Bitcoin (BTC) has dropped beneath $95,000 and dangers an additional decline amid the continued market retrace. As February involves an finish, some analysts take into account the flagship crypto must reclaim some essential ranges to proceed its bullish long-term development.

Associated Studying

Bitcoin Sees Monday Bleeding

Over the previous three days, Bitcoin has seen its value drop beneath some key ranges, dropping 5.7% From Friday’s highs. Amid the information of the US Securities and Trade Fee’s withdrawal of its crypto case towards Coinbase, the biggest crypto by market capitalization traded above the $99,000 mark for the primary time in two weeks.

Nevertheless, the constructive sentiment rapidly vanished after Bybit, one of many largest crypto exchanges on this planet, suffered a $1.5 billion hack that took round 401,347 ETH. In consequence, most cryptocurrencies, together with Bitcoin, misplaced their momentary positive aspects.

Since then, the flagship crypto has hovered between the $95,000 and $96,000 zone, briefly nearing the $97,000 resistance on Saturday. On Monday, the correction continued, with BTC dropping beneath $95,000 and hitting its one-week low at $93,800.

As famous by analyst Jelle, Bitcoin continues to dump on New York markets opening. Per the put up, BTC has been retracing from its early Monday recoveries each week after the US market opens, driving its value to a pink Monday shut a number of occasions up to now few months.

Regardless of these retraces and the current market corrections, Bitcoin has remained inside its post-election vary since November, displaying minimal volatility. BTC has hovered between the $96,000-$102,000 mid-zone of the vary for many of this era.

Amid its current efficiency, Altcoin Sherpa pointed out that, excluding February 18, Bitcoin has not closed beneath its day by day help zone in over a month, signaling that BTC wants to shut above $95,700 to proceed holding this significant stage.

BTC Retests Bullish Flag Breakout

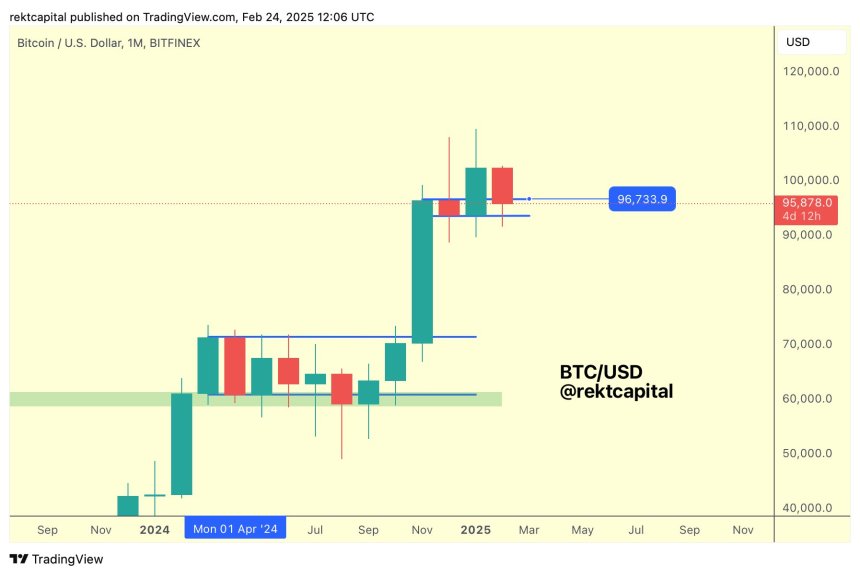

In the meantime, Rekt Capital highlighted that BTC wants a month-to-month shut above $96,000 to proceed its bullish long-term development. In January, the biggest crypto registered a historic candle after closing the month above the $100,000 mark for the primary time.

This shut confirmed Bitcoin’s breakout from its post-election monthly bull flag. Nevertheless, the current value motion has seen BTC retest its breakout stage once more, momentarily dropping it.

The analyst asserted that the cryptocurrency must reclaim and shut February above $96,700 “to verify the breakout & set itself up for development continuation over time.”

He added that BTC has traded round this key stage all through nearly all of February, and persevering with to carry it might point out a “profitable post-breakout retest.”

Associated Studying

Rekt Capital concluded that BTC’s day by day shut “isn’t as vital as the upper timeframe sign” because the bull flag backside continues to carry as help “and the three-month development of a Increased Low on the draw back wicks nonetheless exists.”

On the time of writing, BTC trades at $94,165, a 2.1% lower within the day by day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com