Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has skilled considered one of its most difficult begins to the yr, recording its second-worst efficiency within the first quarter of its historical past.

As of now, ETH is buying and selling simply above the essential support level of $2,000, reflecting a year-to-date decline of 43%. This stark distinction is especially notable when in comparison with Bitcoin (BTC) and XRP, which have seen positive factors of 23% and an astonishing 279%, respectively, throughout the identical interval.

Might A 60% Surge In Q2 Carry It Again To $3,200?

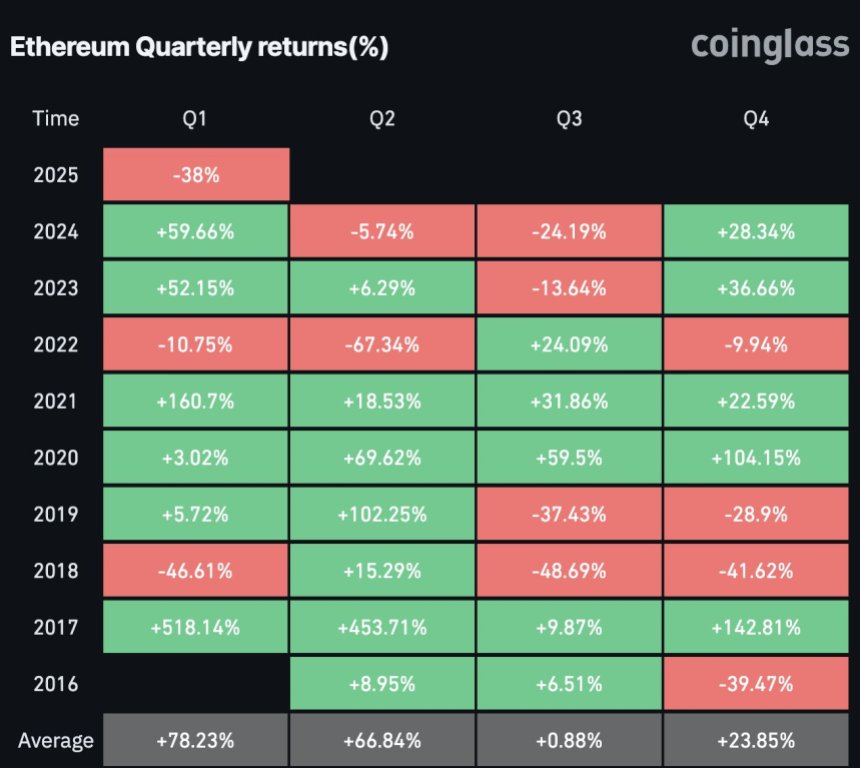

Market professional Lark Davis has drawn consideration to the dramatic downturn in Ethereum’s worth in a latest social media update, highlighting a 38% drop in Q1 of this yr for the altcoin.

This determine is alarmingly near its worst quarterly efficiency of 46% recorded through the first quarter of 2018, as famous within the comparability chart shared by Davis.

Associated Studying

Following that worrying quarter in 2018, Ethereum noticed a quick restoration of 15% in Q2, solely to face greater than 40% declines within the subsequent quarters, respectively, elevating issues for present traders that this pattern would possibly happen as soon as once more on this cycle.

Regardless of these discouraging figures, Davis posed an fascinating query relating to the potential for an “explosive” second quarter for Ethereum. Traditionally, since 2016, ETH has averaged a exceptional 66% surge throughout this era.

If this development continues and the Ethereum worth have been to attain a 60% improve within the coming months, its worth might climb to $3,200 per token—ranges not seen since early February of this yr.

Crypto Professional Predicts 1,100% Surge For The Ethereum Worth

Whereas short-term challenges stay, many analysts retain a long-term bullish outlook for Ethereum. Crypto analyst Merlijn drew parallels between the present market situations and Bitcoin’s previous efficiency, suggesting that Ethereum is poised for the same trajectory.

The analyst noted, “Accumulation, breakout, and V-shape restoration loading,” implying {that a} new bull run may very well be on the horizon for ETH, with forecasts suggesting it might attain as much as $24,000 throughout this cycle—a serious 1,100% improve.

Associated Studying

Nevertheless, the trail to restoration is just not with out its hurdles. Professional Ali Martinez lately highlighted key resistance ranges that Ethereum should overcome for a sustainable rebound within the short-term.

Martinez famous that ETH’s worth has reclaimed its realized worth of $2,040, however the subsequent important problem lies on the $2,300 mark, the place robust resistance has been noticed for the main altcoin.

Regardless of a latest restoration that noticed a ten% spike up to now two weeks, Ethereum nonetheless faces notable month-to-month losses, down practically 25% following a broader market correction.

Featured picture from DALL-E, chart from TradingView.com