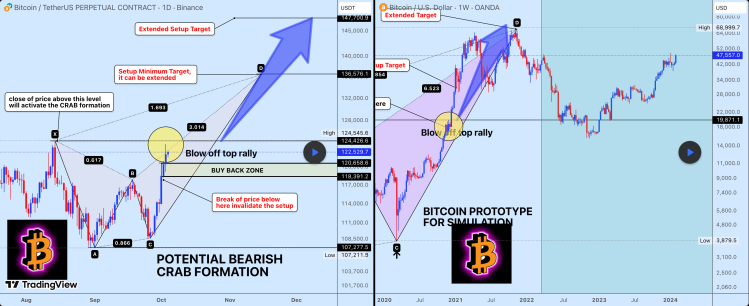

Whereas the Bitcoin value appears to have deviated utterly from the four-year cycle that dictated the earlier bull and bear markets, there are still some similarities that stay that counsel that it may nonetheless play out in the same approach. The key similarity that has emerged is the formation of a bearish crab sample again in 2021, and now, the identical sample has reappeared. Thus, having a look on the route of the 2021 formation may give an insight into where the Bitcoin price is headed next from right here.

The Sample That Triggered The Bitcoin Worth Explosion

In an evaluation, crypto analyst Weslad was the one who pointed out that the Bearish Crab Sample had returned, and this was shaped on the day by day chart as effectively. Apparently, the present formation appears eerily much like the best way it shaped again in 2021, suggesting that the ensuing pattern may play out the identical.

Associated Studying

Again in 2021, when the Bearish Crab Sample got here up, the end result was a value explosion that despatched the Bitcoin value towards its $69,000 all-time excessive. This “Blow-off prime” rally is normally the last rally in a bull market, and its finish typically indicators the beginning of the following bear market.

With this sample, although, there are a selection of targets to be careful for that might present the place the worth is headed subsequent. The primary of those is that the Bitcoin value would want to finish a day by day shut above the $124,545 stage, and this is called the Activation Set off.

Subsequent in line is what Weslad refers to because the “Purchase The Dip Zone”. This may be the ideal price range to enter Bitcoin within the case of a retrace, and this lies between $118,000 and $120,000. A dip towards these ranges is nothing to fret about, because it signifies that the bulls are nonetheless in management.

Associated Studying

Each of the zones outlined above, if held, would see the Bitcoin value proceed its bullish rally. If the ultimate, explosive leg does play out because it did again in 2017-2021, then the Crab sample means that the Bitcoin value will a minimum of go to $136,000, with an prolonged goal of $147,000, and the possibility that it goes further toward $160,000.

Nonetheless, the ultimate goal is the bearish one that might send the Bitcoin price crashing back downward, and it lies at $107,000. In keeping with the crypto analyst, a break under this stage would invalidate your complete bullish thesis, calling it the “line within the sand.” Weslad explains that “The invalidation stage at $107K is essential. A break under there means the setup is damaged, and we should re-assess.”

Featured picture from Dall.E, chart from TradingView.com