Key Notes

- Google Finance will showcase prediction market knowledge alongside Deep Search and AI technical evaluation instruments for enhanced insights.

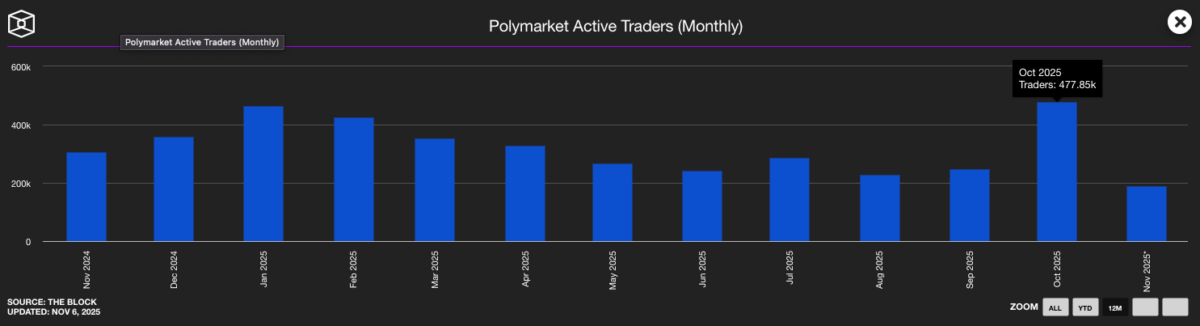

- Polymarket hit 477,850 lively customers in October as institutional buyers valued the platform at $9 billion by way of ICE’s stake.

- The combination exposes decentralized prediction markets to over 8.5 billion every day Google searches amid regulatory growth efforts.

International tech big Google has moved to combine prediction market knowledge from Polymarket and Kalshi immediately into search outcomes, marking a brand new step within the firm’s AI-driven finance technique.

Google’s November 5 press release revealed that the brand new AI-powered Google Finance will allow customers to ask questions on future market occasions. The rollout begins with Labs customers over the approaching weeks earlier than increasing globally.

The platform will now ship real-time market chances and historic modifications sourced from Polymarket and Kalshi, when customers kind in questions resembling “What’s going to GDP progress be for 2025?”

This function is a part of a revamp to Google Finance, which now consists of Deep Search capabilities, AI-enhanced technical evaluation instruments, and company earnings monitoring.

By integrating prediction markets knowledge, Google goals to make monetary insights extra interactive, mixing crowd-sourced chances with institutional-grade analytics.

The transfer may expose prediction markets to a wider international viewers. Google handles over 8.5 billion search requests per day, according to December 2024 reports.

Polymarket Document Adoption Attracts Institutional Eyeballs

Since markets on the US presidential elections boosted its prominence in 2024, prediction markets have continued to realize reputation amongst crypto market lovers and speculative merchants.

Data from The Block exhibits that in October, Polymarket recorded an all-time excessive of 477,850 lively customers and 38,270 new markets created. The surge coincided with intense hypothesis on Bitcoin

BTC

$101 075

24h volatility:

2.3%

Market cap:

$2.02 T

Vol. 24h:

$63.14 B

and gold, each of which reached all-time highs above $124,500 and $4,200, respectively, in the course of the month.

Polymarkets information all time excessive 477,850 lively customers in October 2025 | Supply: TheBlock

Merchants additionally wagered closely on altcoin ETF approvals, which formally went stay on October 28. The amplified engagement throughout decentralized prediction markets attracted vital institutional curiosity in the course of the month.

Intercontinental Alternate (ICE), the father or mother firm of the New York Inventory Alternate, invested in Polymarket, valuing it at round $9 billion. Its most important rival, Kalshi, additionally raised $300 million at a $5 billion valuation, emphasizing investor urge for food for regulated prediction markets.

Google’s partnership announcement comes as Polymarkets ready to launch formal operations in the US. In September, the platform acquired QCEX, a CFTC-licensed derivatives trade and clearinghouse, in a strategic $112 million deal that ensures compliance with US regulatory frameworks.

Bitcoin Hyper Presale Crosses $26 Million Prime Initiatives Consolidate

Because the crypto market consolidates below bearish strain this week, buyers are switching focus to early stage tasks like Bitcoin Hyper.

Bitcoin Hyper (HYPER) guarantees lightning-fast and low-cost transactions geared toward increasing Bitcoin’s use-cases for funds, meme cash, and dApps.

Bitcoin Hyper Presale

HYPER has raised over $26.1 million, with its presale value set at $0.013235 per token. Potential buyers can go to Bitcoin Hyper’s official presale website to safe early allocations earlier than the subsequent value tier unlocks.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.