The escalating US-China commerce battle has despatched international markets right into a frenzy, with BitMEX co-founder Arthur Hayes believing that Chinese language cash might quickly be coming into Bitcoin. BTC value has already bounced again from yesterday’s lows of $74,400, and is at present buying and selling north of $80,000 ranges as of press time. Traders are ready for a greater negotiation within the commerce deal whereas abandoning the volatility.

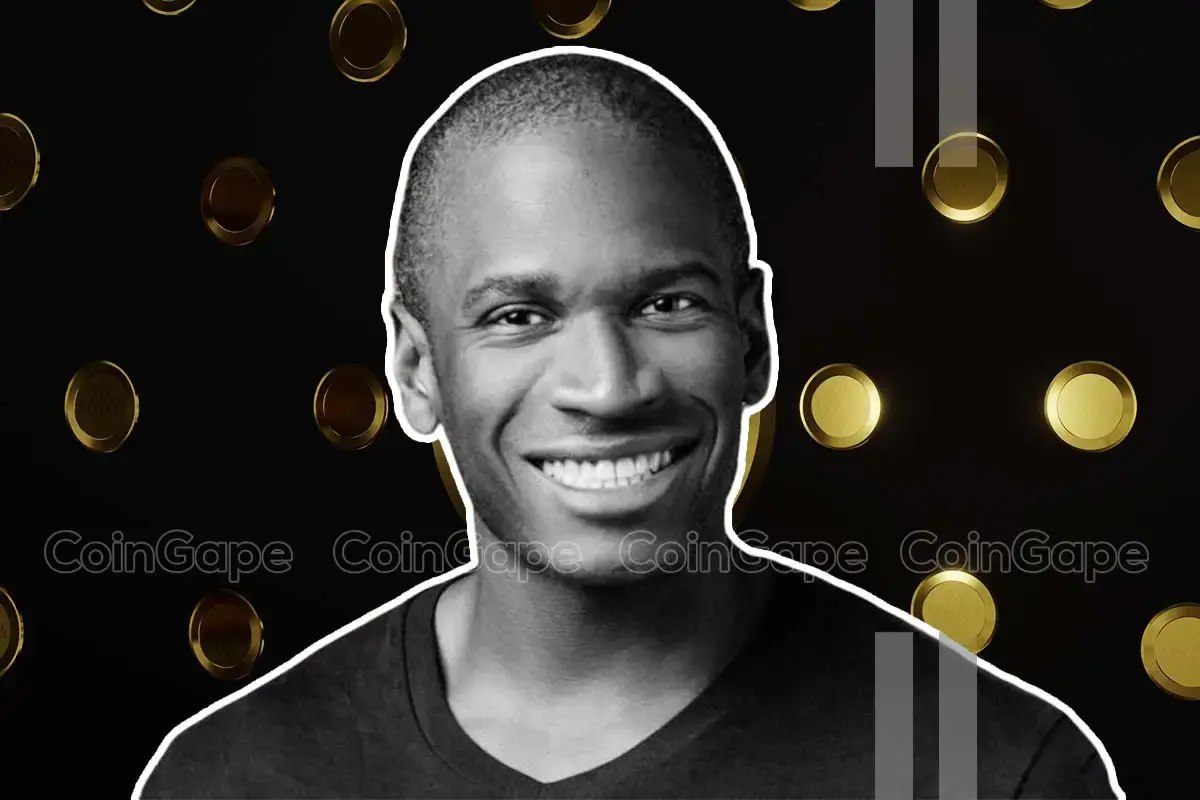

Arthur Hayes Explains Why Chinese language Cash May Enter Bitcoin

Amid uncertainty in international financial traits, market gamers are taking a look at China’s potential affect on Bitcoin. Arthur Hayes argues {that a} devaluation of the Chinese language yuan (CNY) might drive capital outflows into BTC, reviving a pattern seen in 2013 and 2015. With $USDCNH nearing five-year highs, whispers of a doable coverage shift are gaining momentum.

Hayes additional establishes the hyperlink between a weaker Yuan and the Bitcoin nexus. He acknowledged that Yuan devaluation, spurred by China’s impartial financial coverage, is seen as a strategic transfer by President Xi Jinping to maintain financial competitiveness. As per Arthur Hayes, this creates a bullish narrative for Bitcoin as Chinese language capital seeks various avenues amid the devaluation.

Whereas many doubt that China’s management will essentially alter its stance, the present trajectory of the yuan means that authorities could quickly step in to arrest the decline.

Commerce Warfare Tensions At New Excessive

US President Donald Trump is in no temper to again down on his tariffs, particularly on China, as the 2 largest international economies escalate the commerce battle additional. In additional escalation, Trump introduced plans to impose a further 50% tariff on Chinese imports, bringing the whole tariffs on items from China to 104%. This could mix the prevailing 20% and 34% tariffs with the brand new levy.

The USA imports roughly $439 billion value of products from China yearly. President Trump has given China till April 8 to rescind its 34% tariff on U.S. items, warning that failure to take action will activate extra measures. Nevertheless, Chinese language officers have issued a agency assertion, declaring they’ll “combat till the tip” in opposition to the proposed tariffs.

The place Is BTC Worth Heading Subsequent?

As per the Bitcoin falling wedge sample, the BTC price has bounced again from the essential help and is at present buying and selling 4.54% up at $80,336, with each day buying and selling volumes surging 85% to greater than $86 billion. Bitcoin is prone to rebound towards the vital $85,000 resistance degree, some extent the place substantial promoting strain might emerge.

Famend crypto analyst Rekt Capital additionally believes that the Bitcoin backside formation could possibly be in amid the continued market correction. To forecast this, the analyst highlights historic traits in Bitcoin’s each day Relative Energy Index (RSI).

In accordance with the analyst, the present value ranges, extending as much as roughly $70,000, are prone to signify the decrease boundary of this downturn. Our BTC price prediction indicator exhibits the asset to flirt round $77,000 over the following month.

Disclaimer: The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: