The Bitcoin market skilled a average worth rebound over the previous week, following a protracted interval of worth correction that started in early October. The flagship cryptocurrency is now buying and selling above $90,000, with hopes constructing for a possible push again towards its all-time excessive of $126,100.

Notably, common market analyst KillaXBT has flagged a key worth zone that would function the subsequent goal on this relieving market restoration.

Associated Studying

Bitcoin Headed To $95k-$96k, However Value Pullback Might Happen First – Analyst

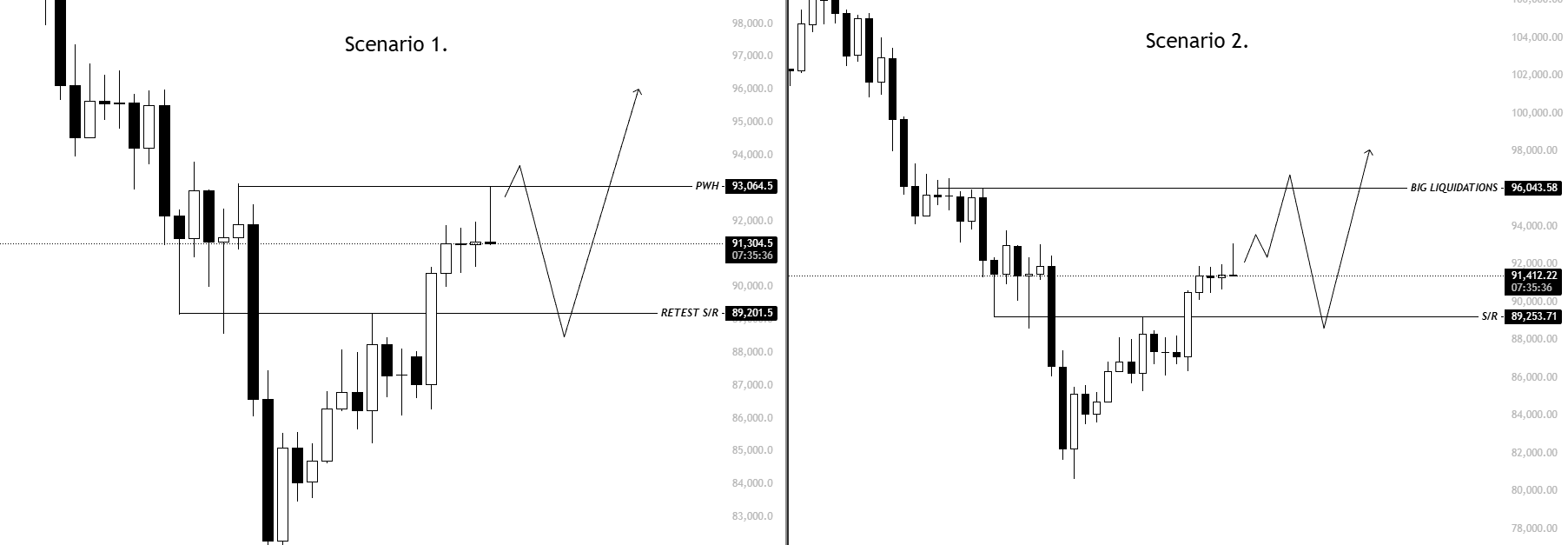

In an X post on November 28, KillaXBT shares some compelling insights on Bitcoin’s worth situation, highlighting each bullish and bearish tendencies. Following the asset’s acquire of seven.22% previously week, the analyst predicts that market bulls are more likely to drive costs to round $95,000-$96,000, which incorporates sturdy, heavy illiquidity pockets and a number of other liquidation clusters.

For context, these zones are enticing to cost as a result of they comprise massive concentrations of resting orders, making them high-value liquidity targets. Liquidation clusters, particularly, maintain teams of leveraged positions that set off compelled shopping for or promoting as soon as the worth reaches them, injecting recent liquidity into the market.

Nonetheless, KillaXBT cautions that this upside transfer could not happen instantly, noting that the market typically delays sweeping main liquidity zones forward of key macro occasions. With the upcoming Federal Open Market Committee (FOMC) assembly anticipated to ship readability on potential fee cuts, merchants might even see continued liquidity constructing beneath the yearly open within the close to time period.

In keeping with the analyst, these higher liquidation ranges are nonetheless more likely to be cleared, however the timing may align extra carefully with subsequent month’s coverage announcement slightly than the present market cycle.

The analyst outlines a possible situation by which Bitcoin experiences a minor pullback to round $93,000 earlier than retesting $89,200. From there, the asset may transfer towards the $95,000–$96,000 goal, consistent with expectations for a possible FOMC fee adjustment.

Nonetheless, KillaXBT additionally highlights the likelihood that Bitcoin could attain these key liquidation zones earlier than the FOMC assembly. In such a situation, the market may see a speedy surge to $96,000, adopted by a pointy drop to round $89,200 because of potential liquidations, earlier than finally returning to those higher liquidity zones.

Following this evaluation, KillaXBT is choosing a brief place, which he intends to reassess in relation to market developments because the FOMC approaches. Curiously, the analyst believes the true short-term alternative solely comes after the FOMC’s announcement.

Associated Studying

Bitcoin Value Overview

On the time of writing, Bitcoin trades at $90,490, reflecting a slight 0.64% decline previously day.

Featured picture from PixelSquid, chart from Tradingview