The WLFI buyback and burn proposal has simply gone reside. It guarantees to show treasury charges into direct shopping for stress and completely cut back provide throughout the community.

May WLFI quickly witness a 50% worth surge because the treasury formally “pours cash” into shopping for and completely burning tokens?

Sponsored

Sponsored

Catalyst: ‘Buyback & Burn’ on WLFI

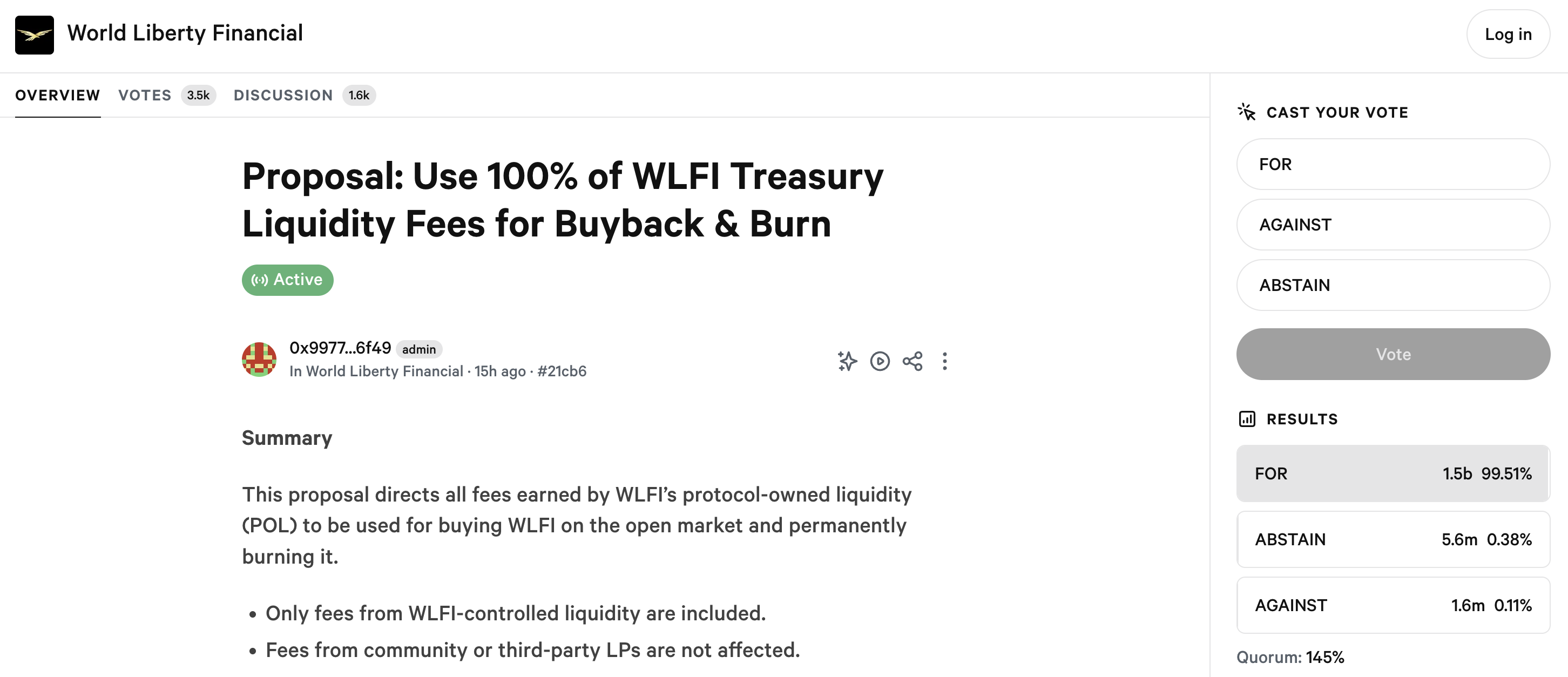

World Liberty Financial (WLFI) has simply launched a key proposal: redirect 100% of treasury liquidity charges to market-buy WLFI tokens and completely burn them throughout a number of chains. In truth, this route charges – market-buy – everlasting burn method is a widely known catalyst utilized by tasks like HYPE, PUMP, and TON.

From an financial perspective, buyback & burn is an efficient deflationary mechanism. The “computerized” demand generated by protocol exercise (liquidity charges) will buy tokens on the spot market, and burning will completely cut back the whole provide. Consequently, assuming demand stays secure or will increase, costs may re-rate upward.

Nonetheless, its full impression is determined by two key components: the quantity of charges collected by the treasury and the frequency/timeline of the buybacks. The buyback impression will probably be restricted if every day/weekly charges are nonetheless small relative to market liquidity. Conversely, the mechanism can ship a major impact if the treasury generates giant and constant charge flows.

If authorized and executed transparently, this buyback-and-burn mechanism may assist revive WLFI’s worth, which has been severely depressed following governance dangers and centralization issues. Since launch, the controversy surrounding Justin Sun has sharply lowered WLFI’s worth. On the time of writing, WLFI is trading at $0.1996, down 40% from its earlier ATH.

Nonetheless, implementing a buyback mechanism is not going to assist enhance token costs. Some analysts argue that crypto buybacks are seen as value-destroying quite than value-creating. They burn income that would have fueled development by product improvement and consumer acquisition.

With rising regulatory dynamics and a maturing business, the main focus must be on constructing clear, environment friendly tokens for long-term traders. These tokens ought to act as on-chain fairness, driving sustainable worth over time.

Sponsored

Sponsored

“The market doesn’t want extra buybacks. It wants productive tokens and endurance.” The Moonrock’s founder commented.

Technical View

From a technical evaluation perspective, a number of analysts on X observe that WLFI is at present in a falling wedge sample and could also be nearing its backside. Value motion suggests a pointy reversal could also be imminent, with upside potential of as much as 50%, focusing on $0.26.

In one other evaluation, a consumer on X noticed that WLFI is testing the Level of Management (PoC) worth zone after breaking out of a descending bearish channel on decrease timeframes.

“A robust breakout above this PoC may spark a 30–40% short-term rally, with rising quantity confirming momentum — one to observe intently!” CryptoBull stated.

These observations all recommend {that a} reversal could also be very shut. Nonetheless, WLFI should nonetheless safe a confirmed shut above key resistance and sustained buying and selling quantity to validate this transfer.

Furthermore, whereas the burn mechanism is engaging, market confidence in governance (who controls the treasury, who indicators buyback transactions, and the way transparently burn reviews are revealed) will largely decide its long-term effectiveness.