Key Notes

- DDC’s bitcoin treasury expanded to 1,183 BTC at a mean price of $106,952 per coin, reflecting disciplined accumulation technique.

- The corporate’s H2 Bitcoin yield reached 122% by way of lively treasury administration, demonstrating sturdy efficiency metrics.

- BlackRock’s $83 million ETF influx on Nov 26 signaled renewed institutional demand following eased US-China commerce tensions.

DDC Enterprise Restricted introduced the acquisition of 100 Bitcoin

BTC

$90 176

24h volatility:

3.3%

Market cap:

$1.79 T

Vol. 24h:

$69.68 B

, increasing its company treasury to 1,183 BTC, in line with an announcement issued on Thursday. With the acquisition executed amid a market dip, the corporate emphasised its dedication to its long-term bitcoin investing technique.

In the official press release, DDC reported its common price per bitcoin at $106,952, whereas the up to date stability interprets to 0.039760 BTC per 1,000 DDC shares.

“Our strategy is outlined by self-discipline, persistence, and long-term conviction,” stated Norma Chu, Founder, Chairwoman and CEO of DDC.

She added that the agency views Bitcoin as a strategic reserve asset and stays targeted on increase shareholder worth by way of periodic purchases.

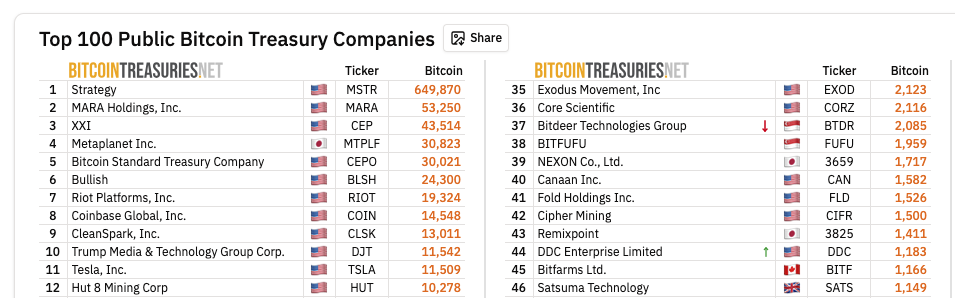

DDC turns into forty fourth Largest public Bitcoin treasury within the US after 100 BTC buy on Nov. 26 | Supply: Bitcointreasuries.net

DDC additionally highlighted that its H2 Bitcoin yield so far stands at 122%, reflecting positive factors from its lively treasury administration framework. The corporate continues to take part within the broader company Bitcoin treasury motion whereas sustaining its operations as a worldwide Asian meals platform.

BlackRock Leads Company Shopping for After Trump’s Name to China’s President

Bitcoin’s push towards $90,000 was bolstered by a resurgence in company demand following US President Trump’s name with China’s management on Nov. 25. The dialogue produced eased commerce tensions, triggering risk-on sentiment throughout US tech shares and adjoining crypto markets.

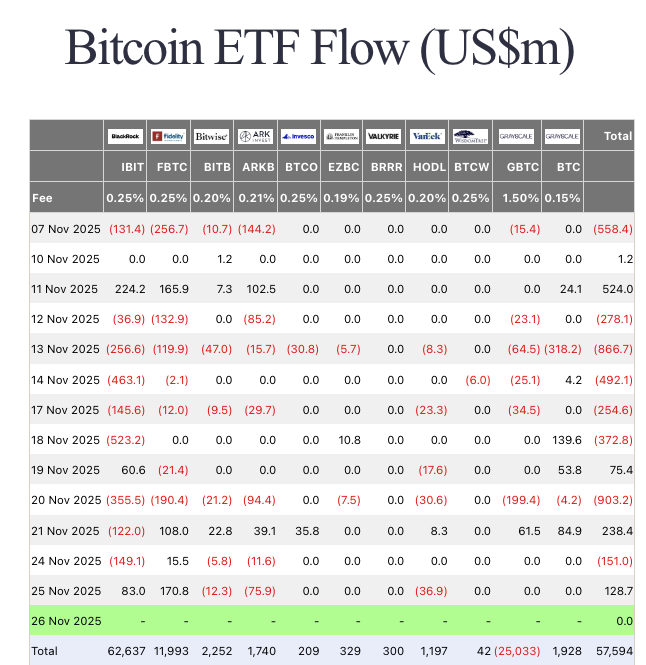

Blackrock returns to purchasing mode with $83 million on Nov. 25, ending a 3-day promoting spree | Supply: FarsideInvestors

US-listed Bitcoin ETFs recorded $128.7 million in complete inflows on Nov. 25, as seen in FarsideInvestors information. BlackRock’s IBIT led the pack with $83 million in deposits, marking its first day of optimistic internet flows since Nov. 19.

The enhancing macro and ETF momentum set the stage for company treasurers to re-enter the market. DDC’s 100 BTC buy on Nov. 26 seems to comply with this institutional rotation.

Greatest Pockets Presale Tops $17.6M as DDC Bitcoin Buy Sparks Bullish Sentiment

DDC’s newest 100 BTC acquisition bolstered institutional demand, as capital flows rotated aggressively towards early-stage crypto tasks.

Greatest Pockets, an AI-enhanced self-custody ecosystem, has now surpassed $17.6 million in presale commitments. The challenge integrates safe non-custodial storage, on-chain staking rewards, and multi-chain interoperability for merchants in search of safety and enticing yield revenue.

Greatest Pockets Presale

The BEST token presale stays lively, with lower than 24 hours to safe allocations at $0.026 earlier than the following pricing tier prompts. BEST tokens can be found solely by way of the official Best Wallet website.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.