Institutional demand for Ethereum seems robust as spot exchange-traded funds (ETFs) have recorded seventh-straight week of inflows.

US Ethereum Spot ETFs Have Lately Seen Steady Inflows

In a brand new post on X, the analytics agency Glassnode has shared an replace on how the netflow associated to the US Ethereum spot ETFs is trying. Spot ETFs are funding autos that enable buyers to achieve publicity to a given cryptocurrency with out having to straight personal tokens of it.

These ETFs commerce on conventional platforms, so merchants taking this route don’t must hassle with digital asset exchanges and wallets. For buyers solely aware of the normal mode, this reality could make the ETFs the preferrable mode of funding.

The US Securities and Exchange Commission (SEC) accepted spot ETFs for Ethereum in mid 2024, half a 12 months after Bitcoin’s approval went via close to the beginning of the 12 months.

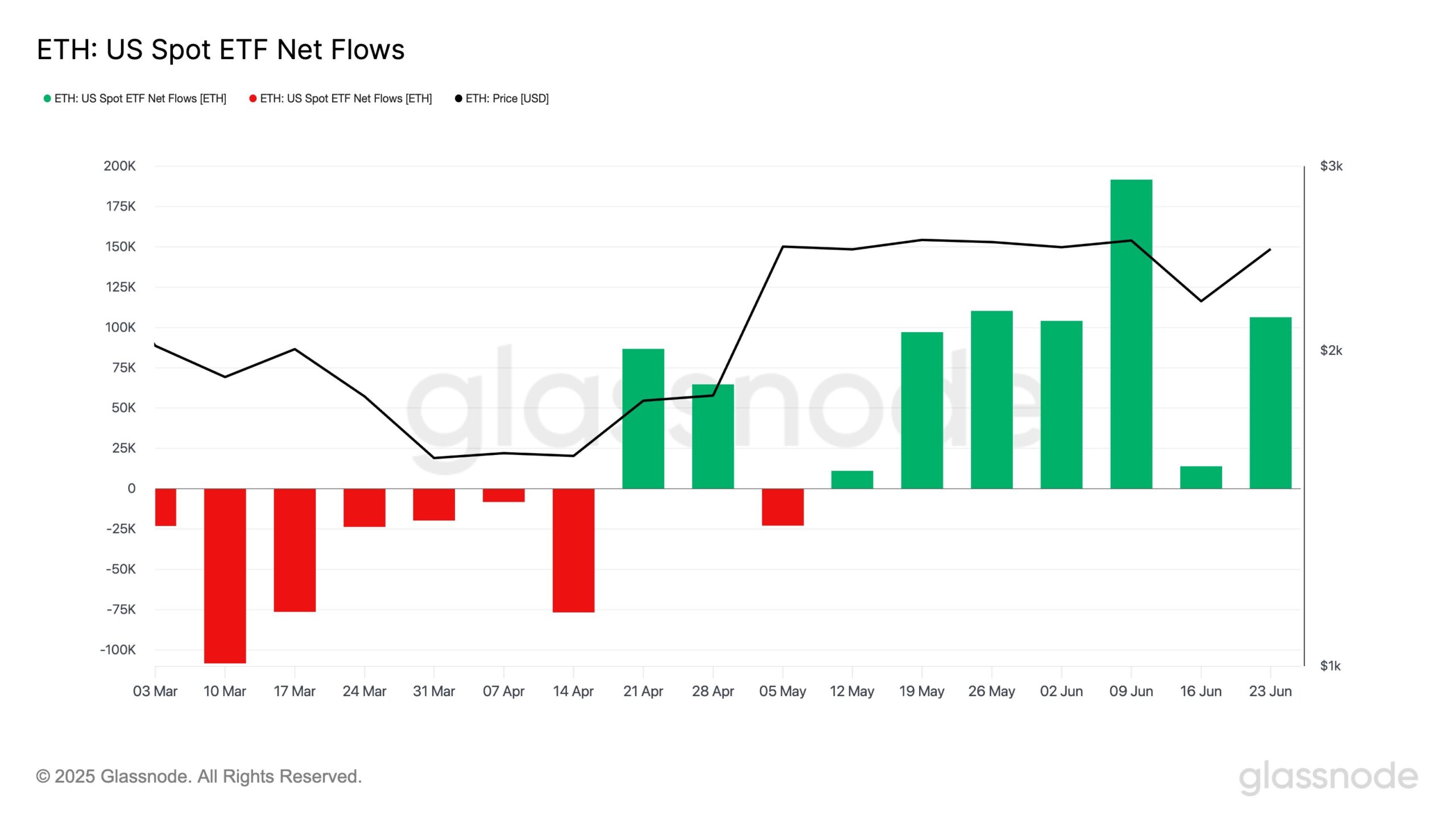

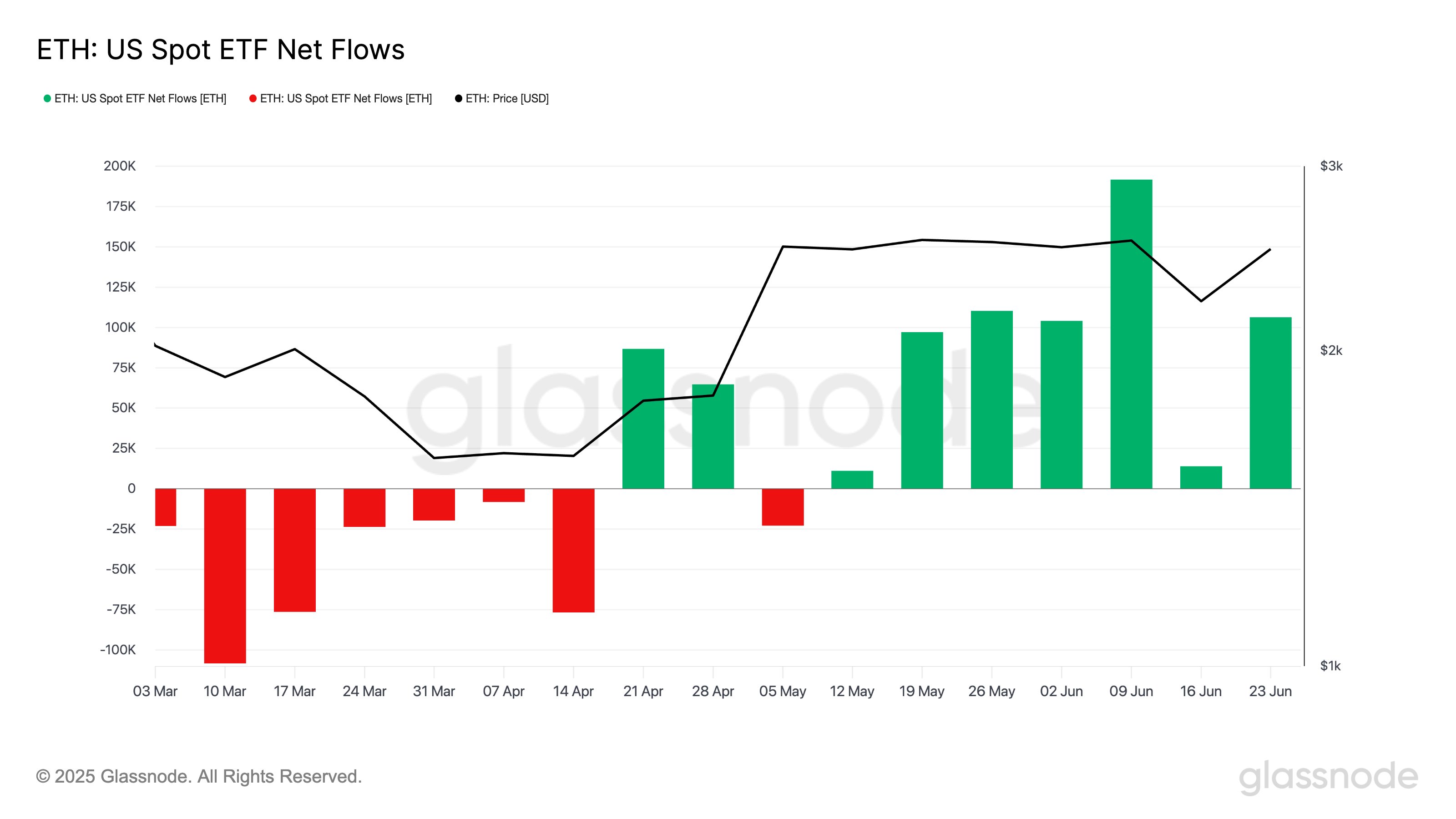

Under is the chart shared by Glassnode that reveals how the mixture netflow has been like for the US ETH spot ETFs through the previous few months.

As is seen within the graph, the Ethereum spot ETFs noticed outflows earlier within the 12 months, however the pattern has been completely different for the reason that closing third of April. Save for every week in Could, a internet quantity of capital has been pouring into these funding autos.

“As ETH rebounded from $2.2K to $2.5K, institutional urge for food adopted,” notes Glassnode. “Spot ETH ETFs recorded 106K ETH in internet inflows final week – marking the seventh consecutive week of constructive flows.”

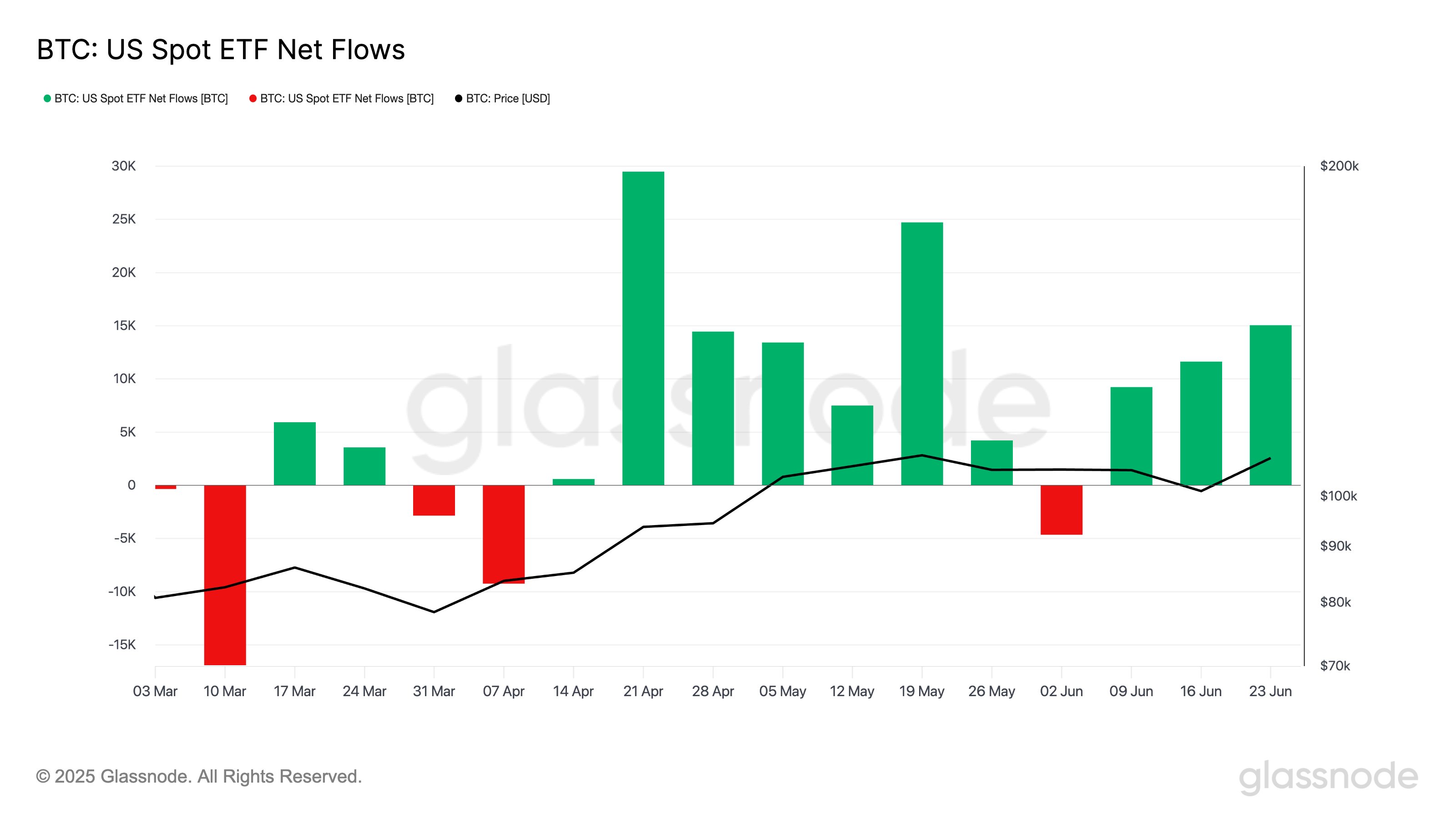

Ethereum isn’t the one cryptocurrency that has just lately been having fun with ETF inflows. Because the analytics agency has identified in one other X post, the primary digital asset, Bitcoin, can also be seeing demand decide up.

As displayed within the above chart, Bitcoin has additionally been seeing a inexperienced netflow for the US spot ETFs, however as a consequence of every week of outflows in early June, the streak solely stands at three weeks for the asset.

Through the newest week, round 15,000 BTC flowed into the ETFs. In USD phrases, that’s equal to $1.6 billion. For comparability, inflows amounted to $258.6 million for Ethereum. Clearly, whereas each have seen demand, there’s a clear distinction of scale concerned between the 2.

From the graph, it’s obvious that the US Bitcoin spot ETFs noticed an acceleration of demand over the course of June. It solely stays to be seen, although, whether or not the pattern would sustain on this month of July.

ETH Worth

Ethereum crossed the $2,500 degree earlier, however it appears the coin has since confronted a pullback as its worth is again at $2,400.