Key Notes

- Bit Digital’s $150 million financing spherical attracted Kraken Monetary, Soar Buying and selling Credit score, and Jane Avenue Capital.

- Quick merchants confronted $21 million in liquidations as Ethereum rebounded above $4,500 following a quick correction to $4,432.

- The corporate’s mNAV stands at $3.84 per share with conversion worth at 8.2% premium reflecting investor confidence.

Bit Digital, a publicly traded agency centered on Ethereum

ETH

$4 521

24h volatility:

1.3%

Market cap:

$545.74 B

Vol. 24h:

$39.65 B

treasury and staking, has introduced one other main buy, whereas derivatives short-traders have been caught off guard with $21 million briefly contracts liquidated as Ethereum worth rebounded above $4,500 on October 8.

According to Bit Digital’s announcement on October 8, the corporate has bought roughly 31,057 ETH, funded by proceeds of its not too long ago accomplished $150 million convertible notes providing.

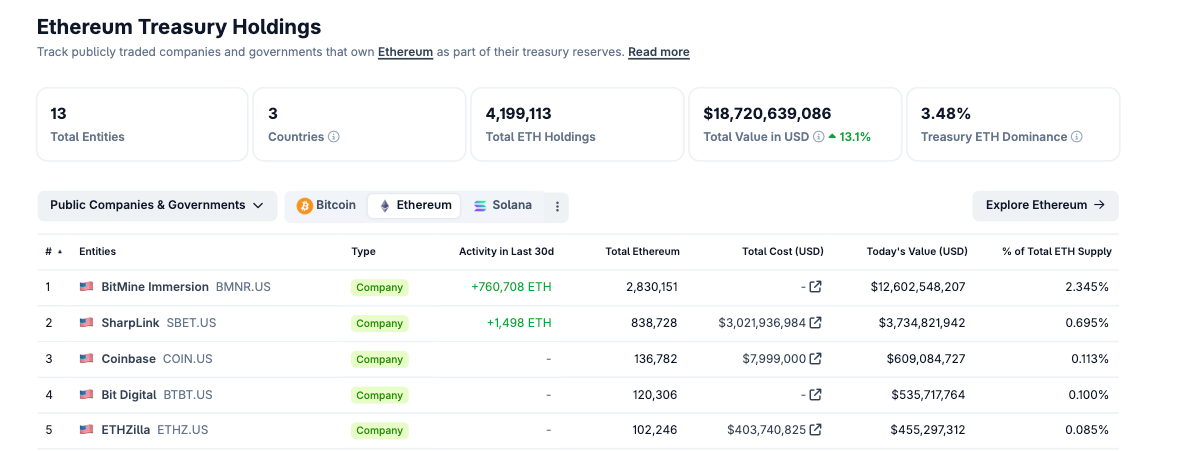

Ethereum Treasury Holdings as of October 8, 2025 | Supply: Coingecko

Bit Digital Expands Ethereum Treasury to 150,244 ETH

Following the most recent transaction, Bit Digital now holds 150,244 ETH, and is about to leapfrog Coinbase into third place among the many largest Ethereum treasuries, according to Coingecko data.

Kraken Monetary, Soar Buying and selling Credit score, and Jane Avenue Capital all participated in Bit Digital’s newest financing spherical, with CEO Sam Tabar reaffirming long-term dedication to the ETH treasury technique.

“This buy demonstrates our dedication to constructing shareholder worth by financing ETH accumulation on phrases which can be accretive to NAV per share. The construction of our convertible notes allowed us to boost capital at a premium to mNAV, and we’ve got deployed these proceeds straight into ETH. We view ETH as foundational to digital monetary infrastructure and imagine present ranges present a compelling long-term entry level,” stated Sam Tabar, CEO of Bit Digital.

According to the company’s estimates as of September 29, 2025, Bit Digital’s mNAV was roughly $3.84 per share, calculated from $512.7 million in ETH holdings and $723.1 million in WYFI shares, totaling $1.236 billion in mixed asset worth.

The $4.16 per share conversion worth marks an 8.2% premium over that mNAV, reflecting investor confidence in Bit Digital’s Ethereum-focused treasury mannequin.

Quick Merchants Shed $28M in 1HR as Markets Brace for Early Rebound

Ethereum worth rose to a multi-month peak above $4,700 earlier this week, monitoring Bitcoin

BTC

$123 595

24h volatility:

2.3%

Market cap:

$2.46 T

Vol. 24h:

$66.44 B

new all-time excessive of $126,200 on October 7. Nonetheless, as Bitcoin started retracing, Ethereum adopted go well with, declining 5% to $4,432 amid profit-taking stress.

That transient correction triggered a spike in leveraged quick positions, as speculators anticipated deeper losses. However regular company demand amid the US authorities shutdown has seen bulls regain management as ETH worth rebounded above $4,500 on October 8, sparking early indicators of a possible quick squeeze.

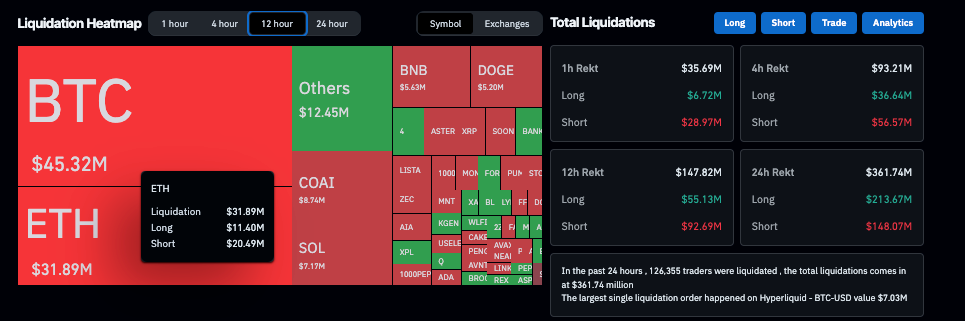

Crypto market liquidations as of October 8 | Supply: Coinglass

Following a extremely risky 24-hour interval the place complete crypto market liquidations hit $361.7 million, bull merchants initially bore the brunt of the sell-off, accounting for $213.6 million of the wipeout. This positioned the bull’s loss incidence at roughly 59% on the 24-hour timeframe.

Nonetheless, current derivatives information studying after Ethereum retook $4,500 suggests an early rebound underway. Inside simply the previous hour, complete liquidations of $35.7 million have been dominated by $28.9 million in shorts versus solely $6.7 million in longs. This quick squeeze has dramatically lowered the bull loss incidence to simply 19%, indicating that bears are being aggressively compelled out of the market.

Ethereum is main the cost, with $20.5 million in short positions liquidated during the last 12 hours alone.

As this early rebound positive aspects traction, and with institutional confidence strengthened by Bit Digital’s $673 million Ethereum treasury, the sharp short-liquidations might probably set the stage for a brand new breakout towards $5,000 because the US government shutdown fuels company risk-on sentiment.

Greatest Pockets Presale Nears $16.4M as Ethereum Rebounds Above $4,500

With Ethereum rebounding above $4,500 and institutional treasuries like Bit Digital increasing holdings to file ranges, buyers are rotating towards promising early-stage initiatives resembling Greatest Pockets (BEST).

Greatest Pockets presale

Greatest Pockets (BEST) is a next-generation multi-chain storage platform providing sensible vaults, multi-sig integrations, and yield optimization instruments designed for each retail and institutional customers.

At press time, the Greatest Pockets presale has surpassed $16.4 million, buying and selling at $0.026 with lower than 24 hours earlier than the subsequent worth tier unlocks. Buyers can nonetheless purchase tokens at $0.026 through the official Best Wallet website, and acquire unique staking rewards forward of the venture’s public rollout.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.