Crypto buyers are properly conscious of the dangers concerned in low-cap altcoins. Nevertheless, this phase typically delivers spectacular returns, generally multiplying investments a number of instances over.

So, ought to buyers begin shopping for low-cap altcoins in July, particularly now that consultants imagine altcoin season has begun?

Alternatives and Dangers for Low-Cap Altcoins in Q3 2025

Though the total market cap reached a new high in July, capital flows primarily into Bitcoin and main altcoins.

TradingView knowledge helps this. Whereas the full crypto market cap nears $4 trillion, the market cap excluding the highest 100 altcoins stands at simply $15.4 billion.

CoinMarketCap knowledge exhibits that the highest 100 altcoins every have a market cap above $700 million. Altcoins outdoors this group—these beneath $700 million—are categorized as mid-cap or low-cap.

This capital disparity means that buyers stay cautious. They like altcoins with excessive liquidity or those who institutional gamers and listed corporations discover.

Nevertheless, one other interpretation affords hope. Some analysts imagine the present capital influx continues to be in its early phase.

Many analysts share the identical view as investor Mister Crypto. Based on them, the market continues to be in part two. On this stage, investors mostly favor Ethereum. Capital will ultimately rotate to large, mid, and low caps.

This delay creates a window of alternative for a lot of buyers to buy early and at a good price. It’s additionally an opportunity to get forward of the broader capital movement.

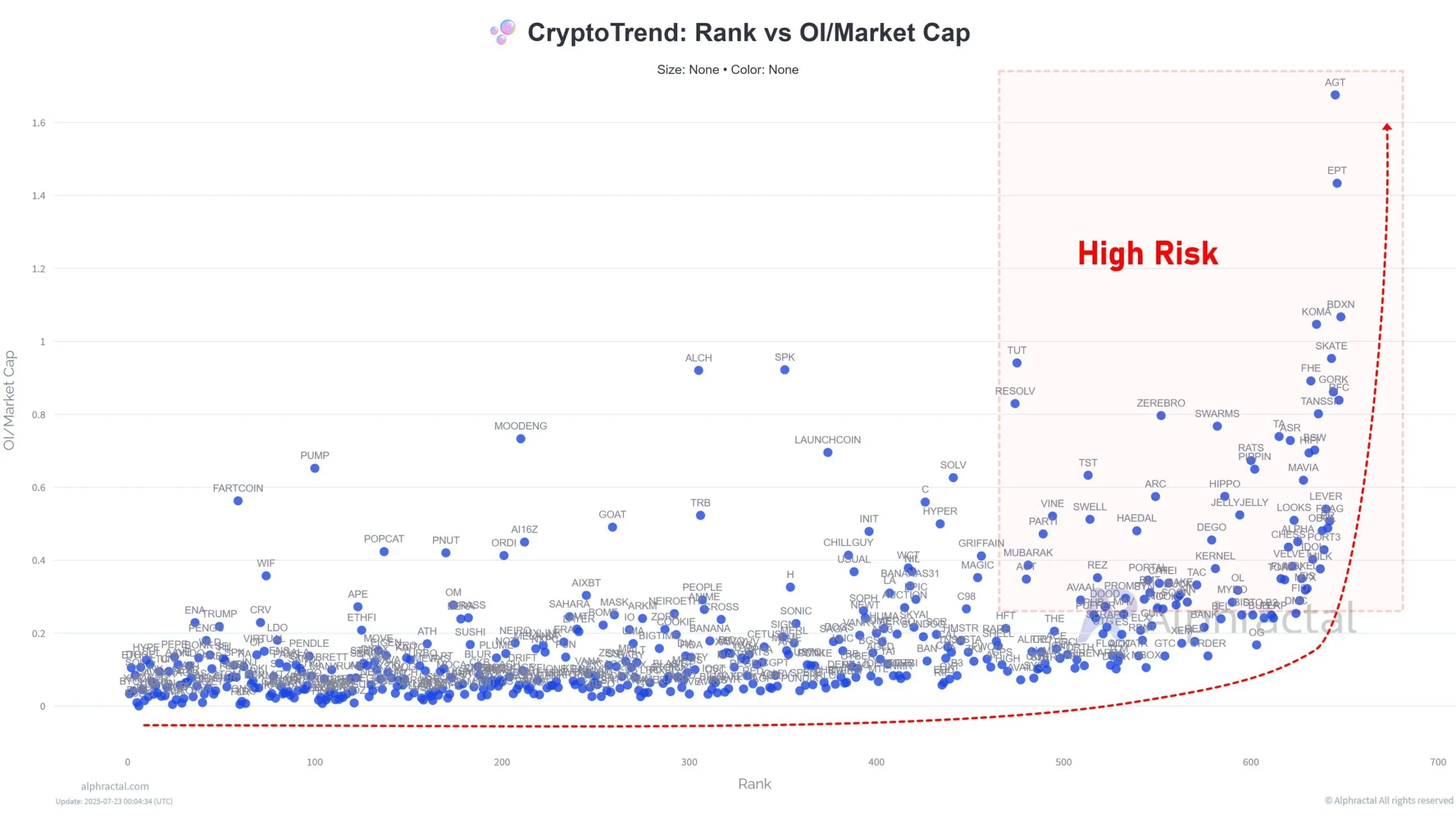

Nonetheless, analysts like João Wedson stay skeptical of ultra-low-cap altcoins—particularly these outdoors the highest 300. These cash normally have a market cap of lower than $200 million. He cites the Open Curiosity to Market Cap Ratio as a warning sign for these cash.

Information exhibits that open curiosity for cash outdoors the highest 300 is unusually excessive in comparison with their market caps.

When open curiosity considerably surpasses market capitalization, it signifies that merchants are specializing in short-term actions within the derivatives market as a substitute of actively buying and selling the tokens in spot markets. Consequently, these altcoins expertise low liquidity and encounter excessive volatility.

“From the Prime 300 down, Open Curiosity turns into disproportionately excessive in comparison with Market Cap — a powerful danger sign. What does this imply? These altcoins will ultimately liquidate 90% of merchants, whether or not they’re lengthy or quick. They’re additionally a lot tougher to investigate with consistency,” Joao Wedson explained.

On X, pleasure about altcoin season is spreading quick in July. Nevertheless, whether or not buyers can buy low-cap altcoins in Q3/2025 nonetheless relies upon closely on their private danger urge for food and funding technique.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.