API3, a decentralized oracle resolution that goals to make real-world information accessible through blockchain APIs, noticed its token value explode practically 90% over the previous seven days, peaking above $1.80.

However within the final 24 hours, it dropped practically 10%, sparking confusion amongst merchants. Is that this the beginning of a deeper correction, or only a brief cooldown earlier than extra upside?

Shorts Stack Up as Funding Price Drops

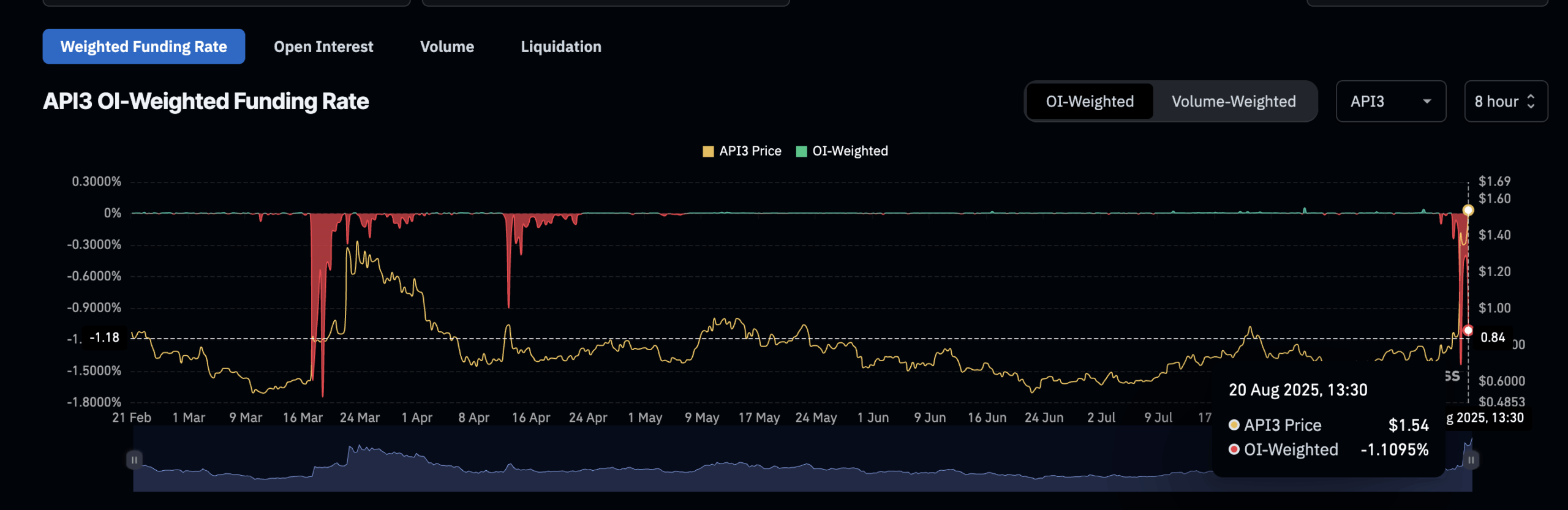

Funding charges on API3 flipped deeply unfavourable over the previous 24 hours. On August 19, the OI-weighted funding price stood at -0.47%. By August 20, it plunged additional to -1.10%. Which means most merchants are actually paying to carry brief positions, betting closely on a value drop.

This exhibits aggressive short-side sentiment. But, the API3 price hasn’t collapsed. It dipped barely from the height, however API3 bulls haven’t absolutely backed off. So regardless of bearish bets piling up, sellers haven’t taken management at press time.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter here.

Good Cash Buys Whereas CMF and Alternate Information Keep Bullish

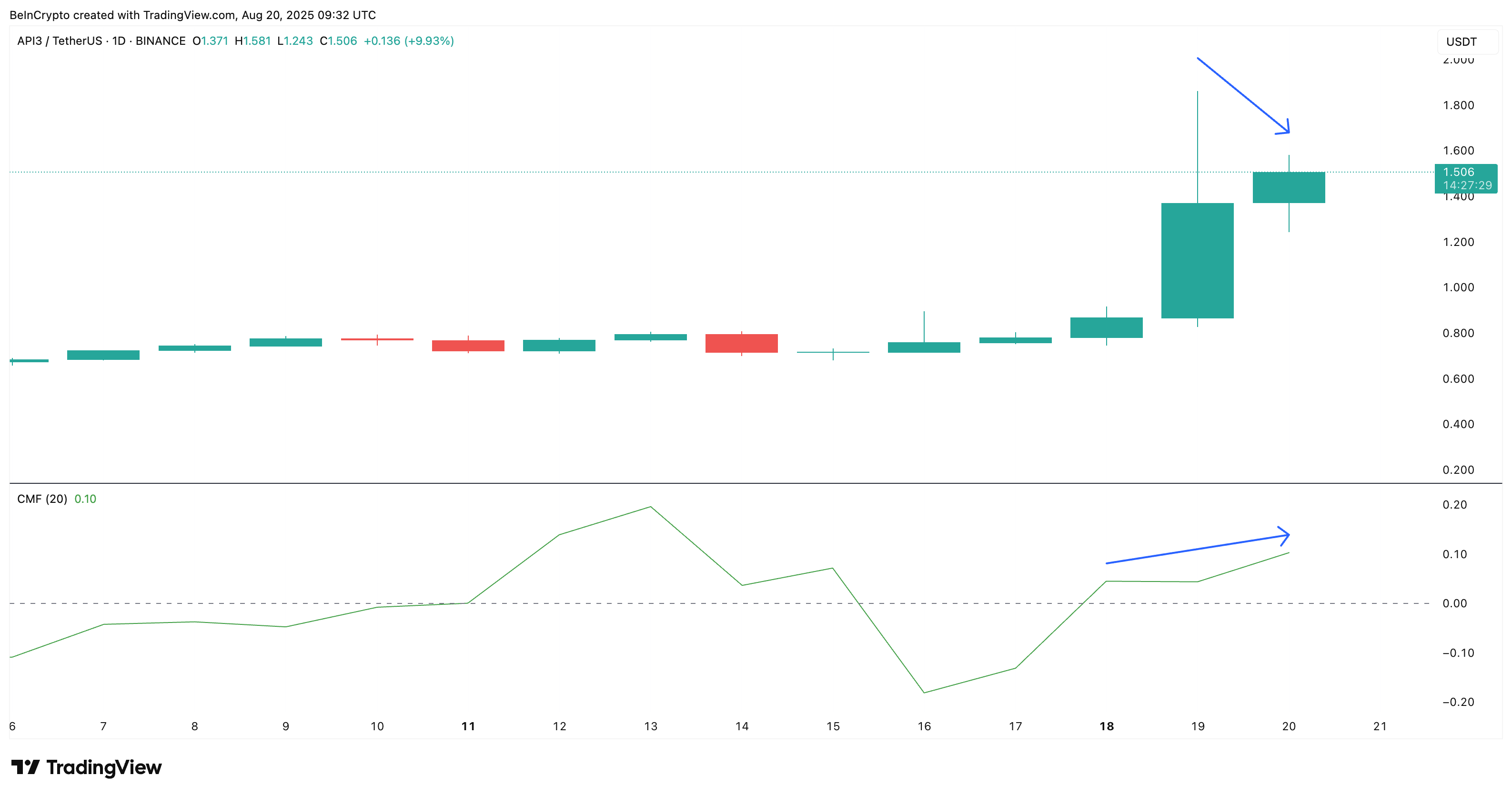

Below the hood, patrons are nonetheless stepping in. The Chaikin Cash Stream (CMF) on the every day chart has climbed steadily from 0.04 to 0.10 over the previous couple of hours, even whereas the API3 value cooled down barely. CMF growing regardless of a small value pullback suggests accumulation: extra capital is flowing in than out.

CMF is a volume-weighted indicator that exhibits if cash is flowing into or out of a token based mostly on value and quantity.

Alternate reserves verify this. Over the previous 7 days (in the course of the rally), API3’s exchange balances fell 30.5%, now sitting at 28.63 million tokens.

On the identical time, the highest 100 addresses elevated holdings by 25.98%, whereas Good Cash wallets jumped 204%.

API3 Value Chart Exhibits Bullish Bias

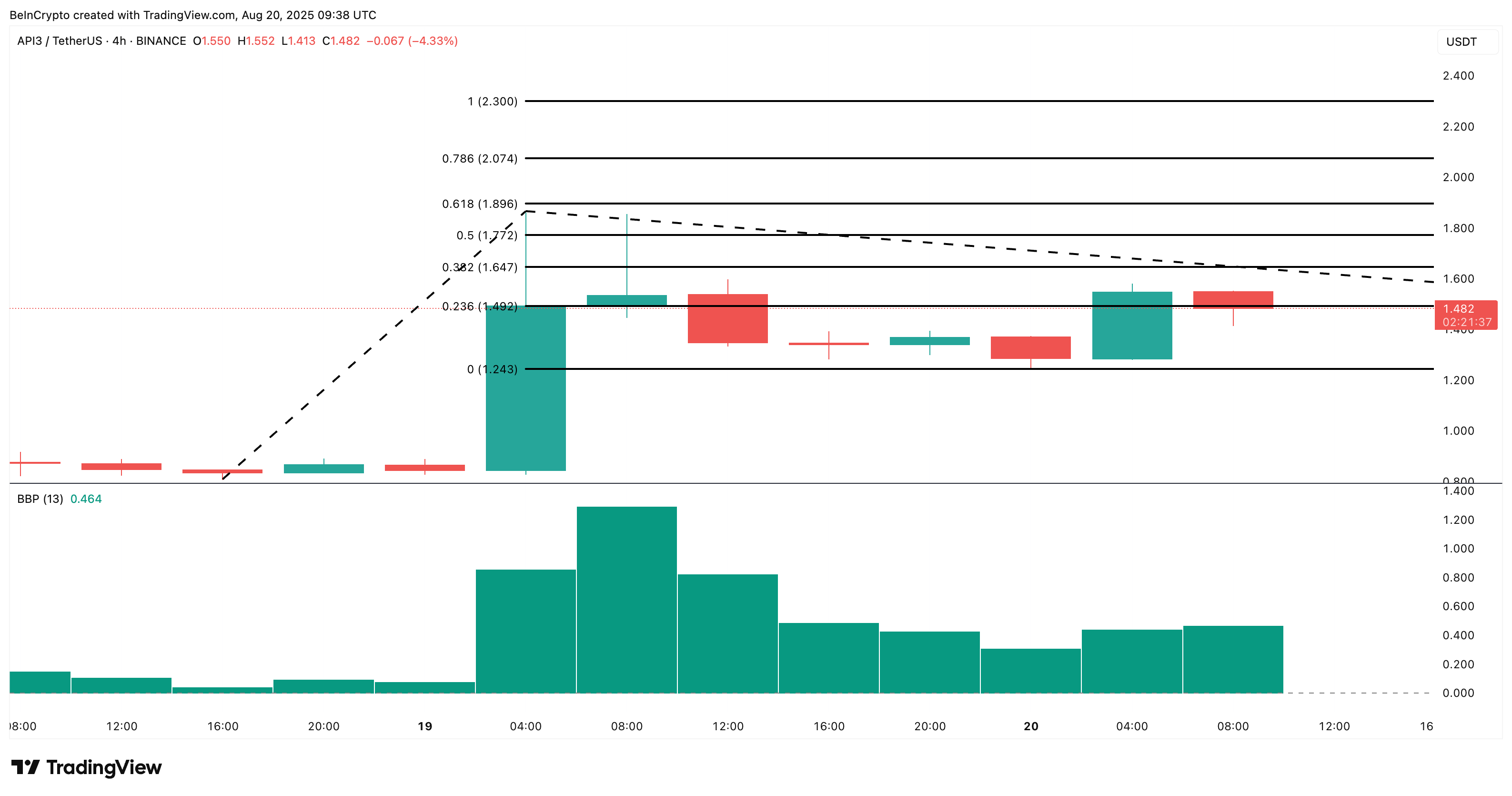

On the 4-hour chart, API3 continues to be exhibiting bullish momentum. The value bounced off the 0.236 Fibonacci stage close to $1.49, and the Bull-Bear Energy (BBP) index stays constructive at 0.464.

This implies bulls aren’t performed, and if shopping for continues, the short-heavy crowd or the bearish bets might get liquidated quick. That will push the costs greater, with the fast targets sitting at $1.64 and $1.77.

Because the bullish momentum appears to be choosing up, with rising inexperienced bars, an API3 value rally continuation seems to be extra probably. The BBP indicator measures the power of bulls vs. bears by evaluating highs and lows with a transferring common.

But when value breaks decrease than $1.24 and patrons cool off, the identical shorts might win the spherical, invalidating the bullish outlook. Longs would then be uncovered, and liquidations might deepen the drop quick.

The publish API3 Price Rally Stuck Between Bullish Buys and Bearish Bias appeared first on BeInCrypto.