Bitcoin’s worth has spent the previous week hovering within a tight band and bouncing between $108,000 and $112,000 with none clear path but. There have been a number of rejections on the $112,000 worth degree and technical evaluation shows pressure around the 200-day shifting averages on the four-hour chart.

Notably, a technical evaluation shared by crypto analyst Daan Crypto exhibits Bitcoin is at risk of a breakdown beneath $100,000, however bulls nonetheless have an opportunity to stage a restoration rally within the weeks forward.

Analyst Warns About Sweep Of Month-to-month Lows

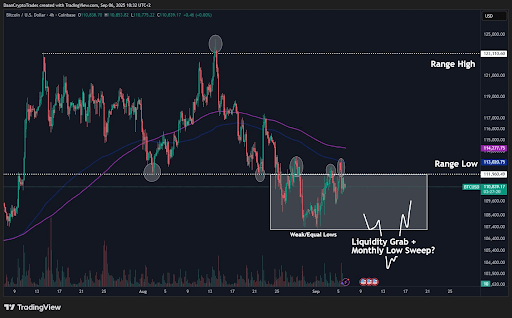

In his latest post on the social media platform X, Daan Crypto Trades famous that Bitcoin is presently indecisive, and its worth motion is leaning towards a sweep of the month-to-month lows. This motion relies on the 4-hour candlestick timeframe chart, which exhibits the Bitcoin worth was lately rejected on the 200MA/EMA final week.

Associated Studying

The 4-hour candlestick chart beneath exhibits Bitcoin has been buying and selling in an outlined vary since August 25, with equal lows forming a weak base round $107,000 and liquidity sitting simply beneath. This makes a stop-hunt sweep a attainable subsequent step.

Such a transfer, the analyst defined, would seemingly open up a bearish case of panic throughout the market, which could finally trigger fears of Bitcoin collapsing below the $100,000 worth degree.

Nevertheless, the analyst additionally recognized the $103,000 to $105,000 worth zone as the support level the place consumers can step in. This space, in line with him, would even be a logical entry level for swing lengthy positions if the Bitcoin worth certainly breaks down beneath $107,000.

Situations For A Bullish Restoration

In keeping with the evaluation, Bitcoin bulls have an opportunity to stop any breakdown beneath $100,000 by holding above $105,000 to $103,000. Regardless of laying out a bearish base case, Daan additionally described a roadmap for the bulls.

Associated Studying

The primary situation can be energy above $115,000, which might mark a break of August’s vary low, which has was resistance within the first week of August. A break and shut above $115,000 would invalidate any short-term bearish momentum.

Alternatively, he pointed to a fast liquidity seize beneath the month-to-month lows at $107,000, adopted by a reclaim of the $107,000 and $112,000 ranges, as essentially the most bullish state of affairs. In keeping with the analyst, this second setup might pave the way in which for a sustained one-to-two-month uptrend rally via October and November.

For now, the analyst stated he’s on the sidelines aside from short-term scalps. On the time of writing, Bitcoin is buying and selling at $111,733, up 0.7% up to now 24 hours.

Featured picture from Pixabay, chart from Tradingview.com