Key Notes

- Griffin’s funding by Citadel entities totals 1.3M shares within the Solana-focused treasury firm.

- DeFi Improvement Corp’s SOL holdings present 67% unrealized positive aspects since April 2025 acquisition.

- Technical evaluation signifies potential SOL breakout towards $260 if value sustains above $190 resistance.

Kenneth Griffin, founder and CEO of Citadel, disclosed a 4.5% helpful possession stake in DeFi Improvement Corp, a Nasdaq-listed agency that adopted the Solana

SOL

$178.5

24h volatility:

6.0%

Market cap:

$97.75 B

Vol. 24h:

$7.56 B

treasury reserve technique in April 2025, in response to a Schedule 13G submitting with the SEC.

The filing revealed Griffin’s indirect ownership by Citadel Advisors LLC and affiliated entities, totaling 1,315,654 shares, with one other 4.5% stake owned immediately by the fund by its subsidiaries.

DeFi Improvement Corp’s enterprise mannequin focuses on buying and staking Solana tokens, a method designed to mix long-term capital appreciation with constant staking yield. By locking in newly bought SOL, the corporate not solely secures a passive earnings stream but additionally contributes to community safety and validator exercise inside the Solana blockchain ecosystem.

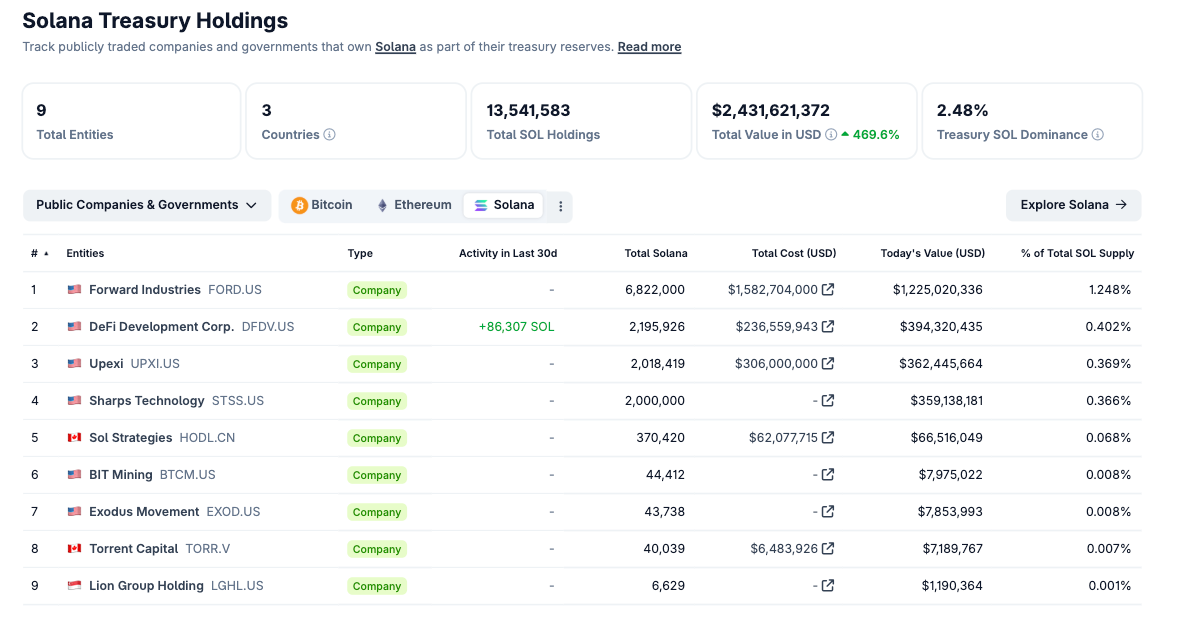

Solana treasury holdings as of Oct. 22, 2025 | supply: Coingecko

According to CoinGecko data, DeFi Improvement Corp at the moment holds 2,195,926 SOL, representing roughly 0.402% of Solana’s circulating provide. The corporate acquired its Solana holdings at an estimated $236.5 million, which are actually valued at roughly $395.3 million, reflecting a 67% unrealized achieve.

Solana value is buying and selling at $179 at press time, up 370% since DeFi Corp started buying SOL in April 2025.

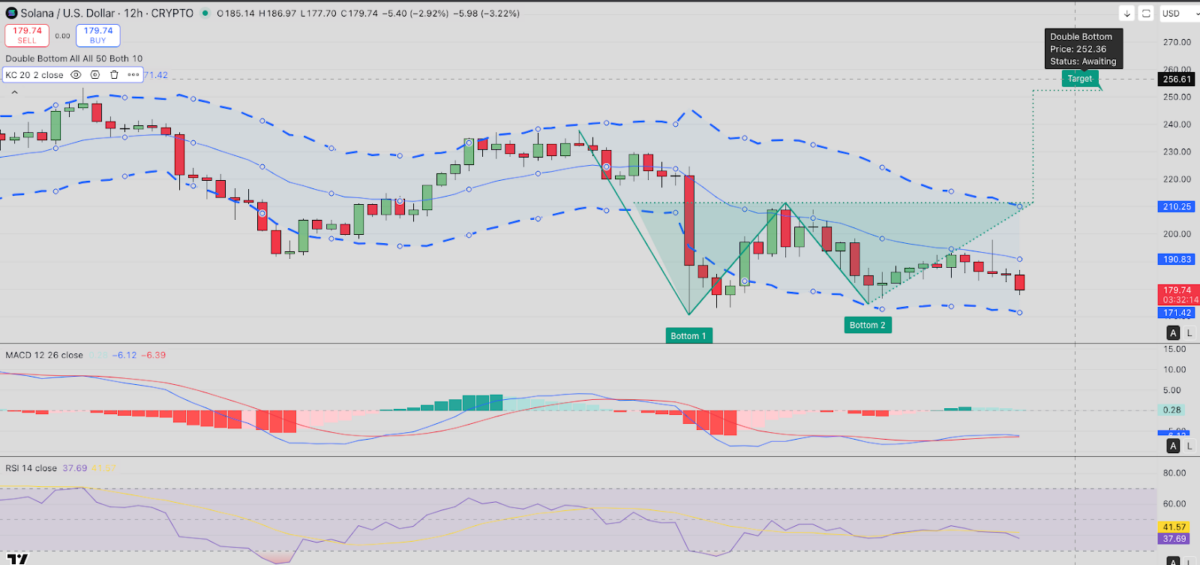

Solana Worth Evaluation: Double Backside Sample Suggests Potential Breakout Towards $260

Solana value hovered close to $179 on Wednesday, forming a basic double-bottom reversal sample on the 12-hour chart that indicators a possible bullish rebound. The sample, marked by two native lows on the $175 and $170 stage, signifies sturdy help just under present value ranges.

A sustained shut above the neckline resistance close to $190.82 might affirm a bullish reversal, whereas a validation of the double backside sign would require a forty five% upside transfer from present ranges.

Solana Technical Worth Evaluation | Supply: TradingView, Oct. 22

Different key indicators additionally help the optimistic Solana value forecast. The MACD histogram has narrowed, suggesting waning bearish momentum, whereas the RSI at 41.5 reveals Solana nearing oversold territory, which might sign entry strikes from merchants trying to purchase at an area backside.

If Solana breaches $210 with sturdy quantity, the double-bottom sign factors to a possible rally above $250. Nonetheless, failure to take care of help above $171.41 might invalidate the bullish formation, doubtlessly sending costs again towards $160.

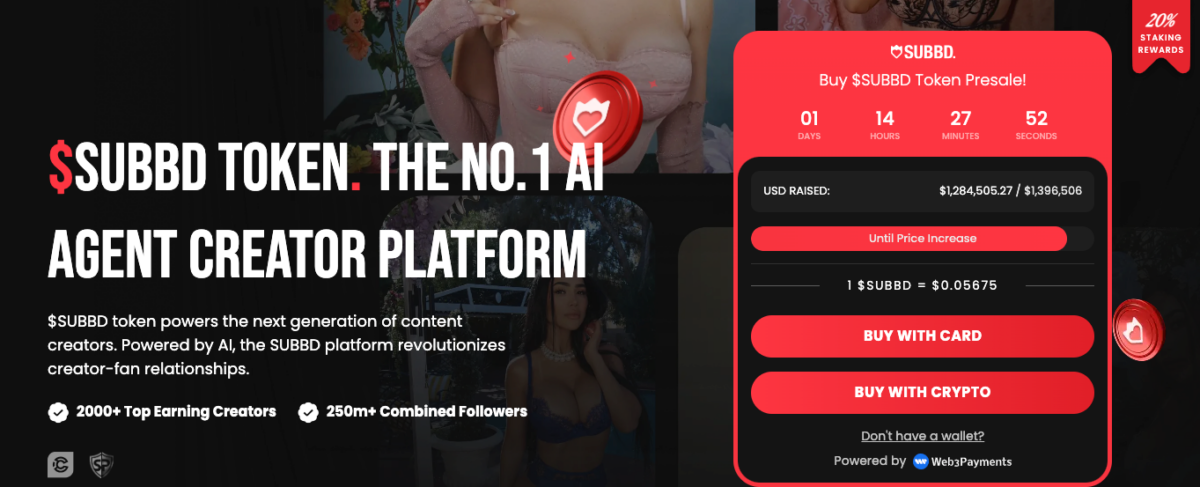

SUBBD Presale Nears $1.5M as Solana Whale Demand Intensifies

Citadel’s oblique funding in Solana has sparked renewed investor curiosity in early-stage tasks like SUBBD.

SUBBD deployed superior AI instruments to bridge the hole between influencers, manufacturers, and their international on-line communities.

SUBBD Presale

The continuing SUBBD presale has surged previous $1.45 million of its $1.6 million goal, with tokens at the moment priced at $0.058. With the subsequent pricing tier approaching in lower than 24 hours, early individuals can go to the official SUBBD presale website to safe as much as 20% staking rewards earlier than the subsequent spherical begins.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.