strategic bulletins relating to tariffs and liquidity events have been used to depress altcoin costs, making Ethereum (ETH) a lovely purchase for main traders.

“Launch TRUMP Sucks liquidity out of all alts, permits world liberty fi to purchase low-cost ETH. Launch MELANIA Dumps all alts, permits world liberty fi to purchase low-cost ETH. Asserting tariffs causes a liquidation cascade in an already weak altcoin market, permitting the world liberty fi to purchase low-cost ETH. Calls of tariffs baggage have been stuffed,” Hoem wrote.

This concept implies that these occasions create shakeouts that finally profit well-positioned gamers.

Nachi, a high trader on Binance, sees a sample in Trump’s market affect. He suggests the latest tariff information was a deliberate political maneuver to create a crisis, shake out merchants, and permit main traders to build up Ethereum at decrease costs. He believes this cycle will repeat with China, resulting in additional shakeouts earlier than one other main value rally.

Ran Neuner, founding father of Crypto Banter, reiterates this allusion, referencing Eric Trump’s tweet suggesting, “It’s a good time so as to add ETH.” The tweet was later edited, main analysts like Duo 9 to speculate about potential insider information.

“The Trumps are the last word KOL,” Neuner remarked.

Nonetheless, The DeFi Investor counters this view, arguing that Trump’s DeFi venture had already bought over $100 million value of Ethereum earlier than Trump’s tariff announcement. This implies their holdings additionally suffered.

Warning Amid Market Uncertainty

Regardless of the optimism, some analysts are urging warning. Andrew Kang believes the latest rally was a large mechanical bounce and advises merchants to take income whereas they will.

“Huge mechanical bounce as we speak. When you made good income, IMO it’s a great place to safe them. Straightforward mode is over for alts. Imply reversion consumers flip into imply reversion sellers. There might be extra nice shopping for alternatives in February/March,” Kang advised.

In the identical tone, Binaso advises merchants to money out income into their financial institution accounts instead of stablecoins or different crypto property. The analyst encourages a disciplined method to securing features. Others add to the skepticism, highlighting extreme leverage out there as merchants have been front-running Bitcoin’s rise since $15,000. Nonetheless, with open curiosity nonetheless at excessive ranges, probabilities of a correction stay excessive.

Sachin Sharma, a market analyst, refutes the notion of an imminent crash. He factors out that true market tops are usually marked by extreme hypothesis and unsustainable valuations, which, in his view, haven’t but materialized. He additionally argues that AI-driven innovations usually tend to gas progress than trigger a downturn.

“Market tops close to when IPO and speculative progress tech goes up with no income to again. As a sector, tech monetary metrics are nonetheless inside 1-sigma to imply. And BTW the entire AI saga which is main the market to dip as we speak comes with a promise that you need to use AI to enhance productiveness, merchandise, money cycle, decrease prices, and better revenues,” the analyst challenged.

Nonetheless, Evanss6 takes a agency stance, estimating a 90-95% likelihood the cycle has topped.

As the controversy over whether or not the crypto market has topped stays extremely contentious, merchants should navigate the market cautiously. Balancing optimism with threat administration methods to maximise features finally, however traders should additionally conduct their very own analysis.

BeInCrypto information shows BTC was buying and selling for $98,900 as of this writing, up by over 5% since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.