One other crypto market crash has occurred, with Bitcoin, XRP, Solana, and Dogecoin costs experiencing vital declines. This growth comes amid financial uncertainty and the bearish sentiment amongst traders.

Crypto Market Crash: Why Bitcoin, XRP, Solana, And Dogecoin Are Dropping

CoinMarketCap data reveals that the Bitcoin, XRP, Solana, and Dogecoin costs are dropping in the present day amid one other crypto market crash. This growth has occurred amid international financial uncertainty, particularly with the tariffs nonetheless looming.

Though the US, Mexico, and Canada had agreed to a one-month pause on the tariffs, there stays the one which Donald Trump and the US had positioned on China’s imports. In retaliation, China additionally imposed tariffs on US items. In the meantime, the nation can be conducting an antitrust investigation into Google.

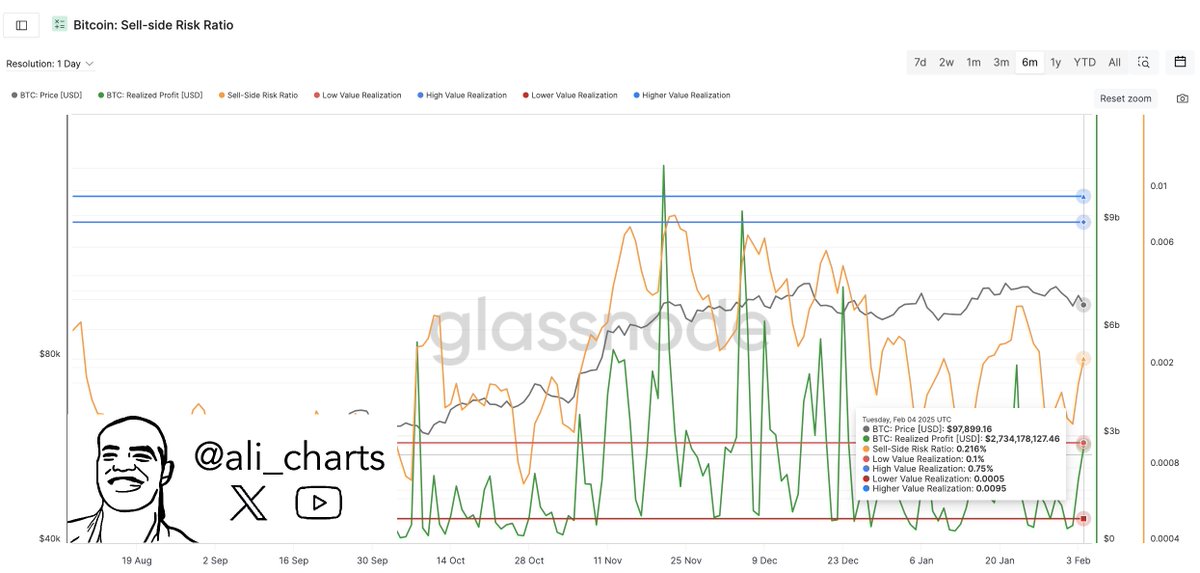

This has sparked a wave of sell-offs within the crypto market, with these developments sparking market uncertainty. Crypto analyst Ali Martinez revealed in an X submit that $2.73 billion in Bitcoin income had been realized yesterday, which elevated promoting strain available in the market, a transfer that has additionally contributed to the crypto market crash.

XRP, Solana, and Dogecoin had been additionally sure to drop alongside the Bitcoin value, given the flagship crypto’s affect on altcoins. Because of the crash, the market has witnessed over $235 million in liquidations. Lengthy positions took essentially the most hit, with $173 million liquidated.

Market At Pivotal Ranges

In an X submit, crypto analyst Justin Bennett acknowledged that the crypto market is at pivotal ranges. The analyst famous that Tether’s dominance simply secured its highest each day, 3-day, 5-day shut since early November and that the 4.4% space is serving as help to this point this week.

Bennett acknowledged that he isn’t making any calls but as it’s too marginal, and the break from the USDT.D may fail. Nonetheless, he added that that is one thing to pay attention to and monitor this month.

Within the meantime, the analyst appears to be like to be bearish on the Bitcoin price and the broader crypto market. Nonetheless, he remarked that if Tether’s dominance drops again contained in the vary on the excessive time frames, particularly again under the 4.37% stage, then he’ll flip short-term bullish on BTC. Till then, he opined that warning is required.

The Bull Run May Not Be Over

Amid the crypto market crash, crypto stakeholders have steered that the bull run is way from over. Cardano founder Charles Hoskinson recently asserted that 2025 is crypto’s 12 months.

He alluded to how the market confirmed power amid the $2 billion liquidation which it confronted earlier this week. Because of this the Cardano founder is satisfied that this bull run shall be large for the market.

From a technical perspective, crypto analysts have additionally steered that the Bitcoin value will nonetheless attain new highs. These analysts are additionally bullish on altcoins. Crypto analyst Darkish Defender not too long ago predicted that the XRP value may rally to as excessive as $8.

Ali Martinez acknowledged that the Dogecoin value may nonetheless attain $10 on this cycle so long as it holds above $0.19. In the meantime, asset supervisor VanEck predicted that the Solana value will attain $250 earlier than year-end.

Disclaimer: The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: