Key Notes

- BlackRock’s $80 million ETH sell-off accelerated Ethereum’s 14% value drop amid market-wide liquidations.

- ETF information exhibits buyers rotated from ETH to BTC, however on-chain staking deposits surged by $114 million.

- Staking exercise hints at long-term conviction, supporting Ethereum’s fast rebound above $3.800.

Ethereum value fell 14% to $3,800 on Saturday, October 11, doubling Bitcoin’s 7% losses as ETF buying and selling information revealed that BlackRock led Ethereum sell-offs with $80.2 million in web withdrawals on Friday whereas concurrently including extra BTC. The promote stress coincided with turbulent market reactions to President Trump’s new tariffs on China, accelerating crypto liquidations and pushing ETH all the way down to $3,500, its lowest stage since August 3.

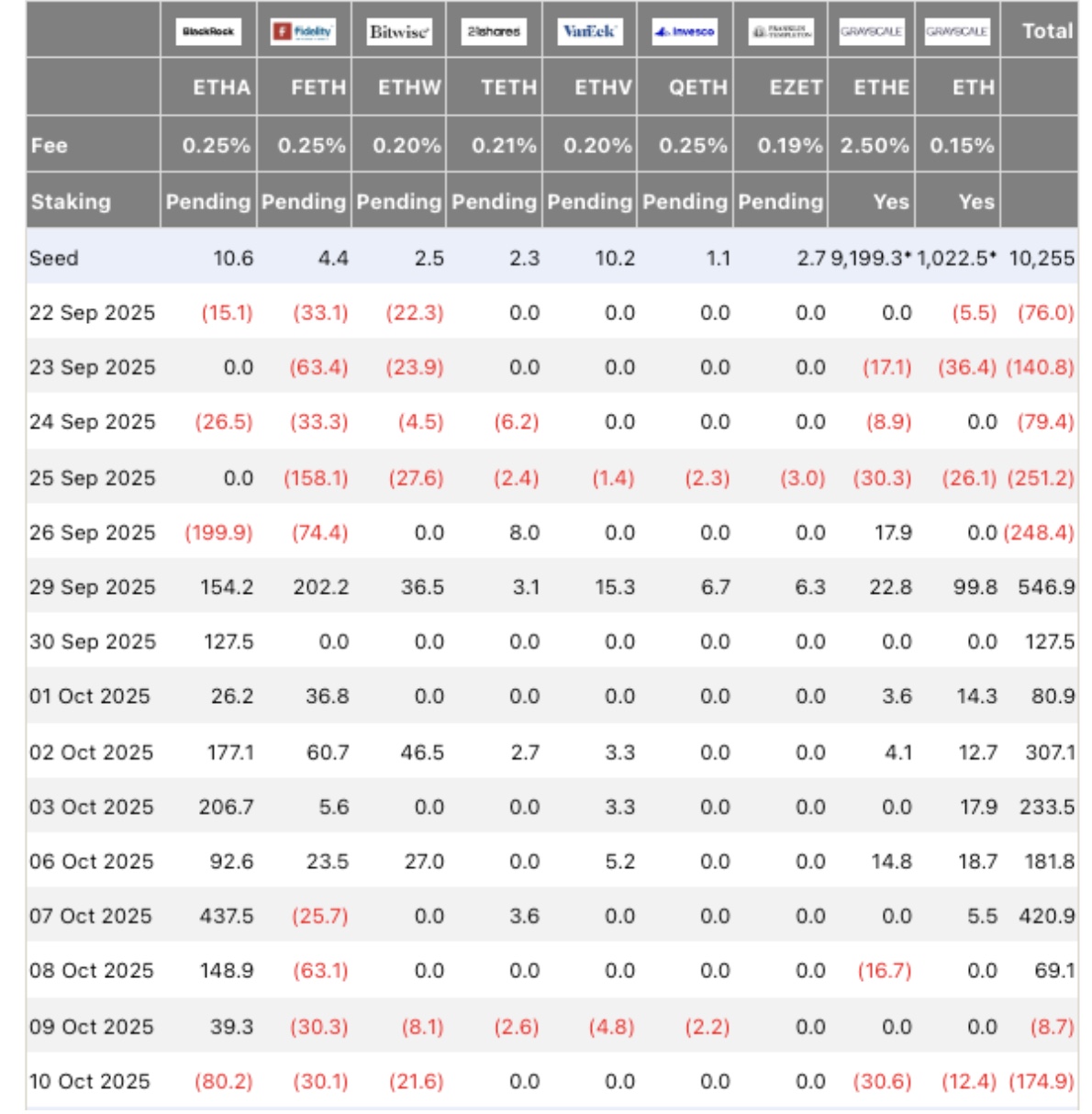

Ethereum ETF Flows (US$m) as of October 10, 2025 | Supply: FarsideInvestors

According to FarsideInvestors, Ethereum ETFs recorded combination outflows of $174 million on Friday, led by BlackRock’s $80.2 million withdrawals. In distinction, Bitcoin ETFs confirmed relative energy, with BlackRock’s IBIT ETF attracting $74 million in web inflows, bringing down combination BTC ETF outflows to simply $4 million on the day.

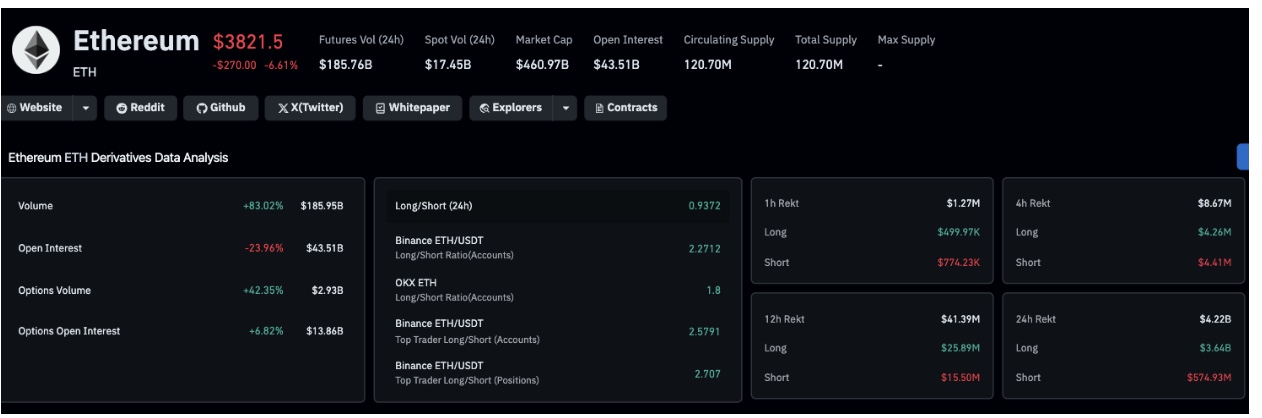

Ethereum Derivatives buying and selling metrics as of Oct 11, 2025 | Supply: Coinglass

Because the world’s largest asset supervisor, BlackRock’s trades closely affect investor sentiment, an impact seen in Ethereum’s sharper downturn. Data from Coinglass exhibits $3.64 billion in ETH derivatives liquidations over 24 hours, whereas the lengthy/quick ratio dropped to 0.94, reflecting a sudden tilt towards bearish positioning as merchants fled ETH amid heightened volatility.

Staking Yield Demand May Ease Quick-Time period Stress on Ethereum Value

At first look, BlackRock’s ETF reallocation suggests institutional buyers favored Bitcoin’s relative stability over Ethereum amid macro stress. But, on-chain information from Ethereum’s Beacon Chain reveals a contrasting pattern, as buyers seem like pivoting toward staking yields slightly than exiting ETH.

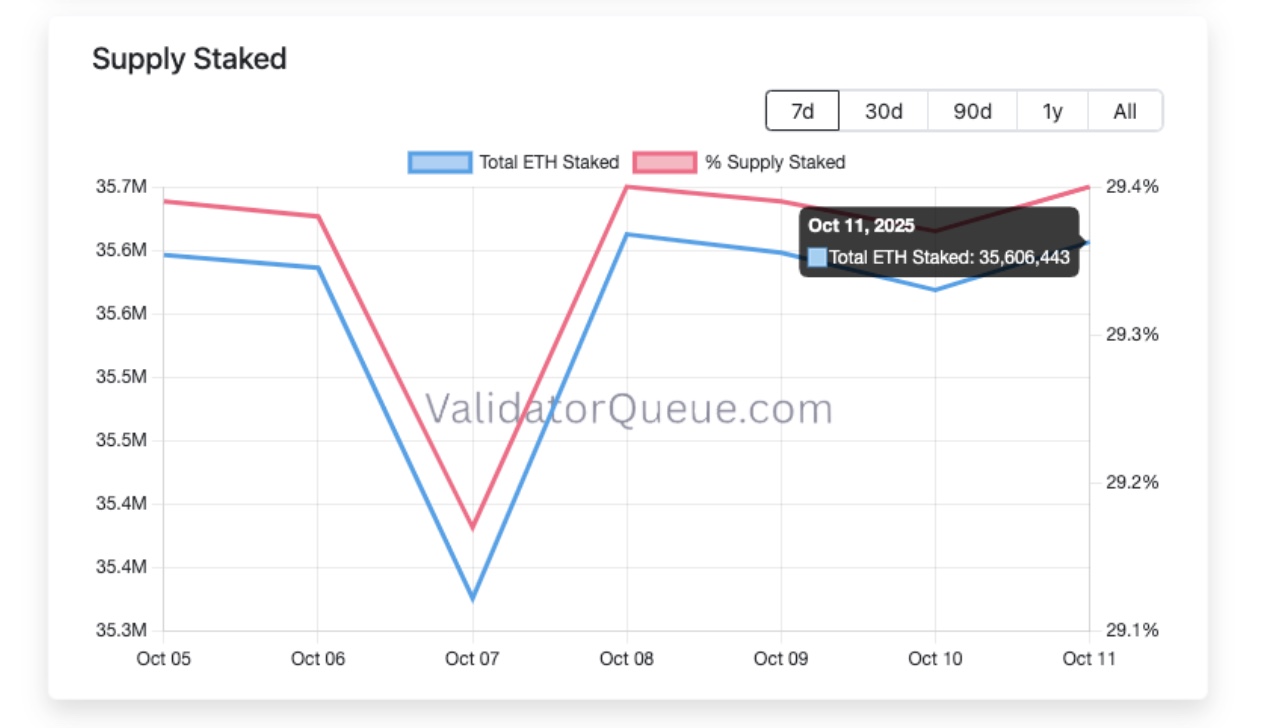

Validator Queue data exhibits that on Friday, the entry queue surged by 1,356,688 ETH, bringing whole staking deposits in progress to 1,386,514 ETH at press time. In the meantime, the exit queue fell from 2,389,032 ETH to 2,357,676 ETH, indicating fewer validators are selecting to unstake.

Ethereum staking deposits elevated by roughly $114 million, whereas Exit Queue declined $119 million as markets react to President Trump’s newest tariffs on China | Supply: ValidatorQueue, Oct 11, 2025

In whole, staking deposits elevated by 29,826 ETH, price roughly $114 million, aligning virtually exactly with the $80.2 million in BlackRock’s ETF withdrawals. Concurrently, exit volumes dropped by 31,356 ETH, equal to $119 million, inside the similar 24-hour interval.

This divergence suggests a reallocation from non-yield-bearing ETF publicity towards on-chain staking positions, signaling long-term conviction in Ethereum’s community safety and passive revenue potential.

Whereas short-term merchants and derivatives contributors bore the brunt of Friday’s turbulence, Ethereum’s underlying community infrastructure and staking flows remained optimistic. Ethereum value has rebounded from intraday lows round $3,500 to achieve $3,823 at press time. Regular inflows into Beacon Chain staking contracts sign confidence that will ease near-term draw back stress from Blackrock’s ETF withdrawals.

Greatest Pockets Presale Hits $16.5M as Ethereum Stakers Eye $4K Rebound

As Ethereum value stabilizes above $3,800 on staking inflows, tasks like Greatest Pockets are rising as engaging yield options.

With the broader crypto market consolidating after a $19 billion liquidation occasion. Greatest Pockets (BEST) presents multi-chain help, good vaults, and built-in multi-sig safety features, giving customers institutional-grade management over digital belongings.

Greatest Pockets Presale

At press time, the Greatest Pockets presale has surpassed $16.5 million, with tokens buying and selling at $0.026. With lower than 24 hours earlier than the subsequent value tier unlocks, potential buyers can be part of the presale through the official Best Wallet website to achieve unique early-entrant rewards.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.