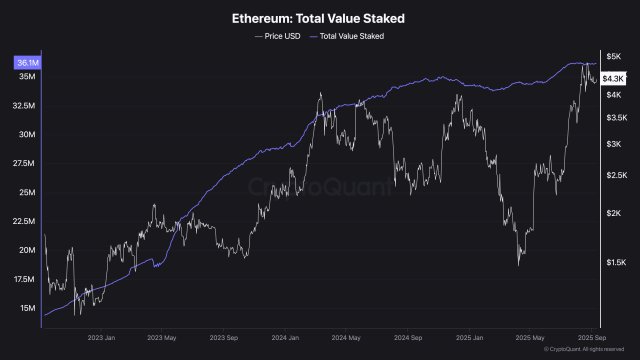

Ethereum has flipped barely bullish once more after going through bearish stress for a number of days and is buying and selling again above the $4,300 worth degree. Amid this worth fluctuation, a current report exhibits that ETH’s staking exercise has grown exponentially, with a large portion of the altcoin locked away in staking.

A Huge Development In Ethereum Staking

Whereas Ethereum’s price is regaining upward traction, staking exercise is on the rise. At present, buyers are doubling down on ETH, with staking exercise spiking sharply as confidence within the community’s long-term potential strengthens.

This notable surge in staking exercise was shared by CryptoGucci, a crypto fanatic, on the X (previously Twitter) platform. The event exhibits a sturdy dedication from institutional and retail gamers, who view Ethereum’s proof-of-stake structure as a pillar for safeguarding the blockchain’s future quite than merely a yield potential.

In keeping with the skilled, there may be presently greater than 36,148,793 ETH locked into staking, whilst market volatility continues to form the broader crypto panorama. This vital variety of ETH locked away in staking represents over 29.9% of the overall provide of ETH in circulation.

At present market costs, the overall ETH locked in staking is value a staggering $158 billion. CryptoGucci famous that the large capital from institutional and retail investors championed to the ecosystem is dedicated to securing ETH via staking.

Throughout this substantial wave of ETH staking, a big portion of the altcoin has been persistently withdrawn from main crypto exchanges. Latest reports reveal that Ethereum’s trade provide is on a gentle downward trajectory, and the development doesn’t seem like displaying any indicators of slowing down.

After inspecting the Ethereum Exchange Reserve metric, CryptoGucci highlighted that the ETH provide on exchanges continues to succeed in file lows. This improvement alerts a robust shift in direction of staking and long-term holdings, which displays rising investor confidence within the altcoin’s potential.

Presently, Exchange-Traded Funds (ETFs) are buying billions, treasuries are piling, and establishments are hoarding. Given the continuing sturdy consideration directed towards ETH, the skilled is assured {that a} notable rally might be on the horizon.

ETH Locking A Bigger Chunk Of Spot Market Share

Ethereum is constantly breaking crucial boundaries within the ongoing bull market cycle. In a post on the X platform, Milk Street, a crypto skilled, reported that ETH has flipped Bitcoin, the biggest crypto asset, by way of spot market share.

For the primary time ever, ETH has captured a bigger share of the spot market in comparison with Bitcoin, surpassing the 50% mark. In keeping with the crypto skilled, this can be a five-year breakout that signifies the course of liquidity circulation. ETH’s overtaking BTC on this space is a results of stablecoins, tokenization, ETFs, and regulation converging on the community.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.