Ethereum is combating to carry the $2,800 stage after a brutal correction that has erased greater than 45% of its worth since late August. The sharp decline has flipped market sentiment decisively bearish, with many merchants fearing that ETH has entered a chronic downtrend. Bulls are struggling to determine a dependable assist stage, and the dearth of robust buy-side response thus far has solely intensified uncertainty. Liquidity continues to skinny out throughout main exchanges, reinforcing the narrative that the market continues to be deep in a risk-off section.

Associated Studying

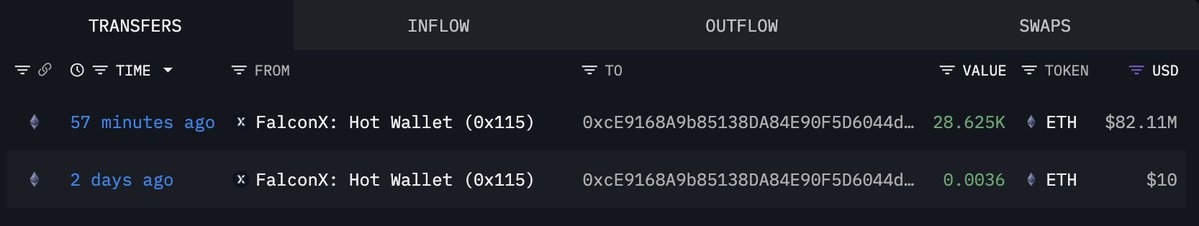

But, regardless of the heavy promoting stress and underwhelming value efficiency, not all main gamers are stepping again. In reality, some are doubling down. Contemporary on-chain information from Lookonchain reveals that Tom Lee’s Bitmine — a widely known crypto-focused funding operation—continues to purchase ETH aggressively at present costs. Bitmine has been one of many few entities constantly including to its place through the downturn, signaling robust conviction that Ethereum stays undervalued in the long run.

This divergence between retail fear and whale accumulation is changing into more and more notable. As ETH hovers round a vital psychological stage, the approaching days might decide whether or not this whale’s confidence interprets into broader market stabilization or stays an remoted guess towards the prevailing pattern.

Bitmine’s Aggressive Accumulation Indicators Confidence

In accordance with Lookonchain, Tom Lee’s Bitmine has continued its aggressive accumulation, buying one other 28,625 ETH price $82.11 million. This transfer reinforces the rising narrative that a few of the market’s most subtle gamers are positioning for a rebound regardless of the prevailing concern and relentless promoting stress. Massive-scale shopping for throughout deep corrections has traditionally aligned with early reversal zones, and Bitmine’s conviction provides weight to the concept that Ethereum could also be approaching a big turning level.

Nonetheless, a restoration is much from assured. ETH stays trapped close to the $2,800 zone, a stage that has acted as a fragile line of protection throughout this downturn. For momentum to shift, Ethereum should not solely maintain this space but in addition reclaim the $3,000 mark, which has now flipped into an essential resistance zone. A decisive transfer above this stage would sign that patrons are lastly stepping again in with power, probably setting the stage for a broader pattern reversal.

Till then, the state of affairs stays delicate. Bitmine’s accumulation presents a bullish sign, however with out affirmation from value construction, Ethereum continues to stroll a tightrope. A failure to carry present ranges might invite one other wave of capitulation, however stability right here might spark the rebound whales appear to be anticipating.

Associated Studying

Testing a Main Weekly Assist Zone

Ethereum’s weekly chart exhibits the asset sitting on a vital assist zone after a steep decline from the $4,800 area. Worth has now pulled again to round $2,800, a stage that aligns intently with the 200-week transferring common—a traditionally essential space the place ETH has usually discovered long-term assist. This zone beforehand acted as a launchpad throughout main market reversals in each 2022 and mid-2023, making its protection essential for sustaining broader structural power.

The latest breakdown beneath the 50- and 100-week transferring averages highlights the depth of the present selloff. Momentum clearly shifted in favor of bears over the previous weeks, with a number of massive purple candles confirming aggressive distribution. Nonetheless, ETH’s present stabilization try above the 200-week MA indicators that patrons are lastly stepping in, stopping a deeper slide towards $2,400.

Associated Studying

If Ethereum can maintain above this assist space and reclaim the psychological $3,000 stage, a restoration construction might start to kind. But when the 200-week MA breaks convincingly, the market might face a extra extended correction.

Featured picture from ChatGPT, chart from TradingView.com