Key takeaways

- BTC targets the $120k resistance forward of FOMC.

- The $116k resistance presents a hurdle to merchants regardless of bullish worth motion.

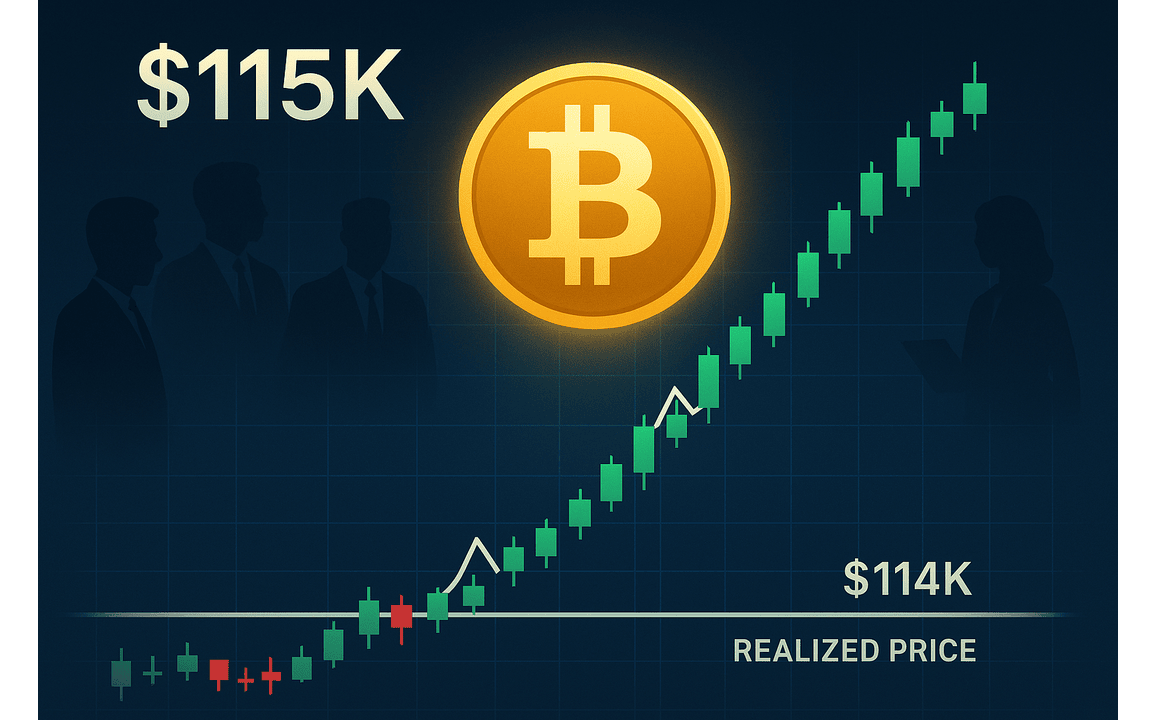

BTC remains to be buying and selling beneath the $116k resistance

The crypto market opened the brand new week bearish however is now on its path to restoration as Bitcoin and different main cryptocurrencies are recording features. Bitcoin dropped to the $114k degree on Monday, with altcoins recording larger losses.

Nevertheless, BTC has barely recovered and is now buying and selling above $115k, with the $116k resistance nonetheless in play. The stagnated worth motion comes forward of an important FOMC assembly tomorrow.

Analysts expect a price minimize of no less than 25 foundation factors, with some predicting a 50 foundation level minimize. Polymarket odds of this minimize have jumped to over 90%, whereas the CME Fed Monitor software has the chance at 95%. A Fed price minimize will favour cryptocurrencies equivalent to Bitcoin, with the main cryptocurrency more likely to goal its all-time excessive worth as soon as once more.

BTC eyes $120k forward of FOMC

The BTC/USD 4-hour chart stays bullish and environment friendly regardless of Monday’s dip. The technical indicators have improved over the previous couple of hours, with all eyes now on tomorrow’s anticipated Fed price minimize.

The RSI of 55 reveals that patrons are nonetheless in management, with the MACD traces additionally throughout the bullish territory. If the $116k resistance degree is surpassed, BTC may shortly rally in direction of the $120k psychological degree over the following few hours or days. An prolonged bullish run would permit it to focus on the all-time excessive worth above $125k.

Nevertheless, failure to surpass the $116k resistance degree may see BTC face additional correction to the draw back. This might see the cryptocurrency retest the TLQ and assist degree at $113,479. This assist degree will probably maintain as the following assist degree is round $110.