Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

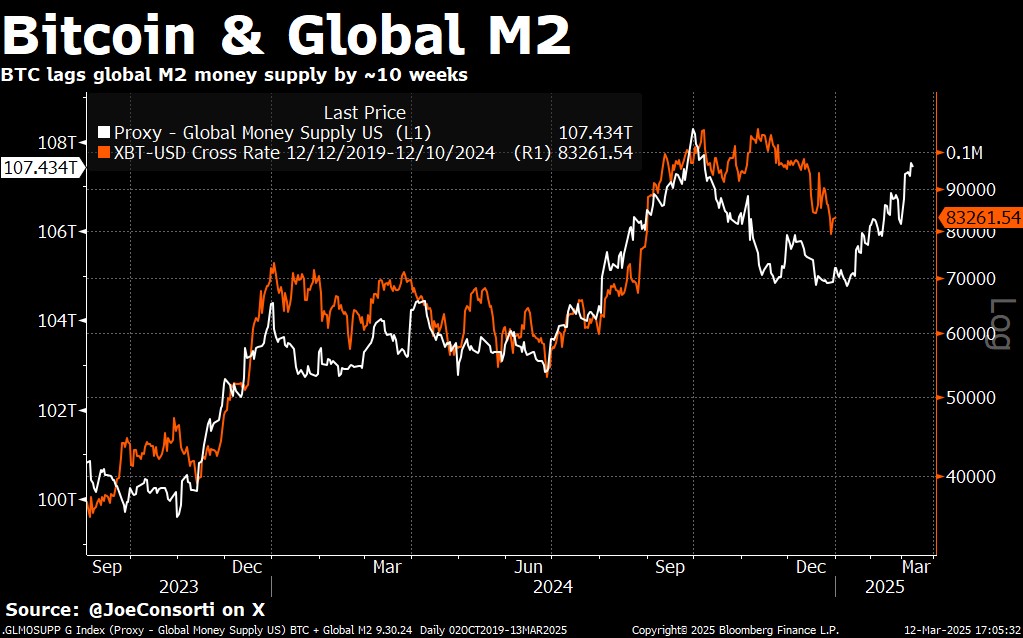

Bitcoin’s tight correlation with world M2 has returned to the highlight, suggesting that broader financial situations stay a key power behind the cryptocurrency’s market trajectory. Current worth motion reveals Bitcoin converging with M2’s downward drift—mirroring roughly a 70-day lag. This cyclical motion highlights Bitcoin’s ongoing responsiveness to fluctuations in liquidity, at the same time as different basic elements, just like the newly introduced US Strategic Bitcoin Reserve (SBR), proceed to seize headlines.

International M2 Correlation And Bitcoin Market Inefficiency

In his newest analysis note, analyst Joe Consorti underscores that “Bitcoin’s directional correlation with world M2 has tightened once more,” indicating that worth stays closely swayed by cash provide tendencies. After a couple of months of divergence—fueled partly by a robust US greenback—Bitcoin fell to $78,000, coming inside $8,000 of M2’s projected path.

The worldwide M2 index has softened, partly reflecting the greenback’s strong efficiency. Regardless of that drag, Bitcoin seems to be following the overall liquidity blueprint it has tracked all through this cycle, suggesting Bitcoin’s worth nonetheless hinges on main macro forces like central financial institution expansions and contractions. “Whereas this relationship isn’t a direct cause-and-effect mechanism, it continues to supply a helpful macro framework,” Consorti writes.

He added: “The takeaway? Bitcoin stays the last word financial asset in a world the place cash provide, steadiness sheet capability, and credit score are perpetually increasing. As world cash provide expands, bitcoin tends to comply with it, not less than directionally. However this cycle is seeing extra variables that make M2 a much less dependable standalone indicator, such because the US greenback being traditionally sturdy, making a drag on world M2 denominated in USD, and extra correct measures of cash provide and liquidity coming onto the scene.”

Associated Studying

Though macro situations are exerting acquainted strain, the market’s response to the SBR announcement has been perplexing. After the US President Donald Trump formally declared plans to build up Bitcoin via a “budget-neutral” mechanism, the worth tumbled 8.5% in just below per week. Consorti described the sell-off as “an irrational response highlighting main inefficiencies in pricing Bitcoin’s geopolitical significance.”

Government Order 14233 mandates Treasury and Commerce officers to develop America’s BTC holdings—at present at 198,109 BTC—with out new taxpayer value or congressional oversight. This can be a stark distinction to earlier government-level adoptions, reminiscent of El Salvador’s authorized tender transfer, which coincided with a surge in Bitcoin’s worth. Consorti attributes the disparity to short-term revenue taking and a “sell-the-news” mentality, including that “the magnitude of the selloff signifies an entire failure to cost within the long-term implications.”

Regardless of the SBR-related dip, Bitcoin’s technical alerts recommend a doable native backside forming. The cryptocurrency dipped to $77,000 earlier than bouncing again, filling a low-volume hole within the $76,000–$86,000 vary. Consumers seized on the retracement, creating two hammer candlesticks on the weekly chart.

Associated Studying

Hammer candlesticks usually level to a reversal, particularly once they seem at cycle-defining assist ranges. Based on Consorti, “Historic precedent means that Bitcoin kinds these patterns at cycle turning factors… The final time we noticed this precise worth construction was through the tail finish of Bitcoin’s summer season 2024 consolidation, two months earlier than it surged from $57,000 to $108,000.”

A notable development amid these worth fluctuations is Bitcoin’s rising dominance, even in periods of market contraction. ETH/BTC not too long ago sank to 0.0227—its lowest since Might 2020—indicating intensifying skepticism towards altcoins. In the meantime, institutional demand for Ethereum has likewise slumped, as evidenced by a 56.8% drop within the asset underneath administration (AUM) ratio for Ethereum vs. Bitcoin.

“This cycle belongs to Bitcoin, and all future cycles will solely additional cement this actuality,” Consorti asserts. He suggests altcoins are preventing an uphill battle as Bitcoin-centric narratives achieve world traction.

At press time, BTC traded at $82,875.

Featured picture created with DALL.E, chart from TradingView.com