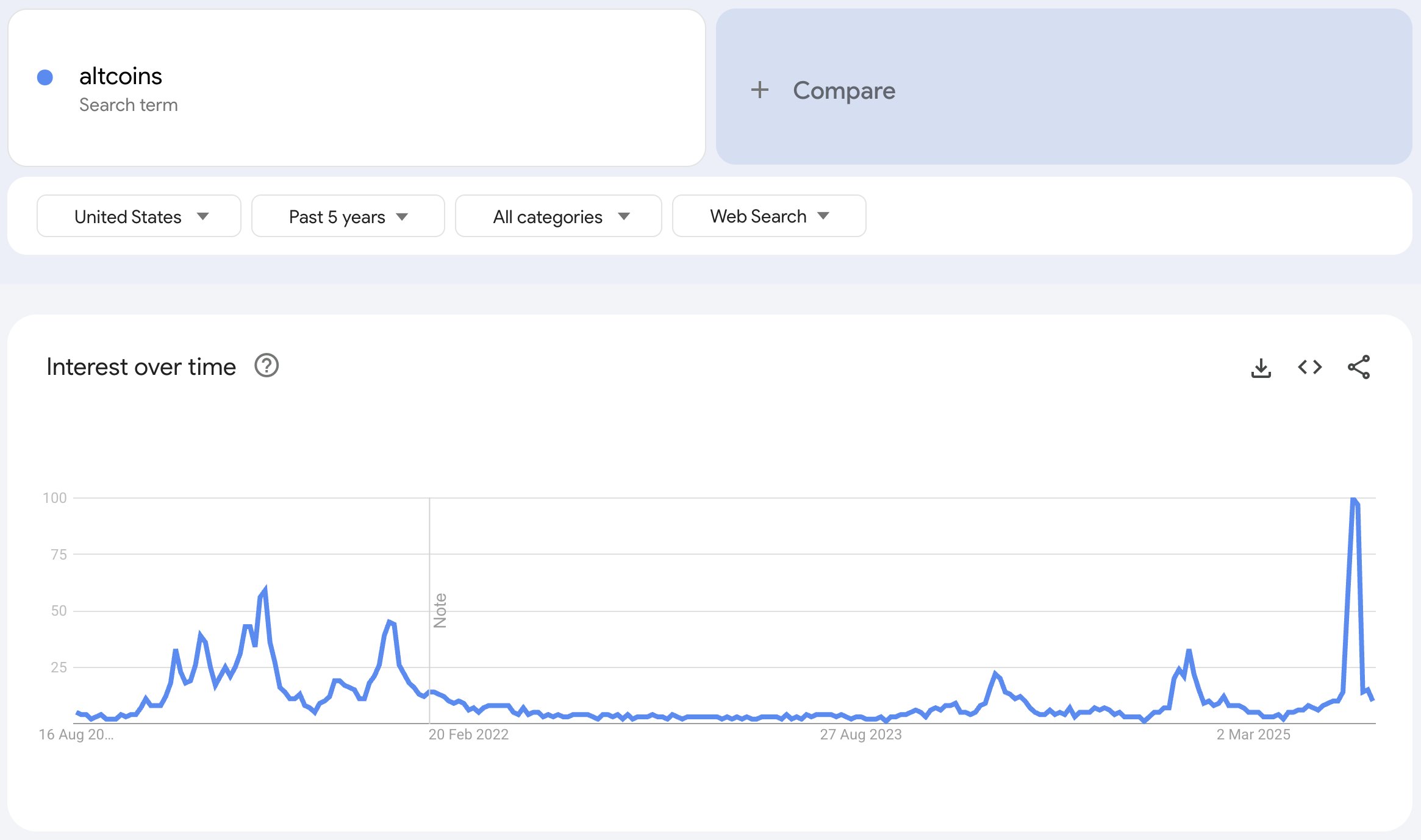

Just lately, the time period “altcoins” noticed a surge of curiosity on Google Tendencies, rapidly reaching an all-time excessive (ATH). Nonetheless, inside only one week, the search quantity collapsed dramatically.

This raised a giant query: Was the so-called “altcoin season” nothing greater than a short-lived phantasm?

Altcoin Season Hype Fizzles Quick as Google Tendencies Plunge

Many traders deal with Google Tendencies as an indicator to gauge contemporary retail curiosity. Traditionally, when a crypto-related time period traits on Google, new capital typically flows into associated initiatives.

One thing uncommon occurred in August. Google Tendencies knowledge within the US confirmed that searches for “altcoin” spiked to a brand new excessive however dropped again to the underside in only one week.

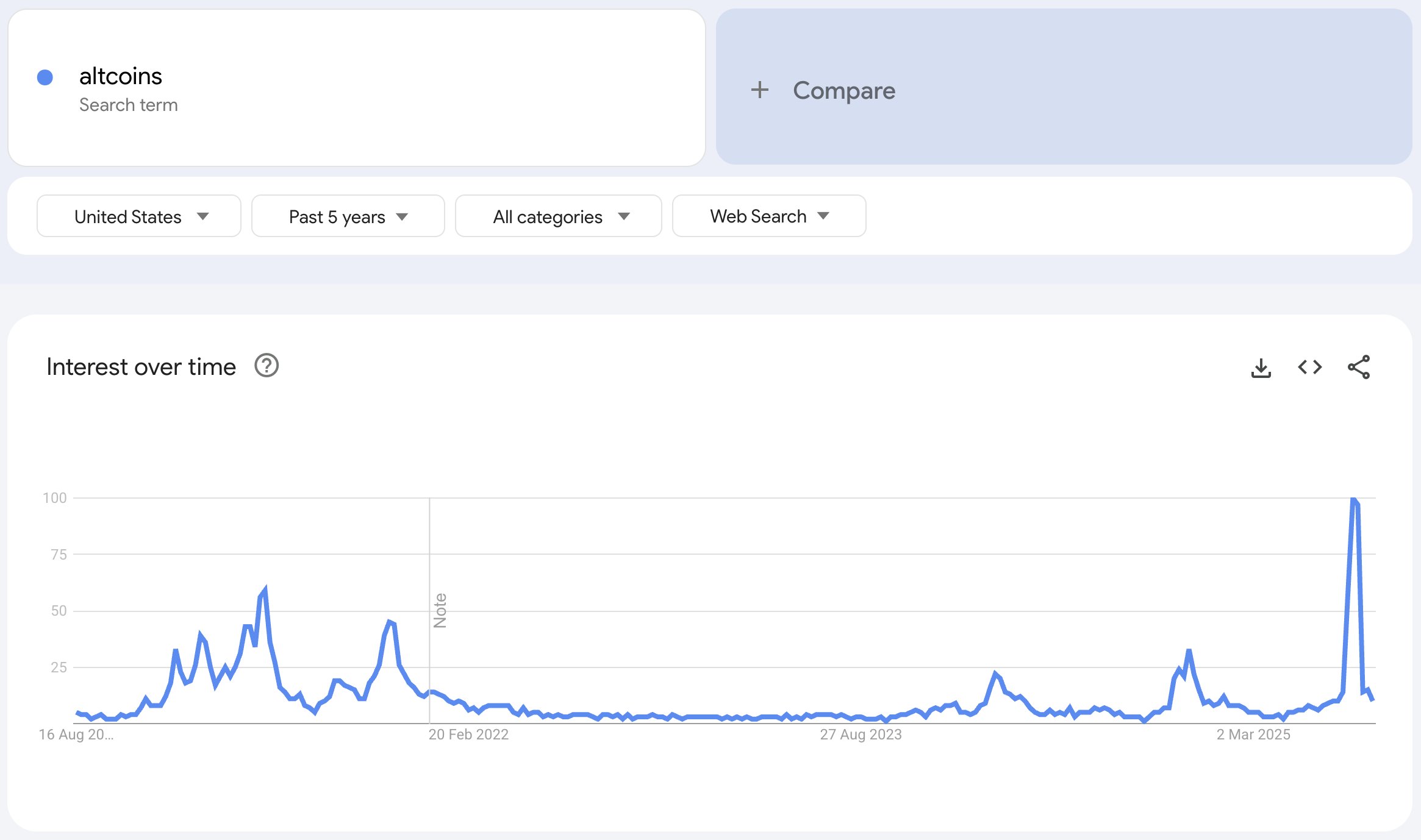

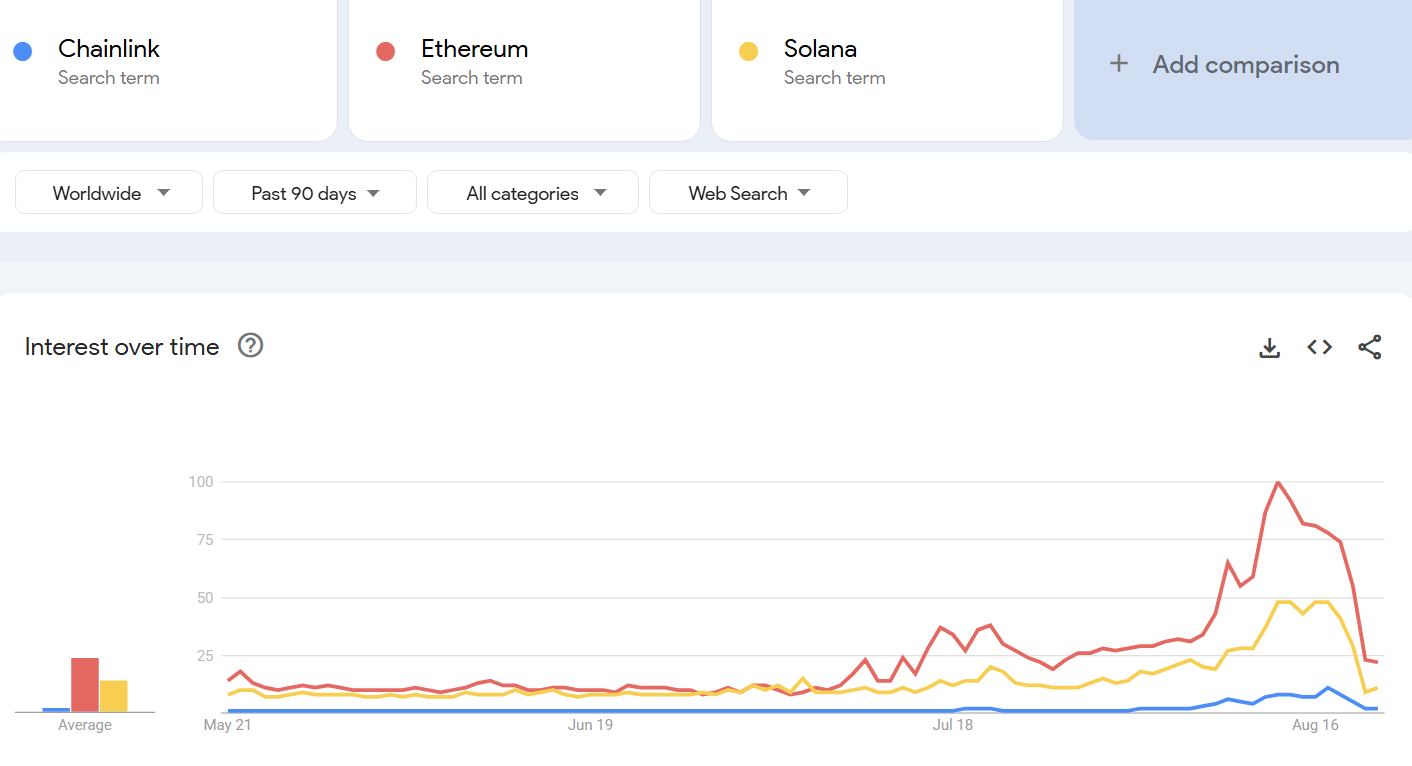

This was not restricted to the US. On a worldwide scale, Google Tendencies additionally recorded searches for “altcoin” peaking on the most rating of 100 earlier than collapsing to 16 inside per week. An identical “pump and dump” pattern appeared with “alt season” and the names of prime altcoins.

“Alt season Google searches pumped and dumped sooner than a bundled memecoin,” Mario Nawfal’s Roundtable mocked.

The chart advised that altcoin season could have ended virtually as quickly because it began. The market capitalization of altcoins (TOTAL3) mirrored this development. It climbed from $1 trillion to $1.1 trillion, solely to fall again to $1 trillion throughout the identical interval.

Some analysts stay optimistic. Cyclop, a well-followed analyst on X, believes the “altcoin” key phrase spike nonetheless has a constructive that means. He argued that the time period has change into mainstream.

“That altcoin spike simply means curiosity is larger than in 2021 – however in all probability as a result of there are 1000x extra cash now, and ‘altcoin’ grew to become the widespread phrase. Again then, individuals simply stated ‘crypto.’ So I feel this mainly simply exhibits that curiosity is beginning to choose up – however it doesn’t imply we’ve hit the height,” Cyclop said.

There are additionally different the reason why Google Tendencies could now not be efficient in measuring contemporary retail demand. Buyers now use AI instruments to seek for info. Broader market ideas have change into so acquainted that many traders now not must look them up on Google.

A Fragmented Altcoin Season in August

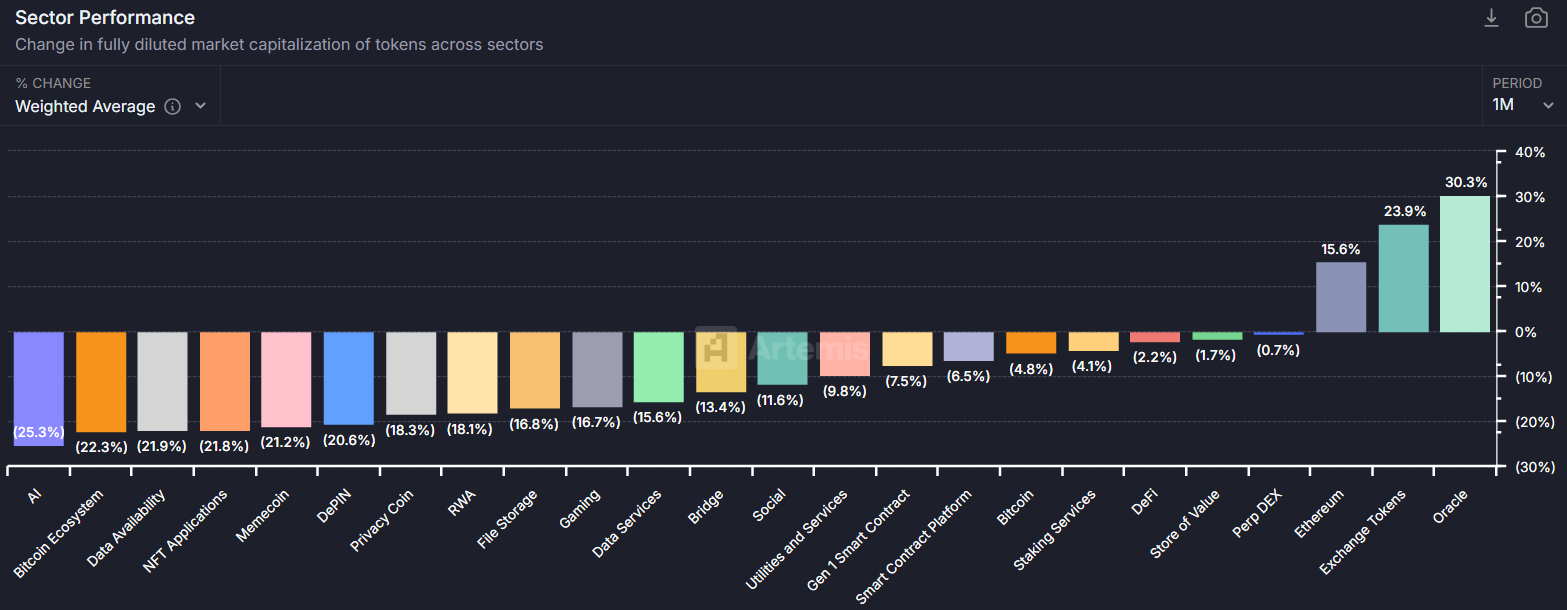

Artemis knowledge offered deeper insights into how the altcoin season unfolded in August.

Though some altcoins rallied strongly, most classes posted adverse efficiency over the previous month. Solely three narratives carried out nicely: Ethereum, Change Tokens, and Oracles.

ETH benefited from accumulation by publicly listed companies. BNB and OKB’s rallies lifted the Change Tokens class. In the meantime, Oracle tokens outperformed primarily due to Chainlink’s (LINK) value surge.

Every profitable altcoin had its driver. OKB rose resulting from large-scale token burns. LINK gained from the Chainlink Reserve plan. In consequence, altcoin season stays fragmented, falling wanting traders’ expectations.

Sandeep, the CEO of Polygon, presents an argument for why future altcoin seasons are more likely to see fewer tokens experiencing vital rallies in comparison with earlier cycles. He highlights a key distinction in intrinsic worth.

Whereas the altcoin seasons of 2017 and 2021 thrived largely resulting from advertising, right now’s savvy traders are on the lookout for practicality and actual utility within the tokens they select to spend money on.

“Right here’s what this tells me: retail is looking, however establishments aren’t shopping for the narratives but. Previous altcoin seasons had been pushed by hypothesis and guarantees and narratives and advertising. Institutional cash is smarter cash. It cares about actual utility and money flows. The following “alt season” gained’t appear like 2017 or 2021. It’ll be fewer tokens with precise utilization, not simply tokens with higher advertising.” Sandeep said.

Nonetheless, analysts haven’t given up hope on a broader altcoin season. Crypto trade Coinbase and asset supervisor Pantera Capital predicted {that a} new altcoin season might start as early as September.

The publish Why Altcoin Season Hype Collapsed After Just One Week—Experts Explain appeared first on BeInCrypto.