- SoFi will allow on the spot cross-border transfers utilizing Bitcoin and UMA.

- Transfers will convert USD to Bitcoin by way of Lightning, then to native forex.

- The service will first launch in Mexico with decrease charges than conventional remittances.

SoFi Financial institution is getting ready to shake up the worldwide remittance trade by introducing a blockchain-powered worldwide cash switch service.

The US digital financial institution has partnered with Lightspark, a Bitcoin infrastructure firm based by former PayPal president David Marcus, to carry quicker and cheaper cross-border funds straight into its app.

SoFi steps into blockchain funds

The brand new service will permit SoFi clients to ship cash overseas with out counting on conventional remittance suppliers or third-party platforms.

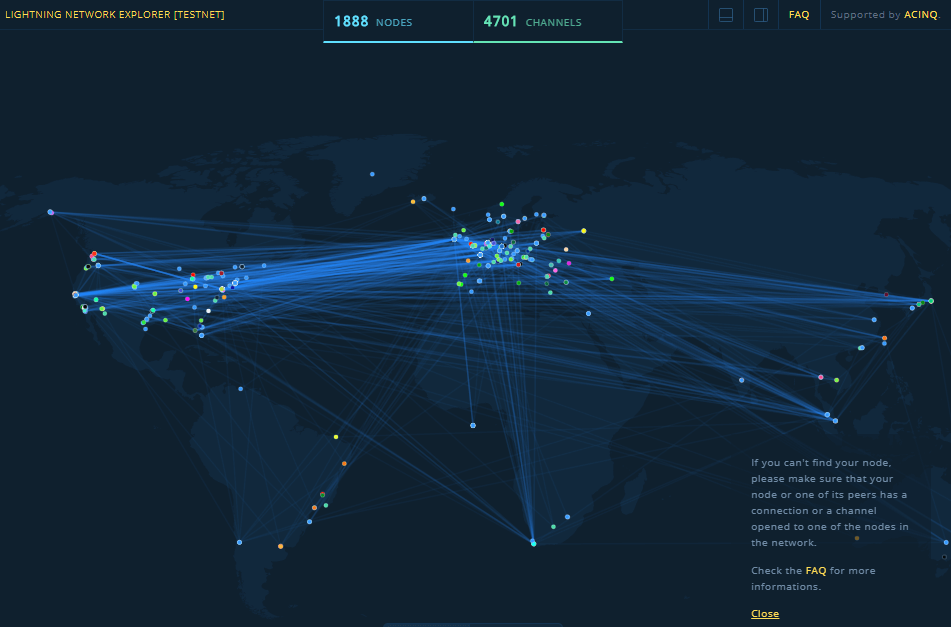

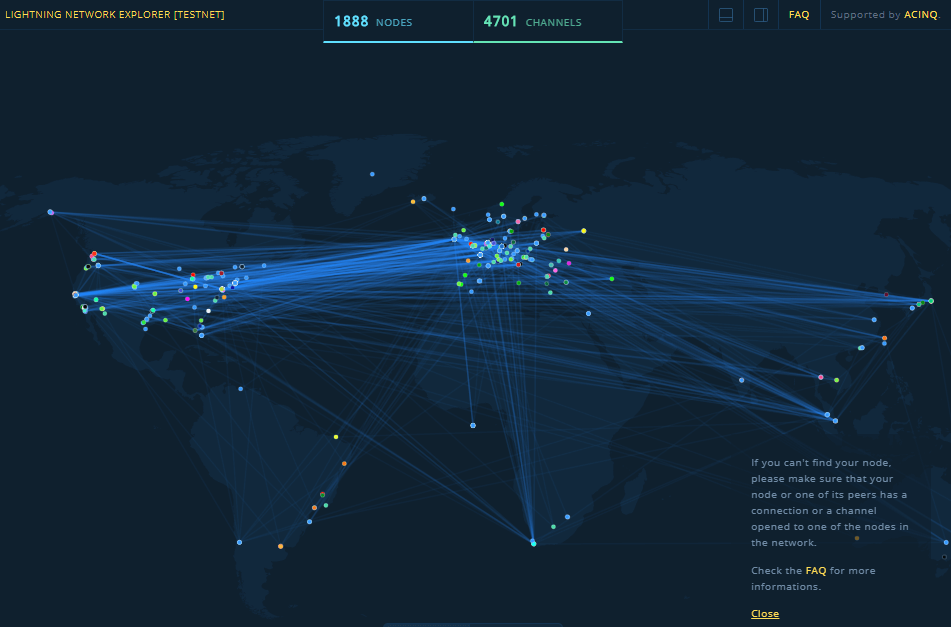

As an alternative, transfers will probably be powered by the Bitcoin Lightning Community and Lightspark’s Common Cash Handle, or UMA.

SoFi + Lightspark = on the spot international funds. 🌍⚡

Ship cash overseas in seconds, proper from the @sofi app, powered by UMA.

Coming quickly for 🇺🇸→ 🇲🇽 with extra nations to comply with.

The way forward for international funds is right here: https://t.co/MxAA5o9k2Z pic.twitter.com/GFVq4KhoxF

— Lightspark (@lightspark) August 19, 2025

This expertise is designed to maneuver {dollars} throughout borders immediately, at any time of the day, whereas guaranteeing that charges and change charges are displayed clearly earlier than every transaction.

SoFi says the service will debut later this yr, starting with Mexico, a key remittance hall from america.

As soon as rolled out, customers will be capable of provoke transfers straight by means of the SoFi app, the place US {dollars} will probably be transformed into Bitcoin, routed throughout the Lightning Community, after which transformed again into the recipient’s native forex earlier than being deposited of their checking account.

Notably, this isn’t SoFi’s first step into the digital asset house.

The financial institution started providing crypto buying and selling in 2019, however later scaled again the service following regulatory considerations throughout the collapse of FTX.

Nonetheless, with a federal banking license secured and new guidelines beneath the GENIUS Act providing larger readability, SoFi is reentering the sector extra aggressively.

Throughout its most up-to-date earnings name, the corporate outlined ambitions past remittances.

These embrace plans for stablecoin issuance, crypto-backed loans, and staking infrastructure for different establishments.

By positioning itself as a bridge between conventional banking and Web3, SoFi hopes to safe a long-term benefit over pure-play crypto platforms.

Quicker and cheaper transfers

The promise of velocity and decrease prices is central to SoFi’s plan.

Conventional remittances typically take days to clear and may value households as a lot as 6% of the quantity being despatched.

By embedding blockchain rails into its platform, SoFi expects to ship a service that’s obtainable across the clock and considerably beneath the nationwide common value of remittances in america.

Anthony Noto, SoFi’s chief govt, emphasised that lots of the financial institution’s members depend on sending cash to family members abroad.

He mentioned that constructing blockchain transfers straight into the SoFi app will give customers “quicker, smarter, and extra inclusive entry” to their funds.

The financial institution can also be opening a waitlist to satisfy early demand and gauge curiosity from members who often ship cash overseas.

Lightspark supplies the spine

Lightspark, which launched in 2022, has been positioning its UMA as a common customary for transferring cash globally in a method that feels so simple as sending an e-mail.

In accordance with Marcus, Bitcoin is the one open funds community that may energy such transactions securely and at scale.

Marcus added that UMA on SoFi will permit members to maneuver {dollars} immediately with full transparency and management, whereas avoiding the delays of conventional techniques.

The collaboration makes SoFi the primary US financial institution to combine Bitcoin’s Lightning Community and UMA at this scale.

It additionally comes at a time when different main establishments, together with Financial institution of America and JPMorgan, are testing blockchain for their very own switch techniques.