Ethereum is present process a correction after weeks of sturdy momentum, however institutional adoption is quietly reshaping the market’s long-term dynamics. In line with CryptoQuant, the favored “Crypto Treasury Technique,” lengthy related to Bitcoin, has now entered the Ethereum ecosystem. Over 16 corporations have already adopted this strategy, collectively holding 2,455,943 ETH price practically $11.0 billion. This vital allocation has successfully locked away a large portion of ETH, decreasing obtainable provide on the open market.

Associated Studying

The treasury motion mirrors Bitcoin’s playbook, the place firms strategically collected BTC as a reserve asset. Nevertheless, Ethereum presents essential variations. In contrast to Bitcoin’s hard-capped provide of 21 million, ETH has no mounted most. As an alternative, its provide dynamics are formed by community exercise and the burn mechanism launched with EIP-1559. Whereas these mechanics can create deflationary intervals, Ethereum’s whole provide nonetheless elevated by about 1 million ETH (~0.9%) over the past yr.

This duality presents each alternative and danger. On one hand, institutional holdings scale back liquid provide and reinforce Ethereum’s position as a strategic asset. Alternatively, variable issuance implies that in periods of low community exercise, provide growth might speed up, diluting shortage results. As Ethereum exams key demand ranges, the treasury technique could show pivotal in shaping its subsequent main pattern.

Ethereum: Treasury Focus And Leverage Dangers

In line with CryptoQuant’s analysis, Ethereum’s latest treasury adoption pattern carries each alternatives and dangers. On one hand, institutional treasuries have locked away billions in ETH, decreasing obtainable provide in the marketplace.

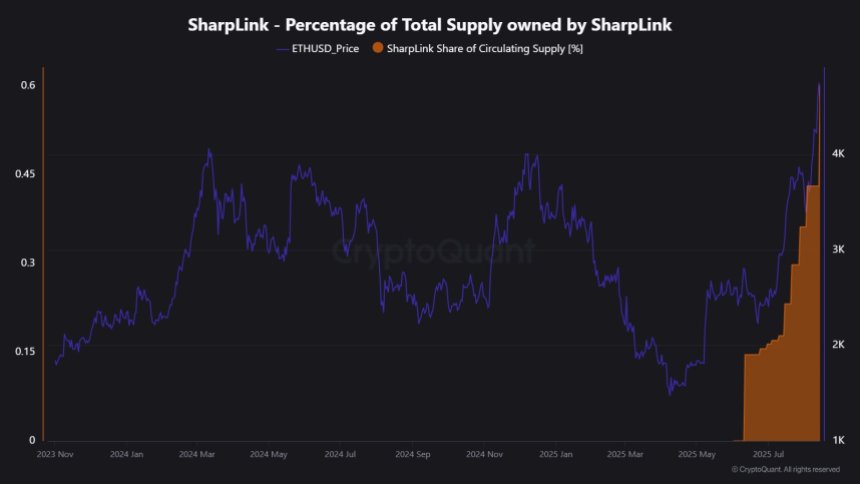

Nevertheless, the construction of those holdings additionally presents focus dangers. For instance, BitMine Immersion Applied sciences, which has overtly said its aim of controlling 5% of all ETH, presently holds simply 0.7%. The following largest holder, SharpLink Gaming, manages solely 0.6%. This implies treasury adoption continues to be concentrated amongst a couple of gamers. If one or two giant holders have been to dump their reserves, the market might face sharp worth shocks.

Past spot accumulation, leverage is one other rising issue. CryptoQuant highlights that ETH futures open curiosity has climbed to round $38 billion. This degree of leverage implies that giant swings in worth can set off cascading liquidations. In crypto markets, leverage is synonymous with volatility.

The fragility of this setup was evident on August 14, when a wipeout of simply $2 billion in open curiosity led to $290 million in pressured liquidations and a 7% drop in ETH’s worth. This occasion underlines how rapidly issues can spiral when liquidity is skinny and leverage is excessive. Spot promoting alone isn’t driving volatility—leveraged positions enlarge each transfer. On this context, Ethereum’s treasury adoption could safe long-term demand, however concentrated holdings and rising leverage stay key vulnerabilities.

Associated Studying

ETH Testing Crucial Liquidity Ranges

Ethereum’s worth motion on the 3-day chart reveals that after rallying to an area excessive close to $4,790, ETH entered a correction section however stays effectively above key transferring averages. At present buying and selling round $4,227, the worth has retraced from its peak however continues to be holding the broader bullish construction.

The 50-day SMA ($2,687), 100-day SMA ($2,838), and 200-day SMA ($2,912) are all trending upward, reflecting sturdy underlying momentum. Importantly, ETH is buying and selling considerably above these long-term averages, confirming that the bullish pattern stays intact regardless of the pullback. The sturdy bounce from beneath $3,000 earlier in the summertime marked a decisive reversal after months of consolidation, setting the inspiration for the most recent breakout.

Associated Studying

If bulls handle to carry the $4,200–$4,100 help zone, ETH might retest resistance close to $4,790 and probably transfer into worth discovery. Conversely, failure to take care of this degree might see a retest of the $3,800–$3,600 vary. The approaching classes will likely be crucial in confirming whether or not Ethereum resumes its uptrend or enters a deeper correction.

Featured picture from Dall-E, chart from TradingView