The crypto market is remodeling and is trying to be on monitor to witness the primary full-fledged Altcoin Season of 2025. The provision flowing into Ethereum and different altcoins from Bitcoin is portray a bullish image in the meanwhile.

The query stays: When ought to the market count on the altcoin season, and which tokens ought to traders watch? BeInCrypto has answered these questions.

The Altcoin Season Everybody Has Been Ready For

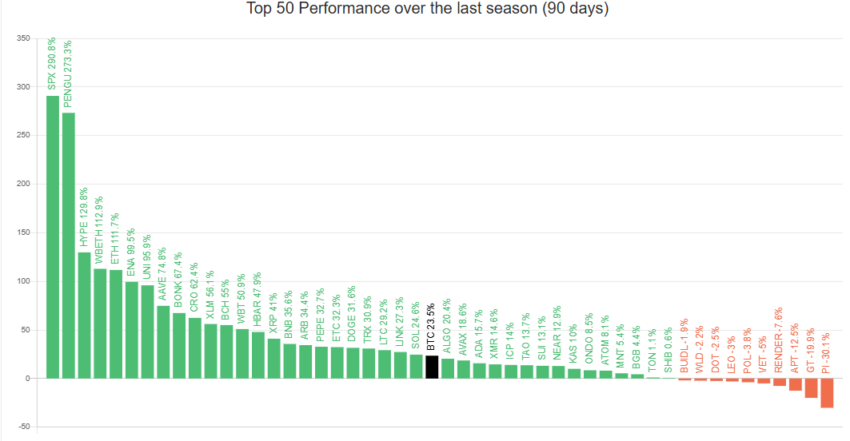

The crypto market is at the moment in a transitional section, sitting midway towards declaring an altcoin season. An altcoin season is formally acknowledged when over 75% of the highest 50 cryptocurrencies outperform Bitcoin.

In the intervening time, this determine stands at 49%, signaling that the market is shifting in the direction of altcoin dominance however has not absolutely transitioned but. As extra altcoins acquire traction towards Bitcoin, investor sentiment is starting to shift, which might result in an altcoin season within the close to future.

This midway mark means that the altcoin market remains to be in a consolidation section, with some tokens starting to outperform Bitcoin; nonetheless, it might possible nonetheless arrive earlier than the tip of Q2 2025.

Speaking to BeInCrypto, analyst Michaël van de Poppe said that macroeconomic components are essential in dictating the motion of crypto belongings.

“Macro-economic is tremendous necessary for traders to shift away from risk-off in the direction of risk-on. That’s why there’s a robust inverse correlation between Gold and Ethereum. When Gold consolidates, that’s the second the place riskier belongings like Ethereum begin to outperform. The opposite manner round, if Gold rallies in a robust manner, that’s often a interval the place altcoins aren’t performing. On prime of that, the crypto-specific hype has elevated because of the M&A’s and IPOs just lately, but additionally because of the approval of the regulatory payments within the US,” mentioned Michaël.

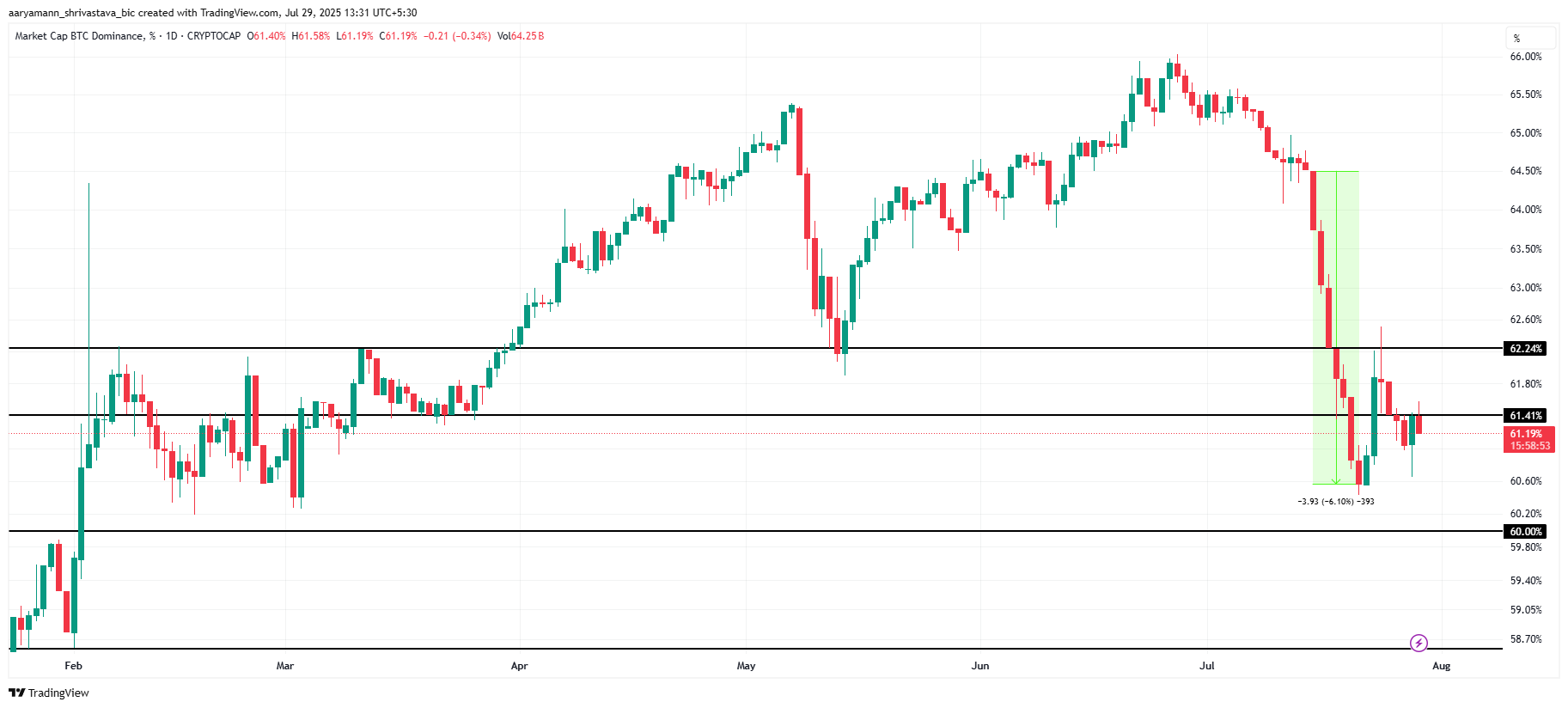

Bitcoin’s dominance has just lately began to regain tempo, following a 6.1% decline earlier this month. The drop in Bitcoin dominance was initially seen as a sign that an altcoin season is likely to be approaching.

Traditionally, Bitcoin’s falling dominance signifies that altcoins are outperforming the crypto king, resulting in broader market development. Nevertheless, if Bitcoin’s dominance picks up once more, it might shift the market again towards Bitcoin’s affect. This may delay the arrival of an altcoin season. Michaël believes this might possible be attributable to macroeconomic components.

“If the altcoin markets received’t be persevering with their upwards momentum, it’s primarily attributable to causes outdoors of the crypto markets, similar to the earlier six months have been yielding unfavourable returns for something within the crypto markets attributable to the truth that the macro has utterly shifted. If that risk-off urge for food comes again into the markets, maybe attributable to commerce wars, precise wars, or a possible recession, we may very well be seeing the altcoin markets fall once more. Nevertheless, the other of that case is that we’re possible going to be seeing a robust upward market,” Michaël said.

Ethereum Is On Observe Of Good points

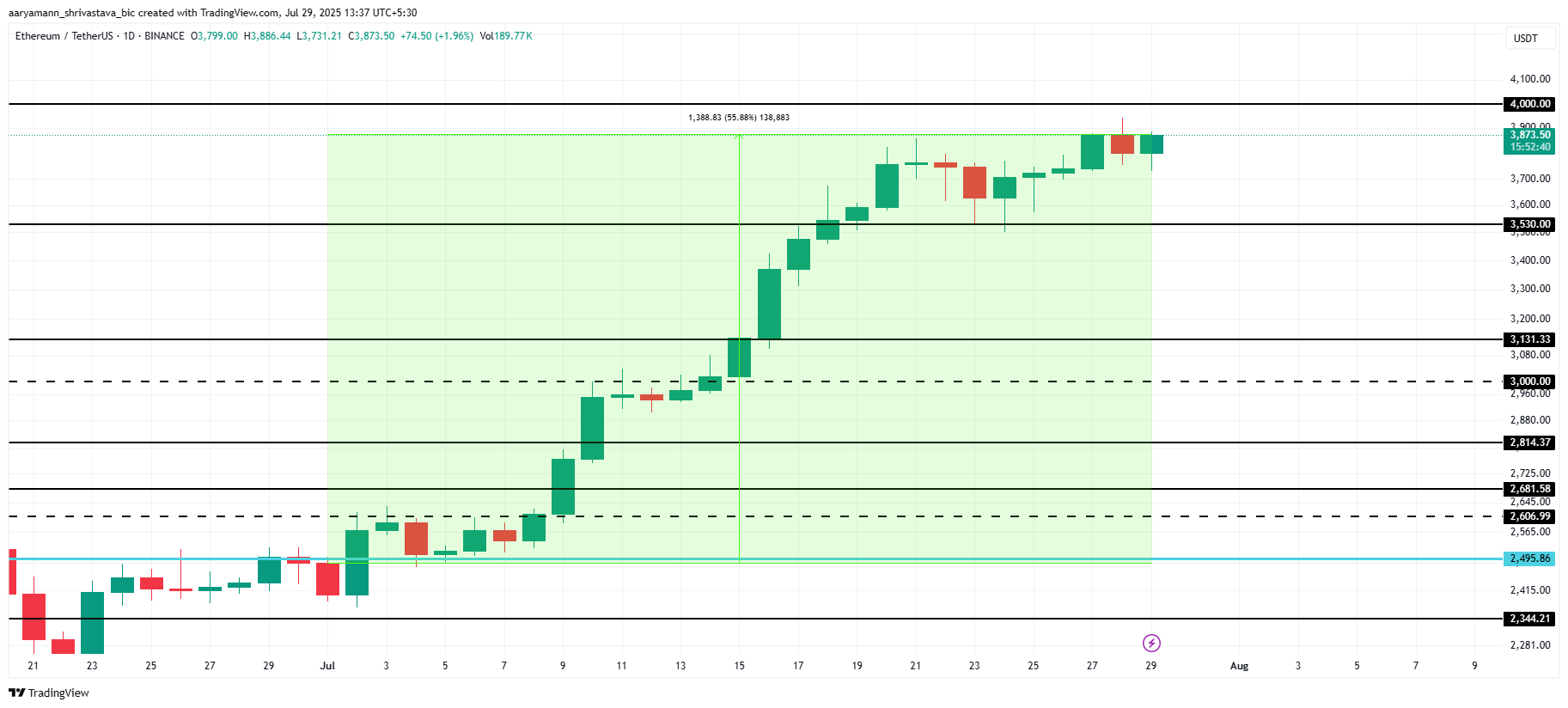

Ethereum’s value has surged 55% because the begin of the month, inching nearer to the $4,000 mark. This development is primarily because of the capital shift from Bitcoin to Ethereum, attracting traders searching for increased returns.

“Ethereum has outperformed Bitcoin by greater than 70%, signalling that we’re now in an Ethereum market. The explanation behind this sudden shift is the regulatory shift in the US. The GENIUS invoice approval and the acceptance of the CLARITY act opened the doorways for institutional liquidity to circulation in the direction of Ethereum, because the Ethereum ETF has seen extra influx than the Bitcoin ETF over the previous weeks,” Michaël informed BeInCrypto.

The current development in Ethereum is prone to profit altcoins constructed on its second-generation blockchain. These cash may very well be the standout performers through the altcoin season that traders ought to watch.

“It’s very possible that cash which might be offering utility throughout the Ethereum ecosystem (Aave, Optimism, Celestia, Arbitrum) will thrive when Ethereum is doing effectively. Moreover, if there are any tokens which have hyperlinks to the US would possible outperform others as there can be hype connected to them,” Michaël famous.

The optimistic momentum round Ethereum is predicted to push its value towards the $4,000 mark and probably past within the coming days. With continued capital circulation from Bitcoin, Ethereum might attain new highs, influencing the broader crypto market. Buyers are anticipating indicators of additional bullish motion as Ethereum leads the way in which.

Disclaimer

According to the Trust Project tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.