The altcoin winter could persist as a consequence of main challenges like low liquidity, Bitcoin’s dominance amid geopolitical instability, and extreme market dilution.

Whereas a couple of main altcoins should still have potential sooner or later, the general image means that this troublesome part is unlikely to finish quickly. Listed here are the highest three the reason why.

#1. Buying and selling Knowledge Reveals Buyers Nonetheless Ignore Altcoins

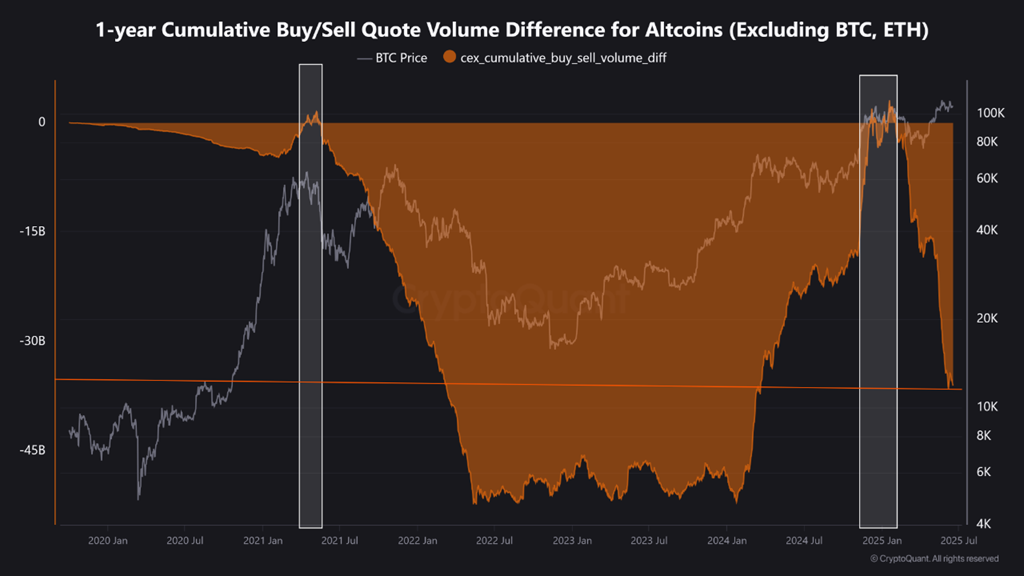

In response to CryptoQuant, the “1-year Cumulative Purchase/Promote Quote Quantity Distinction for Altcoins” is at present at damaging $36 billion and reveals no signal of restoration.

This metric displays the hole between purchase and promote quote quantity for altcoins. A damaging $36 billion studying signifies that, over the previous yr, the overall promote quote quantity of altcoins has exceeded the purchase quote quantity by $36 billion.

Buyers are promoting altcoins greater than shopping for. This pattern might stem from risk-averse sentiment or the idea that altcoins are not engaging within the quick time period.

“Regardless that Bitcoin is having fun with a bull run, altcoins are behaving prefer it’s nonetheless winter. Except this metric begins rising once more, anticipating a full-blown altseason or altcoin FOMO may simply be wishful considering,” analyst Burakkesmeci commented.

Subsequently, to verify the start of an altcoin season, we have to see this metric rise or flip constructive.

#2. Geopolitical Tensions Reinforce Bitcoin’s Dominance

International geopolitical tensions, most just lately the Israel-Iran battle, have created an unfavorable atmosphere for altcoins.

When Israel attacked Iran, Bitcoin’s value dropped—however altcoins suffered even heavier losses. However, when Bitcoin rallies, it attracts a lot of the investor consideration and capital, leaving altcoins overshadowed. This sample has endured since early this yr.

Consequently, Bitcoin Dominance (BTC.D) rises in each eventualities. Actually, BTC.D has posted six consecutive inexperienced weekly candles and is holding above 64%.

Some analysts argue that altseason may need began in June, if not for the Israel-Iran battle.

“Altcoin season virtually began… Ethereum outperformed BTC for ~1 week and Israel-Iran warfare and perhaps WW3 began. Now BTC dominance is close to a 5-year excessive, being very removed from altseason… Solely factor we will do is wait, HOLD and hope. Keep sturdy everybody,” investor Gem Hunter commented.

Furthermore, current geopolitical conflicts will unlikely be resolved inside weeks or months. Meaning risk-averse sentiment will doubtless proceed to dominate the market, placing altcoins at an obstacle.

#3. File Variety of Altcoins Dilutes the Market

The third purpose lies within the explosion of the variety of altcoins.

In response to CoinMarketCap, by June, the variety of altcoins surpassed 17.34 million—an 850-fold improve in comparison with December 2021. In the meantime, the altcoin market cap (TOTAL2) is $1.13 trillion, nonetheless 30% beneath its late-2021 peak.

This explosion has created an excessively fragmented market. Capital influx is lowering and spreading too skinny throughout too many property. Only some main altcoins handle to draw investor consideration.

Even when an altseason does happen, it can doubtless be extremely selective. Cash like Ethereum, Solana, and XRP may benefit, however most smaller altcoins will wrestle to interrupt out.

This dilution lowers the possibilities for brand spanking new or lesser-known tasks to succeed. It additionally makes traders extra cautious when selecting which altcoins to again.

Consequently, even in essentially the most optimistic situation, most altcoins will nonetheless be left behind.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.