Ethereum has entered the highlight as soon as once more after reaching a multi-year excessive above $4,790, solely to retrace towards vital demand ranges. The transfer highlights ongoing volatility as bulls stay affected person, ready for a breakout past the $4,900 stage, a threshold that will push ETH into uncharted value territory. Whereas the retracement could appear to be a pause, market construction nonetheless favors power, with larger lows forming and momentum shifting towards accumulation.

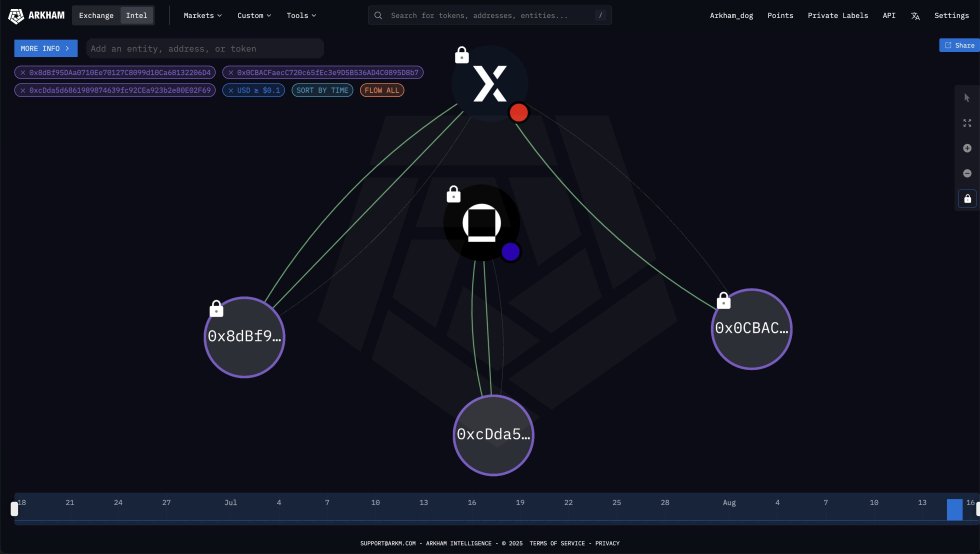

What makes the present setup much more compelling is the surge in whale exercise. Arkham Intelligence knowledge revealed that three new whale addresses collectively bought $279.5 million value of ETH in simply the previous 24 hours. These transactions underscore confidence from deep-pocketed gamers at a second when Ethereum is consolidating under key resistance. Such large-scale accumulation usually alerts expectations of additional upside, aligning with rising optimism that ETH may quickly break above its historic ceiling.

With provide on exchanges persevering with to say no and institutional demand rising, Ethereum’s subsequent transfer carries weight for the broader altcoin market. Merchants and buyers alike will probably be watching carefully, because the convergence of whale accumulation and technical resilience means that Ethereum could possibly be on the verge of one other explosive part.

Ethereum Whale Accumulation Deepens As Bitmine Expands Holdings

Ethereum’s bullish narrative continues to strengthen as whale exercise accelerates. Arkham’s AI has linked the newest wave of ETH purchases to Bitmine, elevating questions on whether or not strategist Tom Lee is doubling down on Ethereum publicity. Bitmine’s whole ETH holdings are a staggering 1.174 million ETH, valued at round $5.26 billion at present costs.

This scale of accumulation locations Bitmine among the many most influential gamers within the Ethereum ecosystem, with its pockets exercise now drawing comparisons to main institutional contributors. The timing of those buys is very important, arriving as ETH consolidates just under the $4,900 mark, with bulls watching carefully for a breakout into uncharted value territory.

What’s extra, this accumulation development aligns with strikes from firms like Sharplink Gaming, which have additionally been positioning aggressively into Ethereum. The shift highlights a broader sample: institutional actors are more and more viewing ETH as a long-term strategic asset, not only a speculative play.

Including additional gas to the bullish outlook, alternate provide is drying up whereas OTC desks report working out of Ethereum. This provide squeeze is traditionally a precursor to main rallies, as demand from whales and establishments collides with diminished availability. If these dynamics persist, Ethereum could also be getting into one in every of its most explosive phases but, with whale conduct performing because the clearest sign of confidence.

ETH Holds $4,400 After Sharp Decline

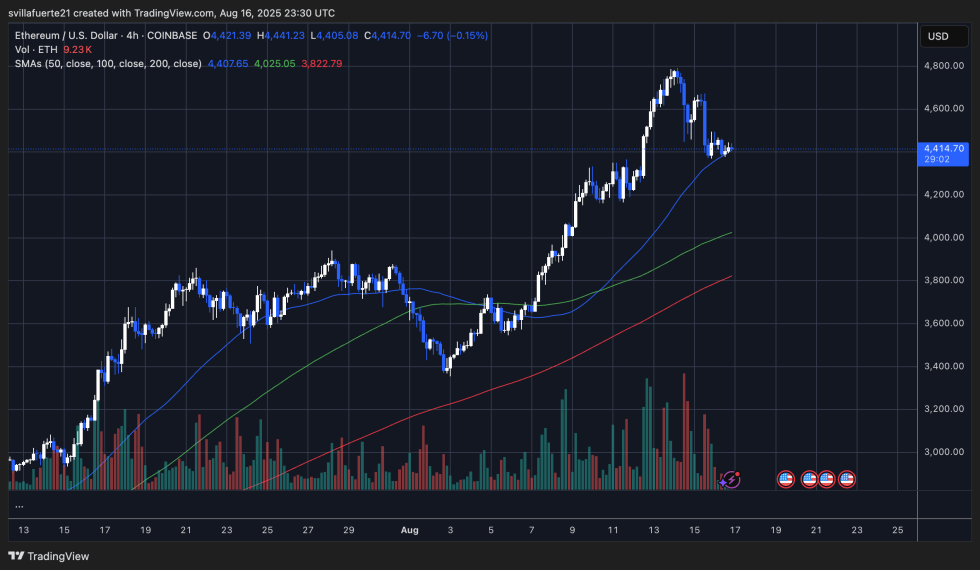

Ethereum’s 4-hour chart highlights a wholesome pullback from the current peak close to $4,790, with the worth now consolidating round $4,414. This decline comes after a powerful multi-week rally, suggesting that the transfer is extra of a cooldown part slightly than a full development reversal.

The 50-period SMA at $4,407 is now performing as rapid assist, making this stage a vital short-term battleground. If bulls can defend it, momentum may rapidly shift again towards the $4,600–$4,800 resistance space, the place ETH was not too long ago rejected. A confirmed breakout above $4,900 would validate bullish power and set the stage for contemporary all-time highs.

On the draw back, the 100-SMA ($4,025) and 200-SMA ($3,822) stay deeper assist zones that might take in stronger promoting strain if the $4,400 space fails. Importantly, buying and selling quantity reveals heavy exercise throughout the rally adopted by decrease participation throughout the retrace, implying sellers aren’t in full management.

General, Ethereum stays in an uptrend, however the present consolidation will decide its subsequent leg. Holding above $4,400 retains bulls in management, whereas a drop under may set off a short-term correction earlier than the uptrend resumes. This makes the approaching classes pivotal for ETH’s trajectory.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.