Key Notes

- BTC futures quantity jumped 22.76% to $81 billion as quick merchants positioned for renewed draw back strain.

- Michael Saylor hinted at one other BTC acquisition after Technique’s Bitcoin holdings worth dropped $4 billion this month.

- Regardless of weekend beneficial properties, open curiosity stagnation alerts low conviction amongst bulls and potential continuation of bearish momentum.

Technique CEO and Co-founder Michael Saylor dropped a cryptic tweet on Sunday, Oct 19, hinting at one other BTC buy. The put up lauded a hypothetical subsequent BTC buy, accompanied by the agency’s Bitcoin holdings tracker.

The information exhibits the full worth of Technique’s 640,250 BTC holdings dropping to $69 billion from peaks round $73 billion when the worth hit all-time highs of $126,270 on October 6, 2025.

$MSTR is a granny shot https://t.co/OREECm3O4a

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) October 19, 2025

On Saturday, Saylor additionally made an look in an interview with Mark Moss, CEO of Satsuma Technology Plc, a UK-based crypto and decentralized AI agency.

Within the interview, Saylor offered technical particulars about $STRC, Technique’s perpetual most popular inventory, launched in July 2025. The product now delivers 10.25% variable month-to-month money dividends backed by 10x overcollateralized Bitcoin to eradicate draw back volatility.

Michael Saylor explains how Technique is stripping away the volatility of Bitcoin to supply traders with a ten.25% dividend treasury credit score instrument, $STRC. pic.twitter.com/bpQliXMLhd

— The ₿itcoin Therapist (@TheBTCTherapist) October 18, 2025

By collaring the worth between $99 and $101 and dynamically adjusting yields, $STRC maintains stability close to par worth, permitting MicroStrategy to monetize treasury property with out liquidation.

BTC Brief Merchants Doubling Down Regardless of Weekend Restoration

Bitcoin value bounced 1.5% on Sunday, with beneficial properties subdued slightly below $109,000 on the time of reporting. Regardless of Saylor’s contemporary bullish trace on Sunday, derivatives metrics present BTC quick merchants positioning for extra draw back motion, defying the weekend restoration.

Coinglass data exhibits Bitcoin futures buying and selling quantity surged 22.76% to hit $81.08 billion, with Open Curiosity solely rising 0.59% to $69.1 billion. The big enhance in quantity with a comparatively flat open curiosity means that a good portion of the buying and selling exercise is from current positions being closed fairly than new positions being created.

With no vital uptick in contemporary BTC positions, the weekend restoration could also be short-lived.

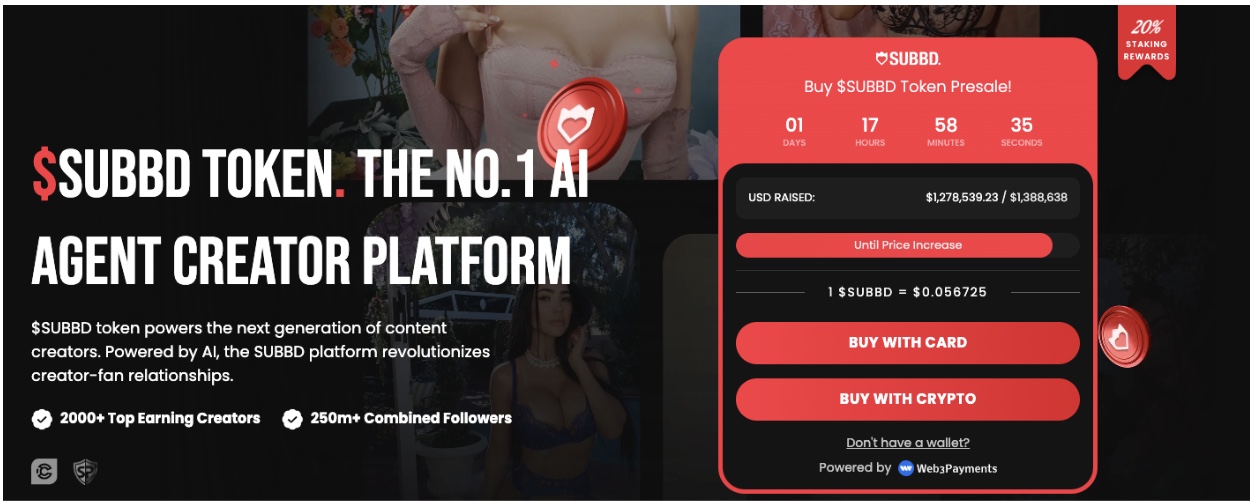

SUBBD Presale Crosses $1.2M as Solana Ecosystem Development Lifts Web3 Investor Confidence

Bitcoin’s underwhelming efficiency over the previous week has pushed investor curiosity in direction of new tasks like SUBBD.

SUBBD is an AI-driven mission with creator monetization instruments for influencers and types.

SUBBD presale

The SUBBD presale has now exceeded $1.2 million of its $1.4 million goal, with tokens presently priced at $0.056.

With lower than 24 hours earlier than the following pricing tier, early traders can visit the official SUBBD presale site to entry as much as 20% staking rewards and different group incentives.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.