Rumors have been flying round about whether or not to count on an impending altcoin season. Ethereum’s efficiency has been exceptionally excessive. China just lately introduced an financial stimulus, and the US Federal Reserve is predicted to chop rates of interest in September.

But, in response to an skilled from the Coinbase-acquired crypto change Deribit, altcoin season stays on maintain. The present panorama suggests cautious optimism moderately than excessive euphoria. Whereas Ethereum has surged, it hasn’t reached the required threshold to verify such an occasion, and mid- and small-cap altcoins nonetheless lack ample buying and selling quantity.

Are Macroeconomic Components Lastly Aligning?

For a lot of cryptocurrency merchants, the attract of altcoin season is the crypto equal of a gold rush. This era represents a market shift from established titans like Bitcoin and Ethereum towards a broader constellation of smaller, extra speculative property. Such an occasion culminates in a development of explosive good points.

Present macroeconomic elements and sure on-chain metrics have suggested the arrival of the long-expected altcoin season.

In a speech right this moment on the Jackson Gap Financial Symposium, US Federal Reserve Chair Jerome Powell indicated a more dovish stance towards probably decreasing rates of interest. He hinted that “the shifting stability of dangers” may warrant adjusting the Fed’s coverage stance, hinting at potential expansionary insurance policies for September.

Earlier this week, experiences emerged that China had announced a new stimulus package to bolster its struggling economic system. Whereas particulars are nonetheless rising, the transfer was broadly seen as a major step towards coverage easing by one of many world’s largest economies.

Jean-David Péquignot, Deribit’s Chief Industrial Officer, acknowledged the confluence of favorable macroeconomic insurance policies as key triggers for a possible altcoin season.

“Loosening central financial institution insurance policies can cut back yields on safer property and inject liquidity into the monetary system, decreasing long-term return expectations… As a high-beta threat asset, crypto tends to amplify what’s occurring in equities, and when liquidity is extra plentiful, speculative flows enhance,” Péquignot advised BeInCrypto.

Ethereum’s consequent worth surge strengthened these expectations.

Ethereum’s Rally Sparks Hope

In a strong show of renewed threat urge for food amongst traders, Ethereum’s price rallied following Powell’s announcement. This worth motion and a latest surge in inflows into spot Ethereum ETFs characterize key developments.

In response to Péquignot’s evaluation, the outperformance of Ethereum relative to Bitcoin is an important sign for the broader market.

“The ETH/BTC ratio sometimes acts as a number one indicator when BTC begins underperforming and traders present an rising urge for food for higher-risk crypto property,” he mentioned, including, “[It] may have a spillover impact, the place Ether outperformance consolidates investor urge for food for innovation and triggers FOMO within the broader market.”

Regardless of these promising indicators, they’re still not enough to confirm the arrival of a full-blown altcoin season.

Bitcoin Nonetheless Dominates

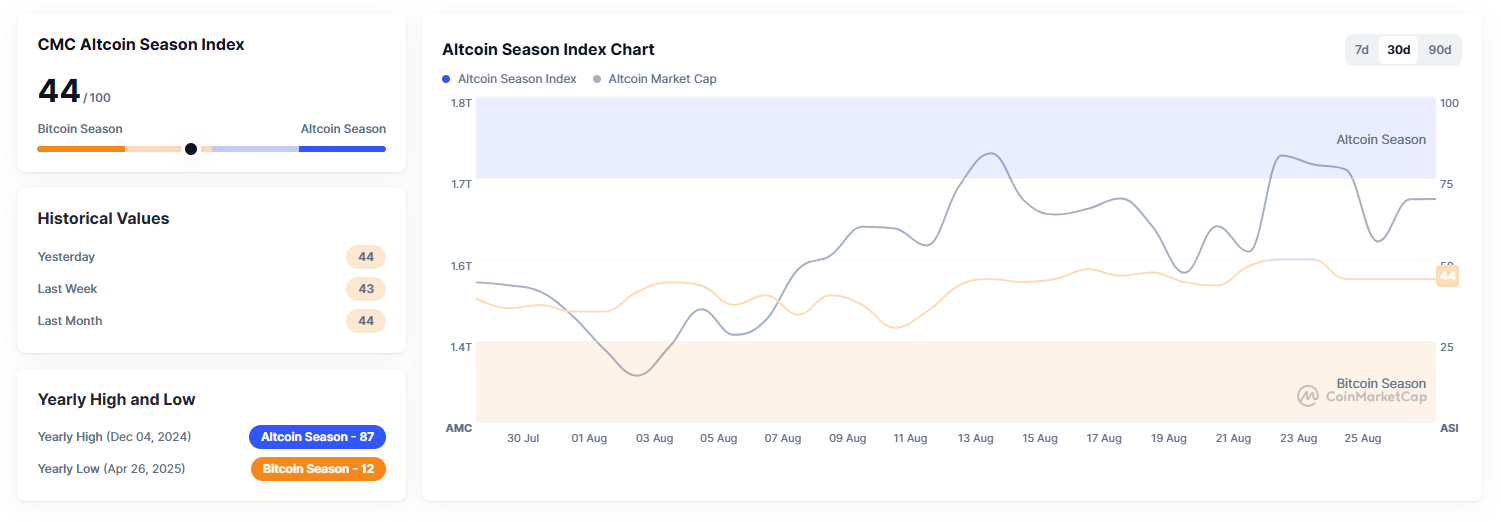

A broad market rally defines a real altcoin season, but a number of key metrics point out this has not yet happened. The CoinMarketCap Altcoin Season Index, for instance, measures whether or not 75% of the highest 100 altcoins have outperformed Bitcoin over 90 days.

At press time, the index stood at 44 out of 100.

“The CMC Altcoin Season Index has additionally recovered however stays nicely beneath the important thing degree of 75. Many mid- and small-cap alts are nonetheless lagging or buying and selling sideways, exhibiting no widespread altcoin outperformance,” mentioned Péquignot.

In the meantime, Bitcoin nonetheless has a stranglehold on the crypto market.

“Bitcoin dominance stays excessive on a 5-year horizon at 58%, to the purpose BTC prevails as the first catalyst for institutional allocation particularly,” Péquignot added.

These indicators recommend that capital remains to be primarily concentrated in Bitcoin, typically thought-about the safest digital asset. For altcoin season to actually arrive, these metrics might want to change.

What Components Are Wanted to Jumpstart Altcoin Season?

Whereas the latest information has supplied vital momentum, Péquignot is ready for a mix of all elements to totally align earlier than he’s assured in making the decision. He defined that true altcoin season is signaled by a collection of occasions confirming a widespread investor conduct shift.

“A breakout of the ETH/BTC ratio signalling sustained BTC underperformance; a decisive fall in BTC dominance, exhibiting extra apparent capital rotation; the Altcoin Season Index pushing in direction of 75, confirming massive altcoin breadth enlargement; and bigger retail inflows evidenced by on-chain exercise, social media exercise, and bigger altcoin buying and selling volumes,” he defined.

This broad-based capital rotation, mixed with macro tailwinds from the world’s strongest economies, could possibly be sufficient to reroute liquidity into altcs. But, even with these constructive developments, the trail is just not with out threat.

Remaining Triggers and Potential Pitfalls

A number of elements may derail a possible rally. For instance, adjustments in central financial institution coverage may reverse the present development.

“Sudden larger inflation prints could drive central banks to pause or reverse easing sooner than anticipated, which might harm threat property and revert the capital rotation,” Péquignot advised BeInCrypto.

He additionally cautioned that the crypto market’s dynamics, notably the excessive use of leverage, can result in sharp corrections.

“As altcoin rallies are fouled by retail greed and huge leverage, overcrowded or disappointing funding narratives can result in revenue taking or loss limitations, triggering liquidations that may minimize brief any altcoin season,” Péquignot added.

Including to the hearth, the continued imposition and reversal of trade tariffs by the USA continues to gasoline persistent uncertainty amongst traders. Such an surroundings can rapidly dampen altcoin urge for food.

The Ready Recreation

Altcoin season would require extra persistence this yr. Although it nonetheless hasn’t arrived, the circumstances are constructing.

The highly effective mixture of macroeconomic tailwinds and Ethereum’s latest surge has supplied the strongest sign to this point that the market is starting to shift. Nevertheless, all the mandatory indicators to verify such an occasion haven’t but been met.

The ready sport continues, however for the primary time in a very long time, the items for the subsequent nice crypto gold rush seem like falling into place.

The submit When Can We Expect Altcoin Season? Deribit Analyst Shares Key Insights appeared first on BeInCrypto.