- The Bybit hack has elevated fears over centralized alternate safety vulnerabilities

- US President Donald Trump’s commerce tariffs are rising market uncertainty

- Trump’s crypto guarantees might have began as being nice, however they may find yourself proving catastrophic

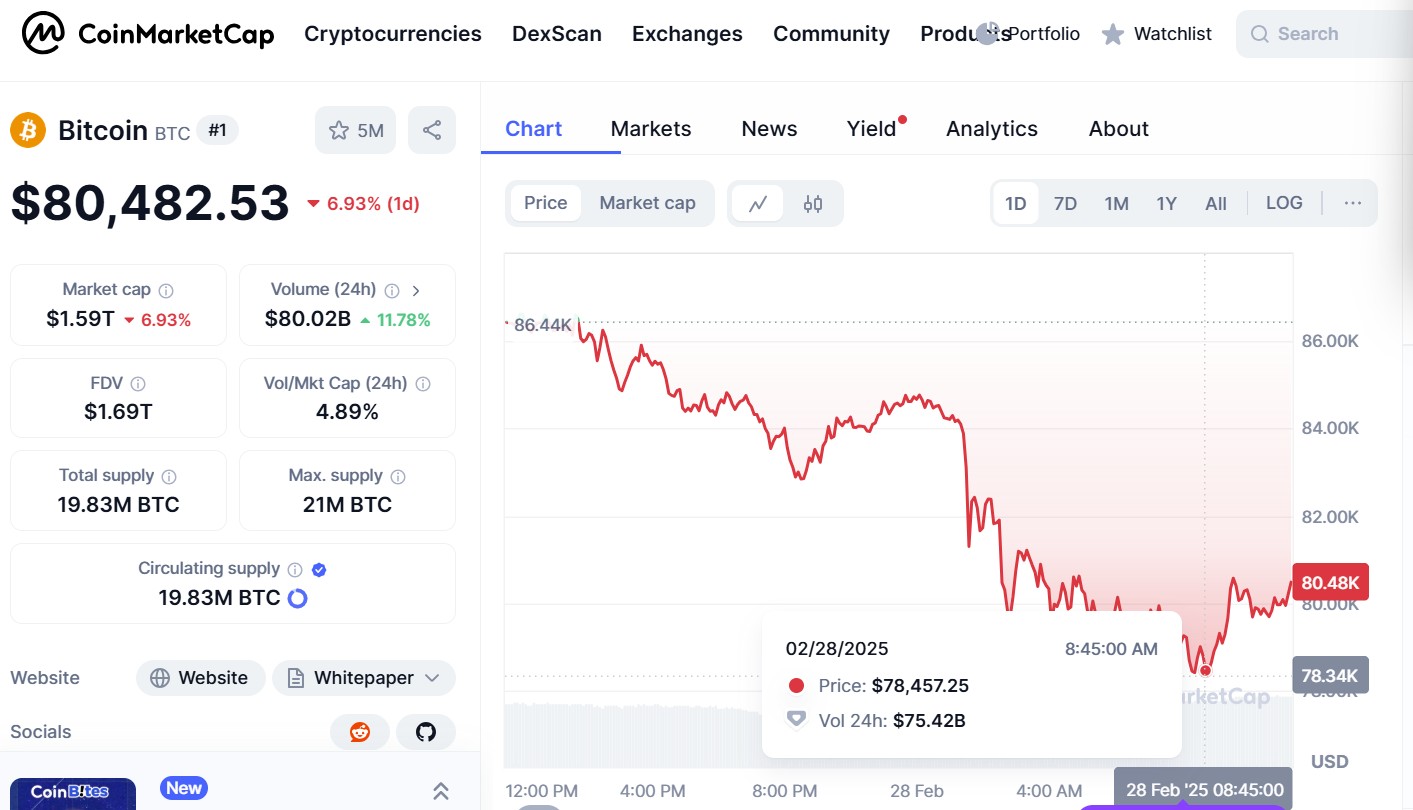

Three issues are contributing to the drop in crypto costs, which has seen Bitcoin fall 7.50% over 24 hours to $78,000, in keeping with Unity Pockets’s COO.

It’s a major drop from Bitcoin’s all-time excessive, which reached $109,000 in January forward of US President Donald Trump’s inauguration.

In accordance with James Toledano, it appears like optimism across the crypto market post-election created a bubble and that the “actuality post-inauguration is now setting in – and exhausting,” he mentioned to CoinJournal.

In Toledano’s view, the Bybit hack on the crypto alternate final Friday—which resulted within the theft of almost $1.5 billion worth of Ethereum—is likely one of the contributing elements affecting crypto costs.

Undermining investor confidence, it has led to panic withdrawals and a market-wide selloff throughout the board. Whereas Bybit’s CEO, Ben Zhou, shortly responded to the hack, the state of affairs has elevated “fears about centralized alternate safety vulnerabilities—which solely solidifies the case for self-custodial providers,” Toledano continued.

Dom Harz, co-founder of BOB (“Construct on Bitcoin”), a hybrid Layer-2, mentioned to CoinJournal the theft at Bybit is a “stark reminder of the business’s elementary points,” including:

“We’ve been hypnotized by value spikes, memecoin frenzies, and media spectacles, forgetting that crypto was meant to be a brand new monetary system—one constructed on decentralized protocols that make finance accessible to everybody. Bybit simply gave us a $1.5 billion reminder that we’re nowhere close to that actuality.”

Trump’s tariffs

The continued market selloff follows Trump’s commerce tariff announcement earlier this week.

Throughout his election marketing campaign, the US president made guarantees relating to crypto, stating that America would be the “crypto capital of the planet.”

Since getting into the White Home, he has appointed pro-crypto people to reshape authorities businesses, specifically Paul Akins because the incoming chair of the US Securities and Exchange Commission (SEC).

Mark Uyeda is at present acting chair of the SEC.

Trump additionally signed an govt order to ascertain a crypto working group to offer regulatory readability. It’s additionally anticipated that the working group will look into the potential of a nationwide crypto stockpile.

But, regardless of these steps, Trump’s commerce wars—which might quickly hit the EU, the world’s largest buying and selling bloc, with a 25% tariff—is rising market uncertainty.

In accordance with Toledano, Trump’s tariffs are “harming the worldwide economic system” and that many within the crypto house really feel let down by the US president.

“The promise was nice and the truth is probably proving to be catastrophic,” he added. “It does make me marvel if Trump understands that monetary verticals are interlinked and more and more converging.”

Greatest financial danger

The third contributing issue affecting market costs—in keeping with Toledano—are questions across the general governance of the US.

An article by Chatham House means that the most important financial danger from Trump’s presidency is a lack of confidence in US governance. It reads that whereas Trump’s insurance policies could seem gentle within the brief time period, steps that undermine the US and its worldwide allies might have lasting results.

“I not often get spooked from the peaks and troughs that crypto presents however once I mix what’s taking place with conventional equities volatility, I believe there’s trigger for concern proper now,” mentioned Toledano.