Ethereum continues to commerce under the vital $3,000 stage as promoting stress intensifies and worry dominates sentiment throughout the crypto market. The broader downturn has pushed ETH practically 40% under its August all-time excessive, elevating issues that the asset could also be getting into a protracted bearish section. Analysts who have been as soon as assured in a continued rally are actually shifting their tone, warning that market construction, volatility, and liquidity situations are starting to resemble early-stage bear market conduct.

Associated Studying

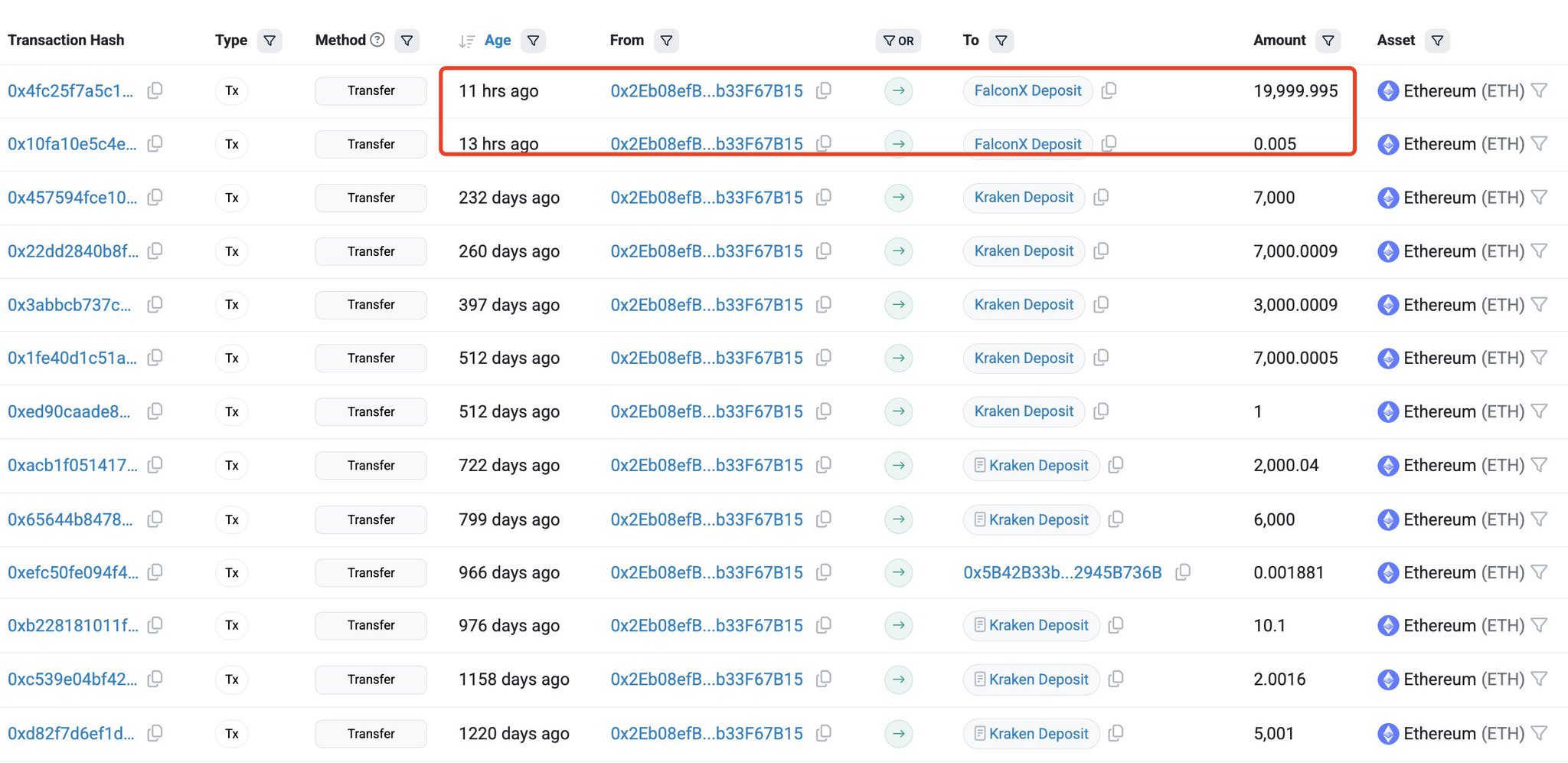

On the similar time, investor confidence is being additional examined by recent on-chain exercise exhibiting massive holders decreasing publicity. In response to information from Lookonchain, an Ethereum ICO participant has bought one other 20,000 ETH, valued at roughly $58.14 million, via FalconX just some hours in the past.

With promoting stress accelerating, derivatives sentiment weakening, and long-term holders starting to scale back positions, Ethereum now sits at a pivotal second. Bulls should reclaim the $3,000 area to stabilize momentum, whereas bears argue {that a} deeper correction may unfold if help continues to erode.

ICO Whale Promoting Raises Strain as Ethereum Awaits Route

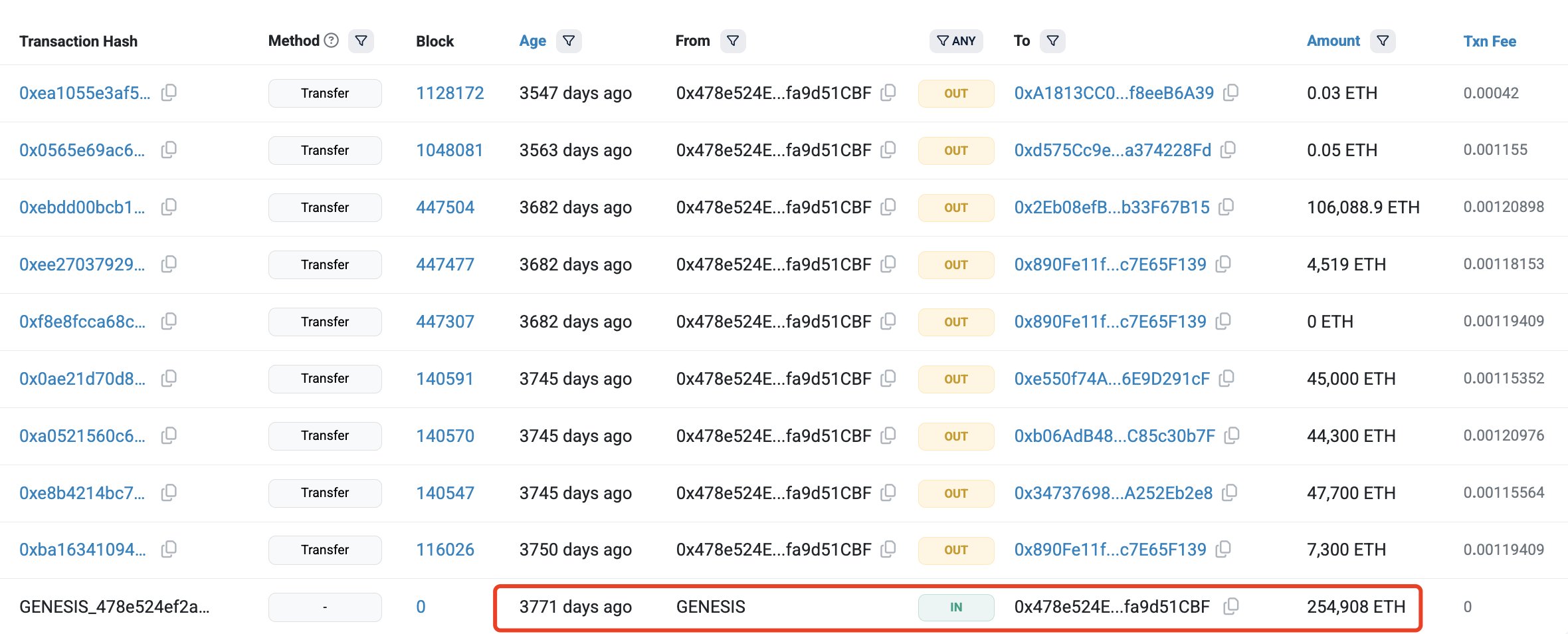

In response to Lookonchain, the wallet behind the most recent sale — recognized as tackle 0x2eb0 — is not any atypical holder. This Ethereum OG acquired 254,908 ETH through the ICO, paying simply $79,000 on the time. At at the moment’s costs, that allocation is value roughly $757 million, highlighting the size of unrealized features nonetheless held by early individuals. The latest sale of 20,000 ETH means that even long-standing holders with substantial revenue cushions are starting to dump cash, including to the already fragile market surroundings.

This promoting exercise is especially impactful given the present sentiment. Ethereum has already fallen sharply from its highs, leverage has unwound throughout derivatives markets, and retail confidence has thinned. When an early participant with a value foundation close to zero begins distributing, it sends a psychological sign that additional draw back is feasible. But, some analysts argue that these gross sales could merely signify portfolio rotation quite than a long-term bearish stance.

The approaching days shall be decisive, as traders watch whether or not Ethereum can stabilize and rebound or if promoting stress accelerates. A restoration above $3,000 may revive optimism and reset momentum, whereas continued weak point dangers confirming a deeper downtrend for each ETH and the broader market.

Associated Studying

Breakdown, Weak Construction, and Fragile Bounce Try

Ethereum’s weekly chart reveals a transparent deterioration in development construction following the sharp rejection from the $4,400 area and the following breakdown under the $3,200 help zone. The selloff pushed ETH towards the mid-$2,700s earlier than a modest rebound, however the value stays under key transferring averages, signaling that momentum continues to favor sellers.

The 50-week transferring common has rolled over, whereas the 100-week and 200-week transferring averages now sit overhead, forming layered resistance that might cap any restoration makes an attempt within the quick time period.

Associated Studying

Quantity through the decline expanded noticeably, indicating energetic distribution quite than passive drifting. The latest candle exhibits a small bounce, however with no robust quantity follow-through, suggesting hesitation and lack of conviction amongst consumers.

For Ethereum to regain bullish construction, reclaiming the $3,000–$3,200 space is important, as this zone acted as a pivotal help all through earlier phases of the cycle and now threatens to flip into resistance.

Featured picture from ChatGPT, chart from TradingView.com