- That is the bottom Bitcoin has dropped since November 2024

- Trump’s commerce tariffs are possible impacting crypto market costs as traders look elsewhere to commerce

- Two crypto hacks days aside have worsened investor sentiment

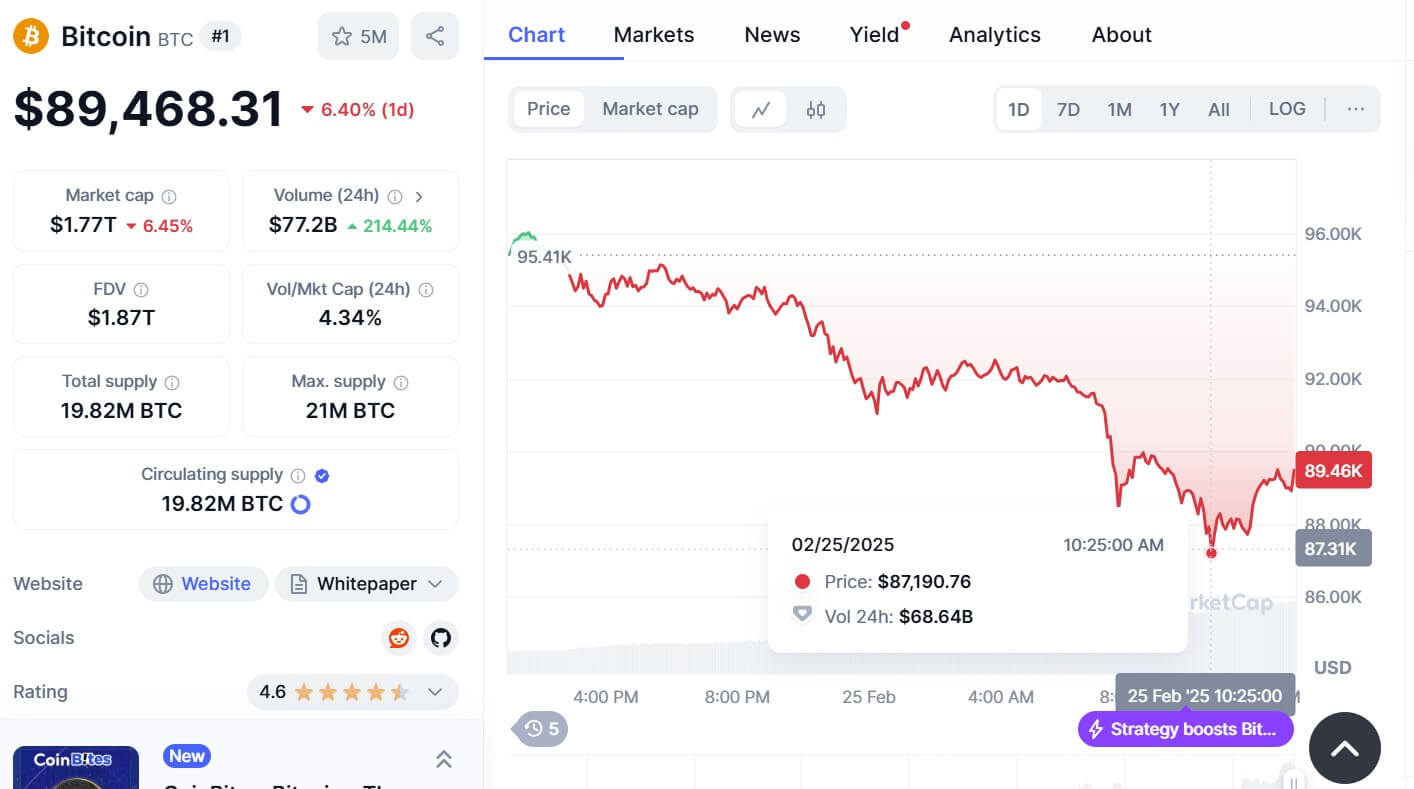

Bitcoin’s worth has dropped under the $90,000 mark, signalling the bottom decline for the primary crypto asset since November 2024.

On February 25 at 10:25 UTC, Bitcoin was buying and selling at round $87,190, in line with information from CoinMarketCap. On the time of publishing, it has risen barely however stays beneath $90,000, a key figure to stay in bullish territory.

In keeping with Arthur Hayes, BitMEX’s co-founder, Bitcoin could drop to $70,000 if massive hedge funds promote their positions in Bitcoin exchange-traded funds (ETFs).

Affect of Trump’s tariffs

The drop in worth comes amid uncertainty about inflation, US President Donald Trump’s insurance policies, and geopolitical occasions.

Yesterday, Trump confirmed 25% commerce tariffs on Canada and Mexico, inflicting the market to react as traders look to different avenues to place their cash.

In keeping with James Toledano, COO at Unity Pockets, many believed that Bitcoin’s worth would proceed rising as soon as Trump entered the White Home, including to CoinJournal:

“However the actuality is that the value has gone south, possible resulting from tariff commerce wars, fragile peace talks in Japanese Europe, and fears round DeepSeek’s affect on the US tech sector. However this might additionally simply be a momentary lapse of pricing purpose.”

Safety breach at Bybit

Final week, Hong Kong-based crypto alternate Bybit was the goal of a significant hack, ensuing within the loss of nearly $1.5 billion worth of Ethereum from a single pockets.

Regardless of Ben Zhou, Bybit’s founder and CEO, saying it had “absolutely closed the ETH hole,” elevating funds to cowl the losses and increase investor confidence, the actual fact stays that traders are shaken.

Not solely that, however neobank Infini suffered a $50 million hack yesterday. In keeping with reviews, insider entry enabled the hacker to govern the platform’s sensible contract it had developed after retaining administrative privileges unbeknownst to Infini.

Following the theft, the hacker transformed the stolen USDC into Dai after which bought 17,696 Ethereum, valued at round $49 million on the time.

“Moreover, international macroeconomic uncertainty and a downturn in conventional markets have weighed on Bitcoin, as danger belongings stay extremely delicate to exterior pressures,” mentioned Toledano.

“Be aware, the S&P 500 which is the bellwether for the equities market is down over 4% during the last month and over 2% this previous week alone. Whereas 2 and 4 share factors imply little within the cryptosphere, these figures are notable in TradFi from a loss perspective.”