After days of intense bearish action, the value of Bitcoin seems to be getting into a calmer state, because it recovers above the $86,000 degree. The most recent on-chain information exhibits that a number of buyers tried to take some revenue previously week, offering a foundation for the premier cryptocurrency registering a double-digit loss.

Bitcoin Alternate Influx Spikes As Worth Faces Downward Stress

In a latest put up on the social media platform X, crypto analyst Ali Martinez revealed that vital Bitcoin quantities had been despatched to centralized exchanges previously week. Knowledge from Santiment exhibits that about $20,000 BTC (value practically $2 billion) has been moved to those exchanges previously seven days.

Associated Studying

The related indicator on this on-chain commentary is the Alternate Influx metric, which tracks the quantity of an asset (on this case, Bitcoin) that flows to centralized exchanges inside a specified interval. This metric is commonly essential as a result of one of many outstanding exchanges’ service choices is promoting.

Therefore, a rise within the Alternate Influx metric suggests the potential offloading of an asset by buyers. The ensuing elevated provide of this cryptocurrency within the open market usually provides downward strain on the coin’s value, particularly if there is no such thing as a corresponding improve in demand.

In a separate put up on X, CryptoQuant’s head of analysis, Julio Moreno, shared a knowledge piece supporting the latest spike in alternate inflows. In accordance with information highlighted by the crypto researcher, the Bitcoin alternate inflows stood at about 81,000 BTC (the best degree seen since mid-July) on Friday, November 21.

In the end, this latest spike in alternate inflows explains the volatility skilled by the value of Bitcoin on Friday. The flagship cryptocurrency succumbed to vital bearish strain, seeing its value fall to only above $80,000 because the weekend approached.

As of this writing, the value of BTC stands at round $86,070, reflecting an over 2% leap previously 24 hours.

Bitcoin In Revenue-Taking Part: CryptoQuant CEO

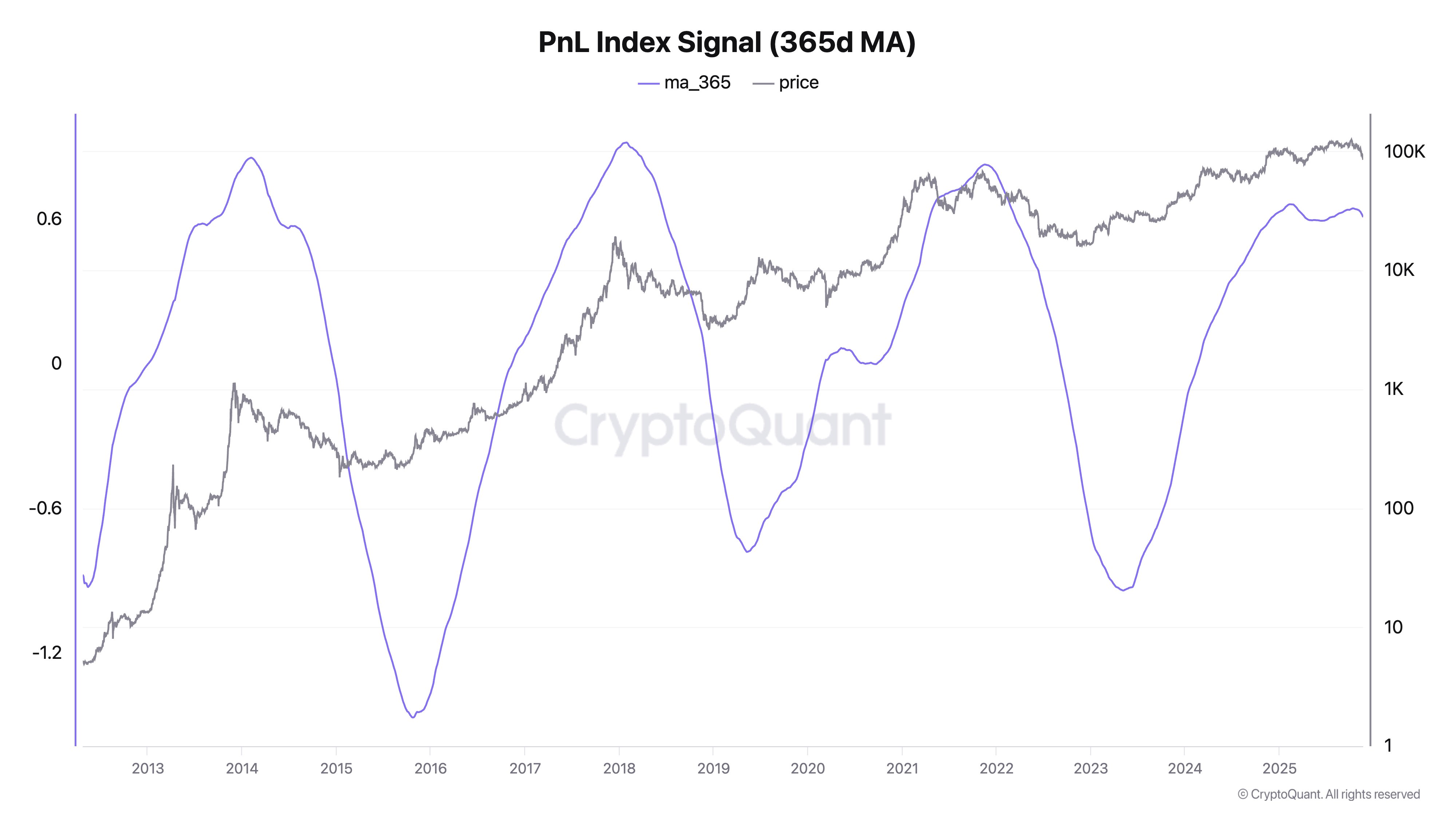

CryptoQuant CEO Ki Younger Ju revealed that Bitcoin is in a profit-taking part, as evidenced by the rising alternate inflows. The crypto founder made this assertion primarily based on the PnL Index Sign, which measures revenue and loss ranges utilizing all wallets’ price foundation.

With the present studying of the PnL Index Sign, Ju proclaimed that the basic cycle concept says that BTC is getting into a bear market. In accordance with the CryptoQuant CEO, solely macro liquidity can override the profit-taking cycle—simply as seen in 2020.

Therefore, all eyes will likely be on the Federal Open Market Committee (FOMC) assembly in December, particularly with the falling expectations of an rate of interest lower by the US Federal Reserve (Fed).

Associated Studying

Featured picture from iStock, chart from TradingView