The cryptocurrency Saros (SAROS) skilled a dramatic 70% value drop on August 24, plummeting to its lowest stage since April 2025.

The steep decline, which briefly erased months of positive aspects, has sparked widespread concern amongst buyers. Some market watchers have even drawn parallels to the troubled trajectory of MANTRA (OM).

Why Did SAROS Token’s Worth Crash?

For context, Saros is a decentralized finance (DeFi) platform constructed on the Solana (SOL) blockchain. It combines a variety of companies right into a single ecosystem, together with buying and selling, staking, yield farming, launchpad participation, and extra.

Its native utility token, SAROS, powers governance, staking, liquidity incentives, and extra. The token is deployed on each Solana and Viction.

The altcoin, which has a market cap of $922 million, has been on a predominantly upward trend for months and reached an all-time high (ATH) on August 04.

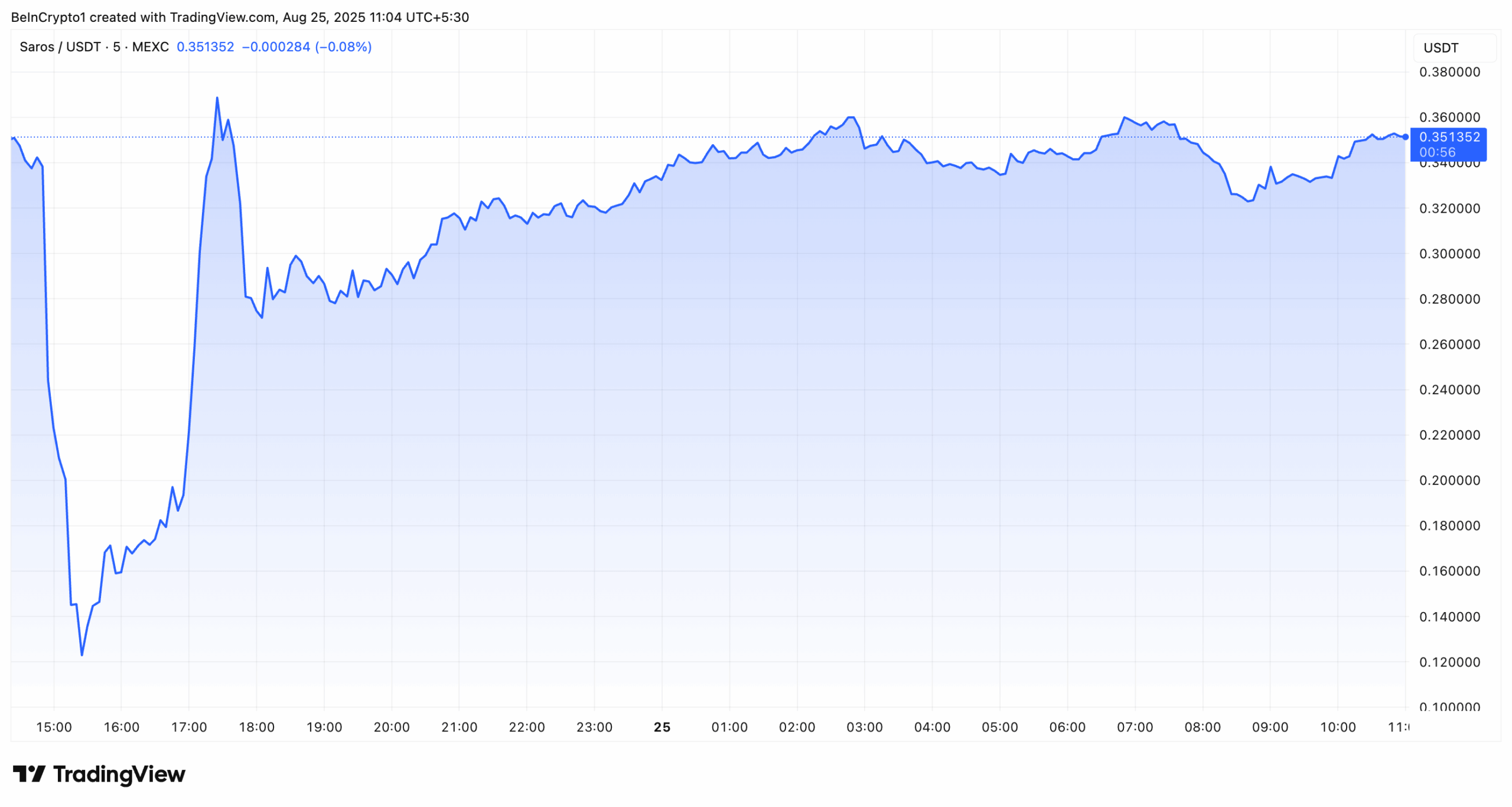

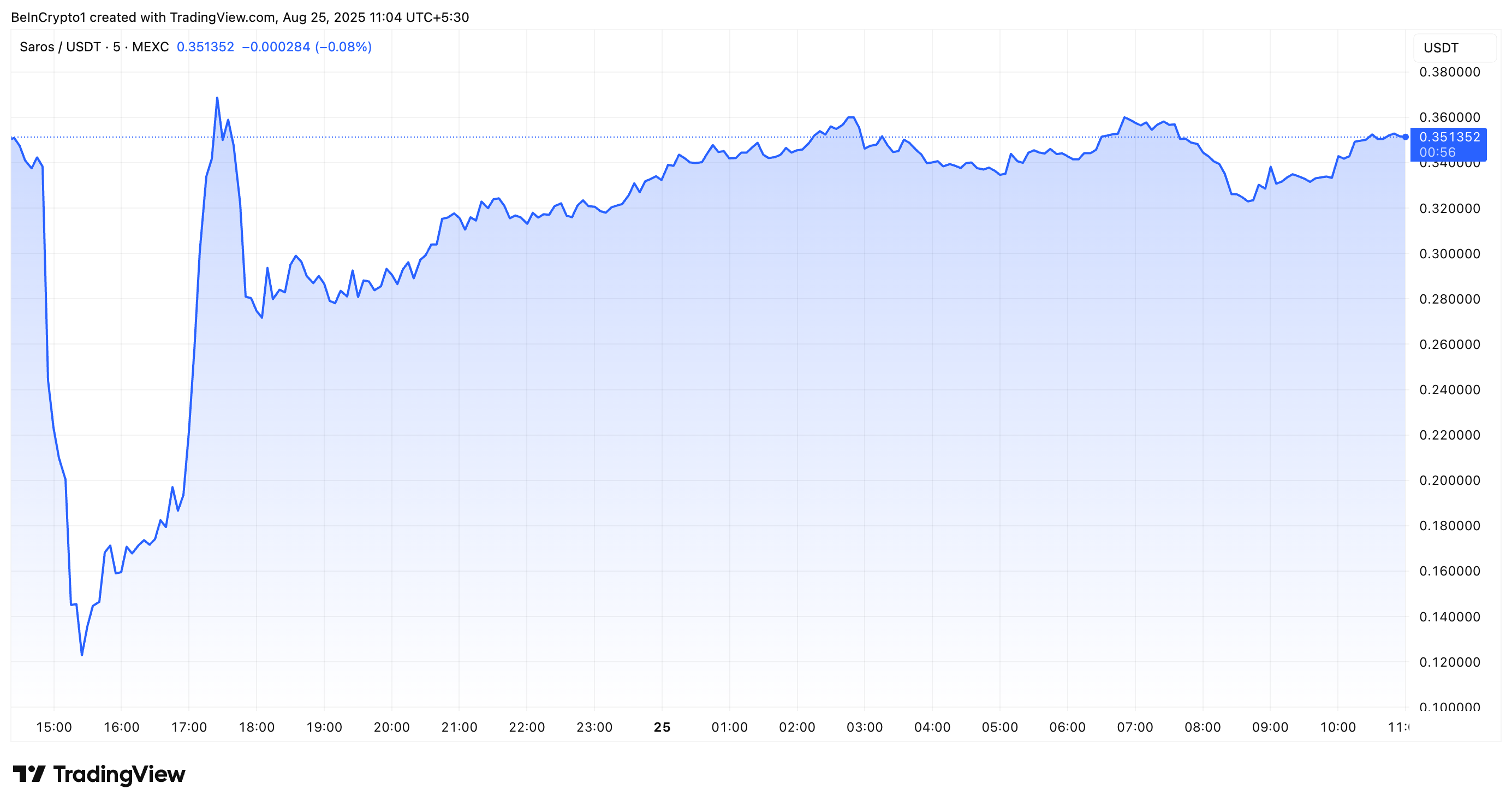

Nevertheless, yesterday’s 70% crash hindered this upward trajectory, pulling the worth shortly again to four-month lows. Market knowledge confirmed that SAROS’ value dipped to $0.109, a stage final seen in April.

Nonetheless, the dip was temporary. SAROS bounced again and reversed its losses. On the time of writing, it was buying and selling at $0.35, down 5.3% over the previous day.

Thanh Le, founding father of Saros, addressed latest value volatility. He defined that the sharp strikes in SAROS resulted from leveraged merchants lowering their positions on centralized exchanges, which precipitated open curiosity to fall sharply.

“Primarily based on our ongoing investigations and accessible knowledge, we consider it is a market-driven adjustment, probably involving a big, highly-leveraged place lowering its publicity on centralized exchanges (CEX). Previous to the motion, open curiosity was roughly 90M SAROS, in keeping with change knowledge, and it has since decreased to round 20M SAROS,” he said.

He harassed that neither the crew nor long-term buyers bought their holdings.

“Market cycles come and go, however our focus stays the identical: constructing Saros into the liquidity spine of Solana. Your belief and help are what drive us, and we’ll proceed to maintain you knowledgeable each step of the best way,” Le added.

Regardless of this, the most important crash precipitated many merchants to lose money and shook the market sentiment. CoinGecko data confirmed that over 50% of the neighborhood is bearish on SAROS.

The volatility has reignited comparisons to OM, which experienced a 90% crash in April and has but to recuperate fully.

“It’s going to maintain falling for at the least 1-2 years now…No matter I stated about OM earlier than got here true, and now no matter we stated about Saros got here true too,” an analyst remarked.

Thus, this incident highlights the broader dangers within the altcoin market. Whereas SAROS has proven some restoration, the worth drop has left many questioning the market’s stability. Now, the neighborhood will watch intently to see how Saros navigates this setback.

The submit Saros (SAROS) Faces 70% Crash: What Caused the Sudden Price Drop? appeared first on BeInCrypto.