Ethereum is dealing with a pivotal check because the market struggles to carry momentum amid mounting promoting stress. After shedding the $4,500 degree, ETH has entered a good consolidation vary, with bulls now pressured to defend present ranges. Analysts warn that failure to reclaim $4,500 quickly may open the door to a deeper correction, with draw back targets close to $3,900. This rising uncertainty weighs on sentiment, however establishments seem unfazed, persevering with to build up ETH aggressively.

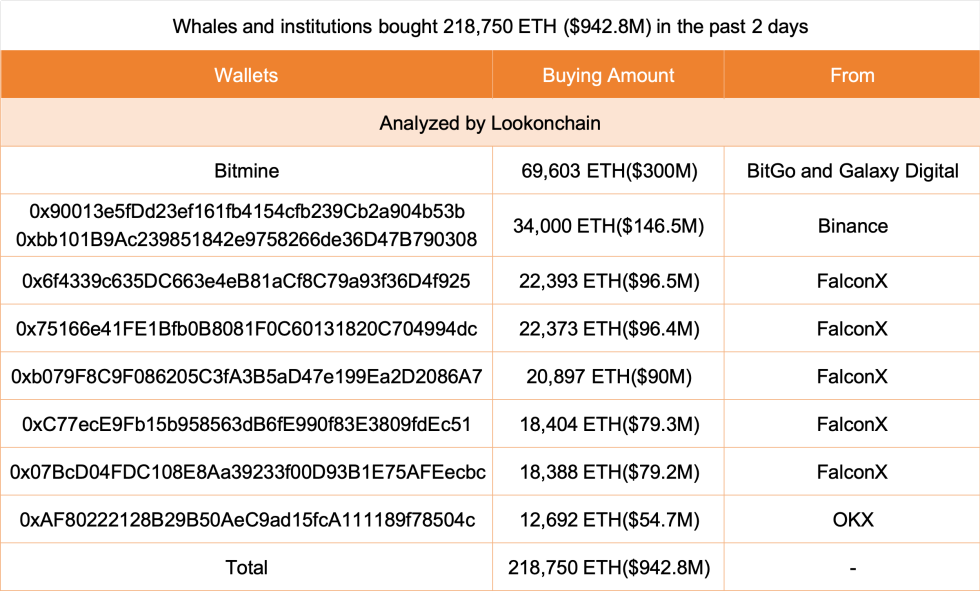

Based on knowledge from Lookonchain, whales and establishments bought a formidable 218,750 ETH—value roughly $942.8 million—in simply the previous two days. This surge in accumulation displays a broader guess on Ethereum’s energy, not solely as a number one sensible contract platform but additionally because the centerpiece of an anticipated altcoin rally. With capital rotation away from Bitcoin changing into extra evident, establishments seem like positioning themselves early for Ethereum’s subsequent potential leg larger.

Regardless of the stress, Ethereum’s fundamentals stay strong, supported by rising institutional flows, regular whale exercise, and a rising DeFi ecosystem. The battle between bulls defending help and bears pushing for decrease ranges units the stage for ETH’s trajectory within the subsequent section of this cycle.

Institutional Ethereum Accumulation Strengthens Bullish Outlook

Institutional flows into Ethereum stay robust regardless of the latest pullback. Lookonchain reviews that Bitmine, one of the vital lively institutional gamers within the area, purchased 69,603 ETH—valued at round $300 million—from BitGo and Galaxy Digital.

Moreover, 5 newly created wallets collectively bought 102,455 ETH, valued at roughly $441.6 million, from FalconX. These large-scale acquisitions spotlight continued confidence in Ethereum’s long-term potential and reinforce the view that establishments are positioning themselves for future good points.

This wave of accumulation is critical for a number of causes. First, it underscores Ethereum’s rising standing because the centerpiece of institutional methods, notably within the context of capital rotation from Bitcoin into altcoins. Second, it demonstrates that even amid heightened volatility, demand for ETH stays resilient. These purchases, executed in dimension, recommend that institutional consumers will not be solely unfazed by short-term corrections however are actively utilizing them as alternatives to scale publicity.

That stated, dangers stay within the close to time period. Technically, Ethereum should maintain above $4,200 to keep away from a sharper decline. Ought to this degree fail, the following significant help lies close to $3,900, a zone that would invite additional promoting stress earlier than consumers return. For now, institutional conviction offers a powerful counterbalance to market uncertainty, signaling that Ethereum’s structural demand stays intact and will function the spine of its subsequent bullish section.

ETH Consolidates Round Key Ranges

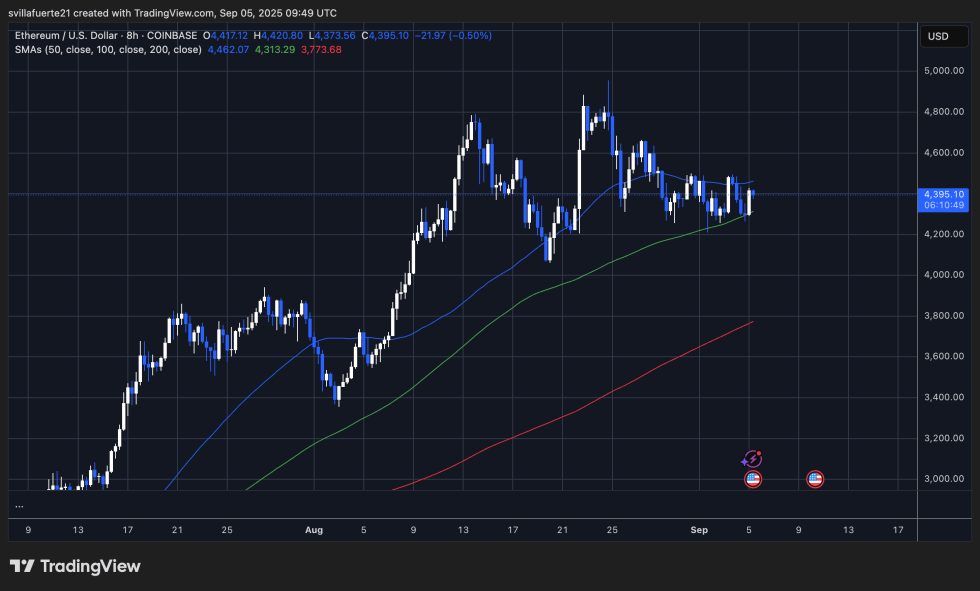

Ethereum (ETH) is consolidating slightly below the $4,500 degree, presently buying and selling close to $4,395 after days of sideways motion. The chart reveals ETH sustaining a good vary between $4,250 and $4,500, with repeated checks of each help and resistance ranges. This sample displays rising market indecision, as consumers try to defend structural demand whereas sellers proceed making use of stress.

The 50-day transferring common (blue line) is barely above present value ranges, performing as dynamic resistance, whereas the 100-day transferring common (inexperienced line) round $4,313 offers close by help. A sustained shut under $4,250 would open the door for a deeper correction towards $3,900, which is the following vital help zone. On the upside, ETH should break and maintain above $4,500 to substantiate bullish momentum and probably retest highs close to $4,800.

Regardless of the shortage of route in value motion, the broader construction stays constructive, with ETH buying and selling properly above the 200-day transferring common (crimson line), which is trending upward close to $3,773. This means the long-term bullish development is undamaged, however the quick outlook hinges on whether or not bulls can defend the $4,200–$4,250 space. For now, ETH stays in consolidation, with breakout or breakdown indicators but to materialize.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.