By the third week of August, a number of altcoins skilled a pointy drop in change reserves. This development displays rising demand for accumulation and off-exchange holding. The shift is very notable because the so-called altcoin season has turn out to be more and more selective.

Which tokens are seeing this surge in accumulation, and what components drive investor optimism?

1. Ethena (ENA)

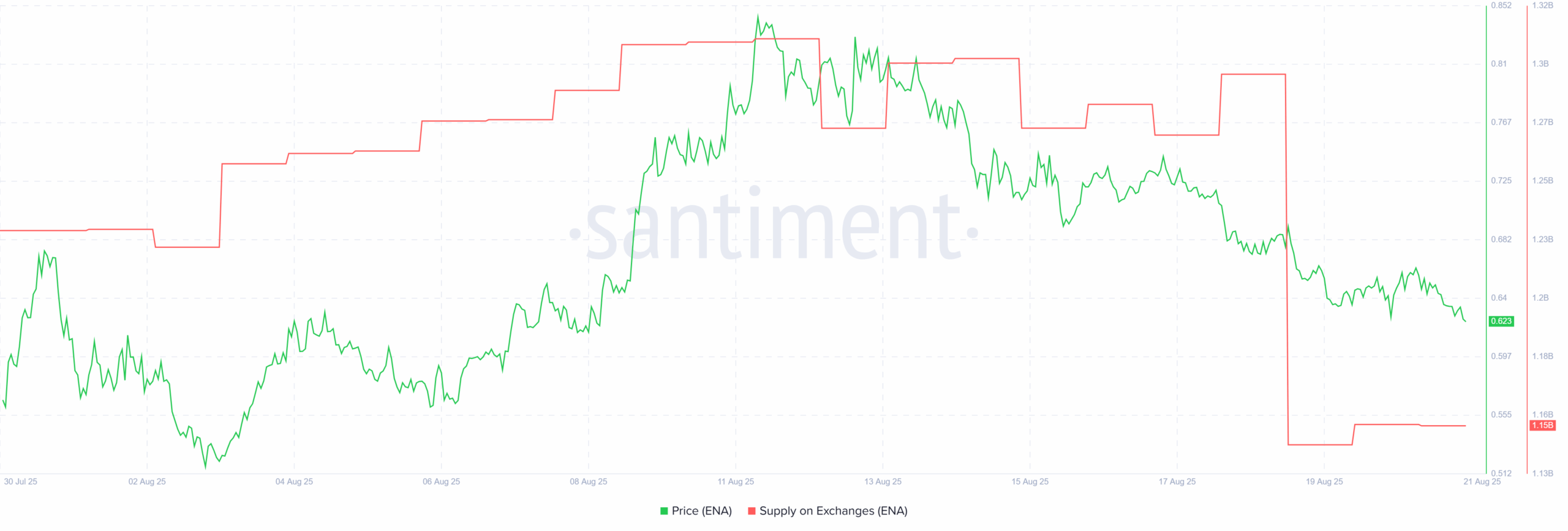

Knowledge from Santiment exhibits that Ethena (ENA) exchange reserves fell from 1.3 billion to 1.15 billion throughout the third week of August. In different phrases, 150 million ENA left centralized exchanges.

This occurred whereas ENA’s worth surged 30% in August, climbing from $0.51 to $0.65.

The reserve drop coincided with the Ethena Basis saying a $260 million buyback program. The plan allocates round $5 million every day to repurchase ENA from the market.

Tokenomist estimates the buyback might take away 3.48% of the circulating provide. This absorption of promote strain boosts long-term investor confidence.

As well as, Ethena crossed main milestones in August. Income surpassed $500 million, whereas USDe supply reached a file excessive of $11.7 billion.

Collectively, these drivers fueled ENA accumulation and change reserve declines.

2. BIO Protocol (BIO)

BIO Protocol, a number one undertaking within the DeSci sector, delivered an distinctive efficiency in August with positive aspects of over 265%.

Alongside the worth rally, change reserves fell sharply. From early August to now, reserves dropped from 380 million to 294 million BIO — a greater than 22% decline.

The third week of August noticed essentially the most dramatic motion. Traders withdrew 42 million BIO in only one week, pushing change reserves to their lowest degree this 12 months.

A number of catalysts clarify this accumulation wave. BIO launched a staking program early in August that attracted over 25 million tokens. Moreover, Arthur Hayes invested $1 million into BIO this week, reigniting market consideration.

Bio Protocol additionally rolled out a brand new technique to attain new traders. Customers are requested to debate the undertaking on social media to earn BioXP, which provides them entry to the primary BioAgent gross sales.

These components mixed to spice up visibility, appeal to new traders, and speed up accumulation.

3. API3

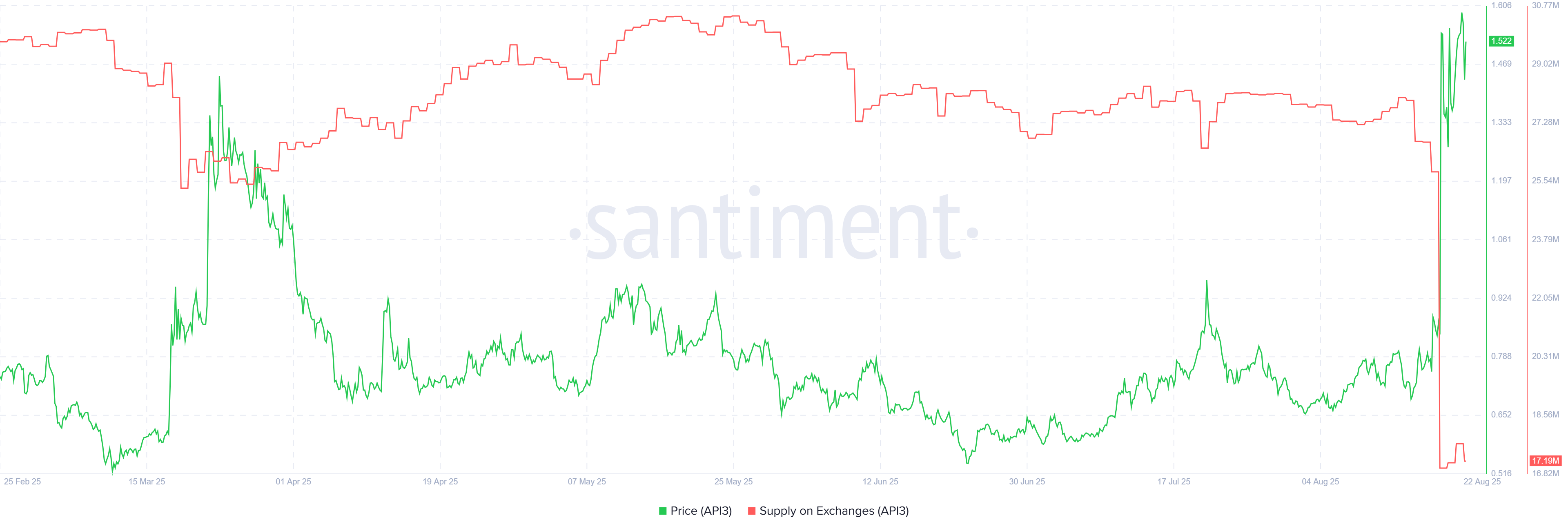

API3, an oracle-focused project, regained investor curiosity in August, sending its worth up greater than 130%. On the identical time, change reserves fell to their lowest level this 12 months.

The third week of August marked a turning level. Over 9 million API3 had been withdrawn from exchanges, decreasing change provide to simply 17.19 million.

The catalyst was Upbit’s itemizing of API3. In line with the BeInCrypto report, the token’s worth jumped over 120% instantly after the itemizing.

Investor concentrate on the Oracle sector additionally elevated attributable to Chainlink’s (LINK) rally. LINK’s strong performance prior to now month spilled over into associated initiatives. Knowledge from Artemis confirmed Oracle was the market’s best-performing sector in August.

The surge in API3 accumulation has saved its worth buying and selling steady at above $1.50.

These three altcoins spotlight completely different drivers behind August’s selective altcoin rally. Whereas a broad-based altcoin season has but to emerge, initiatives with distinctive catalysts — whether or not buyback packages, staking incentives, or an change itemizing — are attracting investor consideration and capital.

The publish Top 3 Altcoins Accumulated Off Exchanges in Mid-August appeared first on BeInCrypto.