During the last month, Bitcoin ranged throughout the $100,000 — $110,000 worth area till its latest breakout to achieve a brand new all-time excessive. On-chain information present {that a} shift in BTC holder conduct could have performed a big function within the flagship cryptocurrency’s recent price action.

LTHs Start Distributing, However STHs Accumulate

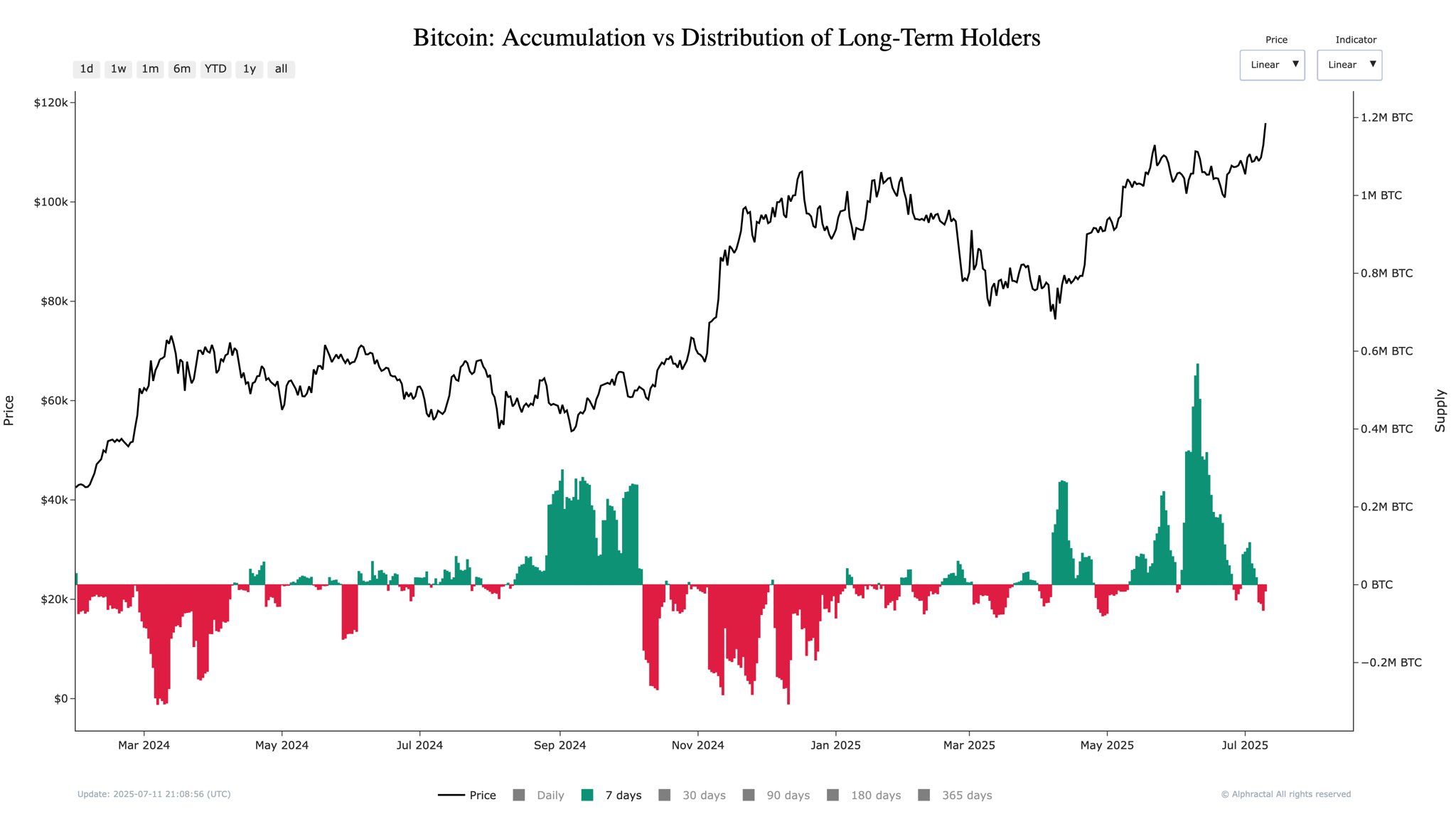

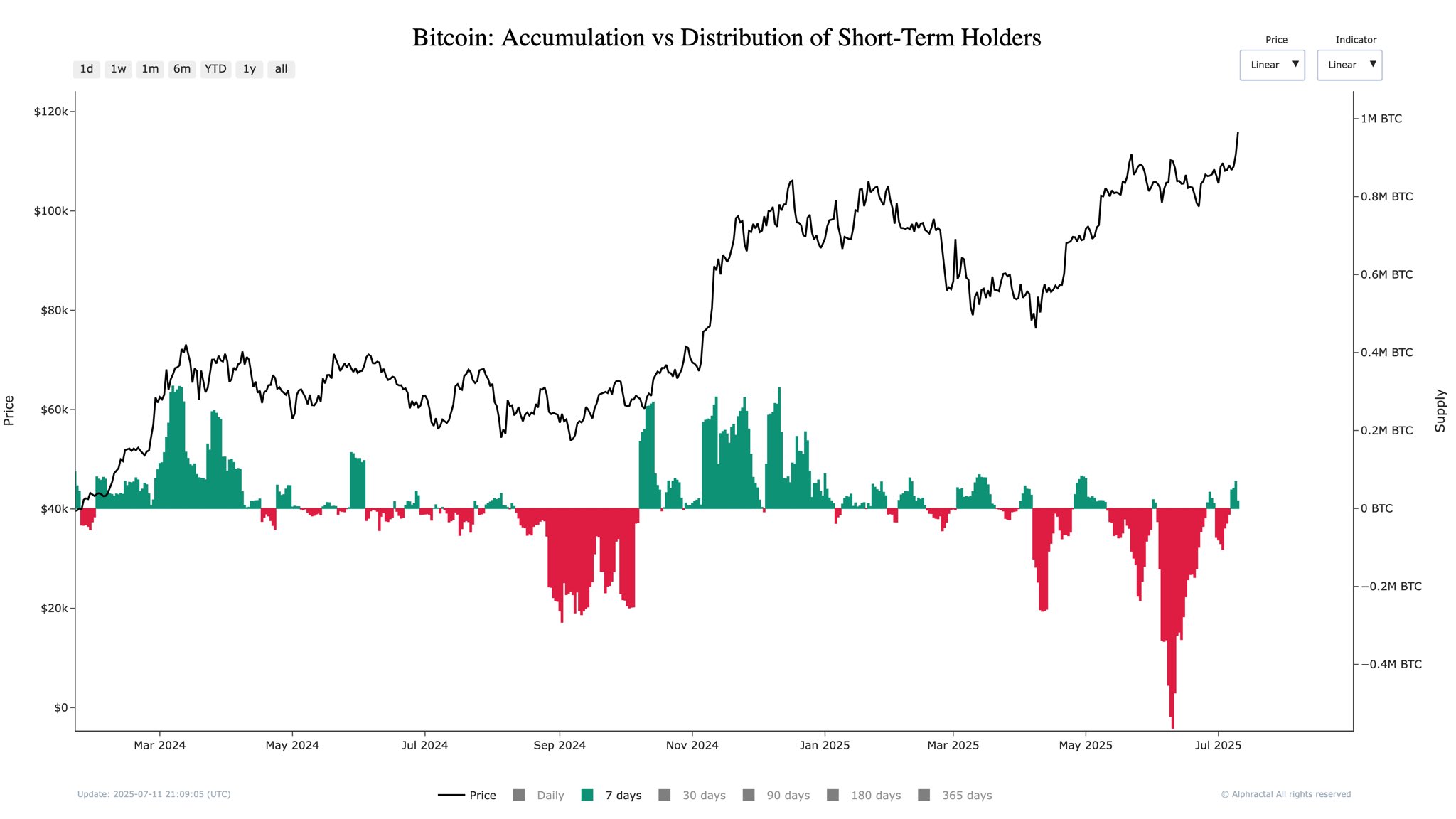

In a July 12 put up on the X platform, on-chain analyst Boris explained how a shift in Bitcoin holder exercise has affected the market over the previous months. This rationalization was based mostly on indicators measuring the Accumulation Vs Distribution of Lengthy-Time period Holders (LTH) and Quick-Time period Holders (STH).

For these two holder classes, the metric tracks and analyzes pockets conduct to find out whether or not they’re rising or reducing their Bitcoin holdings over time.

Associated Studying: Bitcoin Breaks Records: What Miners and Leverage Traders Are Doing Behind the Scenes

For the long-term holders, the chart above exhibits how accumulation grew from the later days of Could to the top of June. That is represented by the rising inexperienced graphs over the pink.

Throughout the identical timeframe, the chart under exhibits short-term holders had been represented extra by the pink graphs than the inexperienced, indicating extra distribution than accumulation prior to now month.

Boris credited the LTHs for Bitcoin’s survival above the $100,000 assist zone. “Regardless of heavy STH distribution and retail promoting stress, BTC defended the 100K assist — a transparent signal of structural accumulation led by LTH wallets,” the on-chain analyst mentioned.

Based on Boris, the short-term holders had been observed to have sold greater than 563,000 BTC as Bitcoin continued to vary. As this occurred, the Lengthy-Time period holders steadily collected Bitcoin, and this absorbed many of the promoting stress from STHs.

Nonetheless, this dynamic appears to have reversed very not too long ago. The net pundit reported that the Lengthy-Time period Holders began distributing their Bitcoin holdings. This sell-off from the LTHs could also be a results of profit-taking, because the cryptocurrency’s upward drift would necessitate.

However, the short-term holders have began to build up Bitcoin. This pattern seen with this reactive group of investors signifies renewed retail curiosity or speculative entry amidst the present bullish rally.

Boris additional inferred that this handover from LTH assist to STH assist will need to have fuelled Bitcoin’s newest breakout, as short-term momentum is injected into the market.

What’s Subsequent For Bitcoin?

Whereas this rotation of provide between holder lessons might not be unusual in crypto market cycles, the size and timing of this swap recommend that Bitcoin’s worth motion holds extra attention-grabbing rallies within the close to future. Nonetheless, if the short-term shopping for stress ought to taper, the absence of long-term assist could trigger a decrease assist to be retested. As of this writing, Bitcoin is valued at $117,300, reflecting no vital motion prior to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView